Rapture #132: Is the Worst of it Over?

Markets are always humbling. While AXS is just a bit higher (currently $56.95) than where I sold my last lot (approximately $55.5 per AXS), BTC and ETH have skyrocketed off their bottoms despite my thinking (which so far hasn’t changed) that there is more downside to come.

Majors Up

BTC is up approximately 25% from its low January 24th, while ETH is up more than 33% from its January 24th low. While most alts have not yet recovered nearly as much, BTC and ETH being up, and alts lagging would not be atypical for a trend reversal.

Interestingly, this rise in price has come in a relatively low volume environment, with daily volumes reaching just above $30 billion on BTC for Friday. Usually when we are at a bottom, the volumes begin to rapidly rise into the new uptrend, though that was not the case for our rise from around $30k last summer to $69k in November 2021.

Other risk-on assets have also been on a positive upswing today, such as the ARK Innovation ETF increasing over 5% on Friday.

Finally, funding is close to flat across the board now, meaning many of the short positions that were in the market in the past 48 hours have been flushed, but overleveraged longs have not yet been opened.

Hikes Still Loom

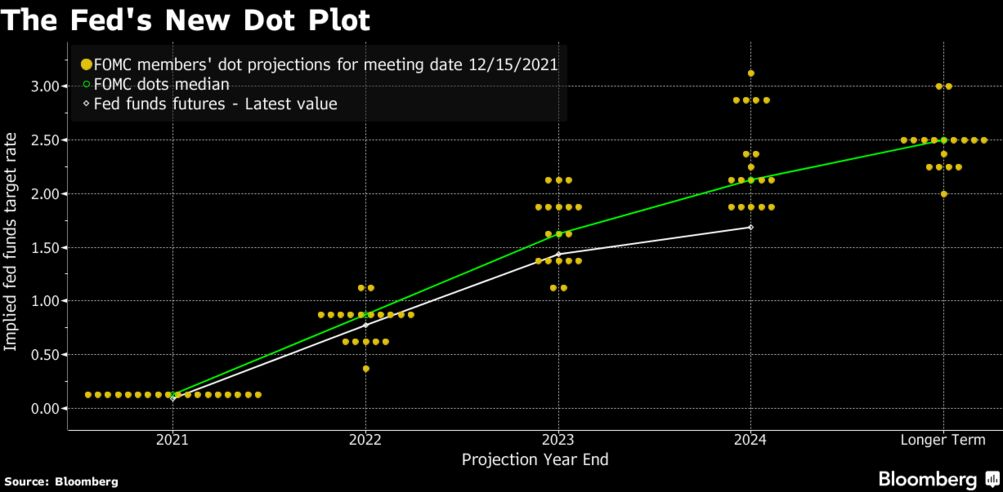

Currently, risk-on assets have put the concerns over fed rate hikes behind us. Yet these hikes still loom in the wings, and in fact could be even more severe now since jobless claims came out more positive than expected.

The Federal Reserve has the economic backdrop they need (improving economy with high inflation) to justify severe rate hikes. The question now is: will they do it, will risk on assets care, and will crypto be treated as a risk on asset?

My answer to these questions remains yes across the board. Biden sees his abysmal poll numbers, and will blame inflation for his waning popularity. He will pressure Powell to raise rates quickly to get control over inflation, potentially even 50 bps by June.

The market will try to prevent the Federal Reserve from raising rates so, so from my perspective there will likely be a sell off mid-march in risk assets. I do think crypto, which has shown time and time again that in the short-term risk-off periods it is affected like other risk assets, will sell off.

Takeaway

The question in my mind is can crypto gain enough momentum now to reach a significantly higher point that, when the projected sell off happens, it would still make more sense to be heavily positioned in the market at these prices.

My answer to that question for myself right now is no, that the risk to the downside is still significantly higher than the upside. I am OK waiting a bit more on this run, and waiting until we get closer to March, to revaluate how crypto is reacting to events.

Of course, there is another theory that could alter my thesis, which is one I am considering: the lengthening cycle. Benjamin Cowen does an excellent job explaining this thesis here. Under the lengthening cycle theory, we likely have 6 months – 18 months left in this bull cycle, and it is secular to what is happening in the macro environment. That being said, we could still experience an even further pullback and the lengthening cycle theory prove out.

Markets are never easy, and anyone who tells you otherwise is trying to sell you something.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.