Rapture #213: Goblin Town

As promised, now that we have clearly broken $30,000, we are undoubtedly in goblin town.

Boy, there are plenty of indicators.

Carnage

Rumors around Celsius, one of the leading centralized crypto lenders, being insolvent on their ETH positions started early last week. Yesterday, Celsius halted their user's ability to withdraw from their accounts.

Yikes.

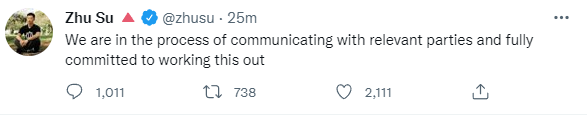

To add fuel to the flames, rumors are now being circulated the leading hedge fund 3AC might also be insolvent. While I think the word "insolvent" is being thrown around too liberally regarding 3AC, their massive liquidations on-chain do indicate serious distress. Zhu Su even tweeted:

Ruh roh.

Both the Celsisus event and the 3AC event have the potential to cause a domino effect of users/allocators losing faith in other similar institutions in crypto, which would put even more downward pressure on the market.

Things don't look pretty.

How I have called this market

Over the past few months, my interpretation of macro, and specifically how it would affect crypto, has been accurate. If you would like to check my previous interpretations for this phase of the bear market, you can find them in Rapture #205, Rapture #202, Rapture #197, Rapture #182, Rapture #132, Rapture #126, Rapture #118, just to name a few.

My 90%+ cash position since January 22nd has been well justified, and my switch to approximately 50% cash at the end of November was also the right move.

Note that I don't always make the right calls, such as not selling 100% my AXS position in Q4 of last year, but in terms of calling the general direction, I have been overall consistently accurate.

I will undoubtedly make more mistakes in the future, but by getting the general cycle direction of the market right consistently and picking outperforming assets during a bull, I have conviction that I will continue to exceed market performance substantially over time.

Where we go from here

I am still not convinced we are at bottom prices today. There are two scenarios where I believe prices of assets in terms of USD can recover: the market regains confidence that the Federal Reserve can successfully lower inflation by raising rates (which would be indicated by inflation being lower than expectations rather than exceeding expectations like it did for May) or a complete sentiment switch occurs where the market believes hyper-inflation is inevitable, which would cause a flight away from cash into any asset.

The latter scenario is extremely scary, as it would likely mean societal collapse, which has occurred many times historically in hyper inflationary countries, with the most famous being the Weimar Republic.

I don't want to be like the guy standing on a corner in NYC calling for societal collapse, but that event is definitely in the cards now.

Regardless, both of the aforementioned scenarios will take time to play out. Until I have clarity on when I believe either of these shifts in sentiment will happen, I will have extreme difficulty in pulling the trigger to deploy capital heavily.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.