Rapture #126: Some Weekend Price Action

First, I don’t want to present myself in any way as being able to consistently predict the market. Because quite frankly, I cannot. I do my best to position myself appropriately regarding what market regime I believe we are in and self-correct where needed.

As of a week ago, I am approximately 95% cash, which I mentioned here. I got to cash by selling the rest of my AXS position, which I had previously sold a large chunk of (around 50%+) in late November.

That being said, many believe the market structure is improving, and now that the FOMC meeting is over, we can resume with upward trend.

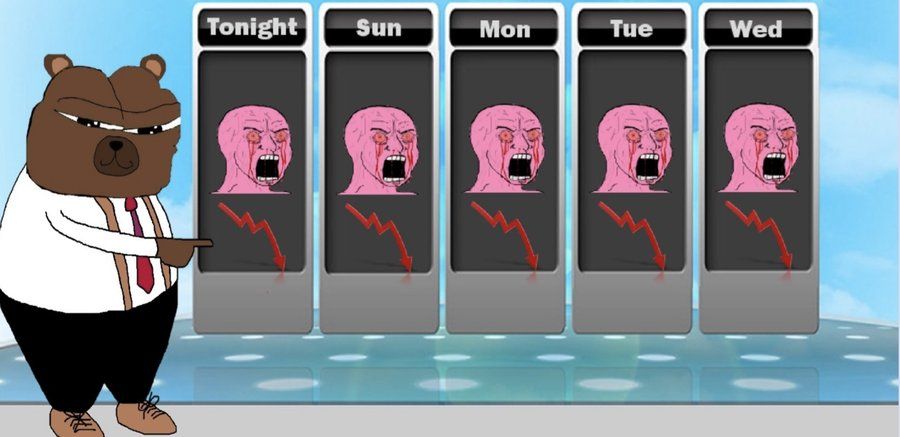

I am not one of those people. While I can change my mind, my current base case is that we are in a prolonged bear market and that valuations (as measured by fully diluted market cap) must come down, usage (as measured by daily active addresses) must increase, and more negative regulatory news needs to be behind us.

Return of the Bull Case

Many are pointing to the fact that the recent technical picture for BTC looks promising. Price action has been on an uptrend over the past 5 days, which could indicate a changing of direction of the market. Volumes have been a bit higher than last week, which is a good sign that potentially buyer volume is returning and we might be forming a bottom.

Furthermore, the market no longer must worry about an immediate FOMC meeting. The next major FOMC won’t be until mid-March, and one can argue that a 50bp rate hike is now priced in, thus risk assets can reverse their downward trend.

Why I am Positioned as if we Have More Pain to Come

Despite there being some signs, the worst of this drawdown is behind us, I don’t think we are anywhere close to being out of the woods.

Volumes still are anemic (generally around $20 billion per day for BTC) compared to where they were in Q4 of last year (generally around $40 billion per day for BTC) and even worse when compared to last summer (generally around $65 billion per day). Furthermore, this most recent price push up is on an incredibly low volume day.

Valuations from my perspective are still mind-blowingly high and don’t reflect a market that has returned to reality. The top 95 coins have a non-diluted marketcap of more than $1 billion, and these include names like SafeMoon. Yes, some of the DeFi 2.0 trash has been taken out, but there is still plenty of trash left in this market to dump.

Finally, despite a 50bp rate hike maybe being priced in by the market, there are still many variables that could cause the macro situation to sour, including an even further rise in growth rate of inflation, Russia invading Ukraine (which in my opinion would also lead to China invading Taiwan), or quite frankly just the stock market itself tanking after being on a tear these last 10 years.

The risk-return here in the short term is still not attractive for me. Always at risk I could be coping, but a lot needs to change for me to become structurally bullish again.