Rapture #202: The puke out

While my base case is still we have more downside to go, there are multiple signs of capitulation that I am noticing. Specifically, exchange volumes, transfer volumes from whale addresses to exchanges, and rumors of major funds going belly up are can be major indicators of capitulation.

Additionally, there has been a bump in some sentiment indicators that historically have signaled a new bullish trend, such as google trends for BTC rising again from its lowest point in more than a year. This reversal happened when the bull market came back at the end of March 2019.

While I am deciding not to reallocate, these are important signals to monitor.

Exchange volumes

Since May 9th, so for a total of nearly 3 days now, exchange volumes for BTC have consistently been above $60 billion. Exchange volumes reached a peak of nearly $82 billion on May 10th. There has not been such a long string of high volume days for BTC since the first bull top of the most recent bull run in April 2020. Surges in volumes often are one indicator of tops in addition to bottoms.

If you are interested in reading more about high volume bottoms, check out this article. Essentially, a surge in intense selling pressure washes out all the market players who were thinking about selling, reducing the supply of would be sellers. The accumulation buyers who stepped in to purchase the large sell lots likely have been positioned well previously and, consequently, have long time horizons.

A surge in volume was one of the ways I determined that the bear market was ending during the first week of April in 2019. Of course, the context was a bit different then, as BTC had gone through an accumulation period sub $4,000 for nearly 3 months, with volumes slowly rising during the last of those 3 months. Today, equities are tanking, the macro environment is terrible, and crypto just experienced one of its worst project blow ups in years if not ever.

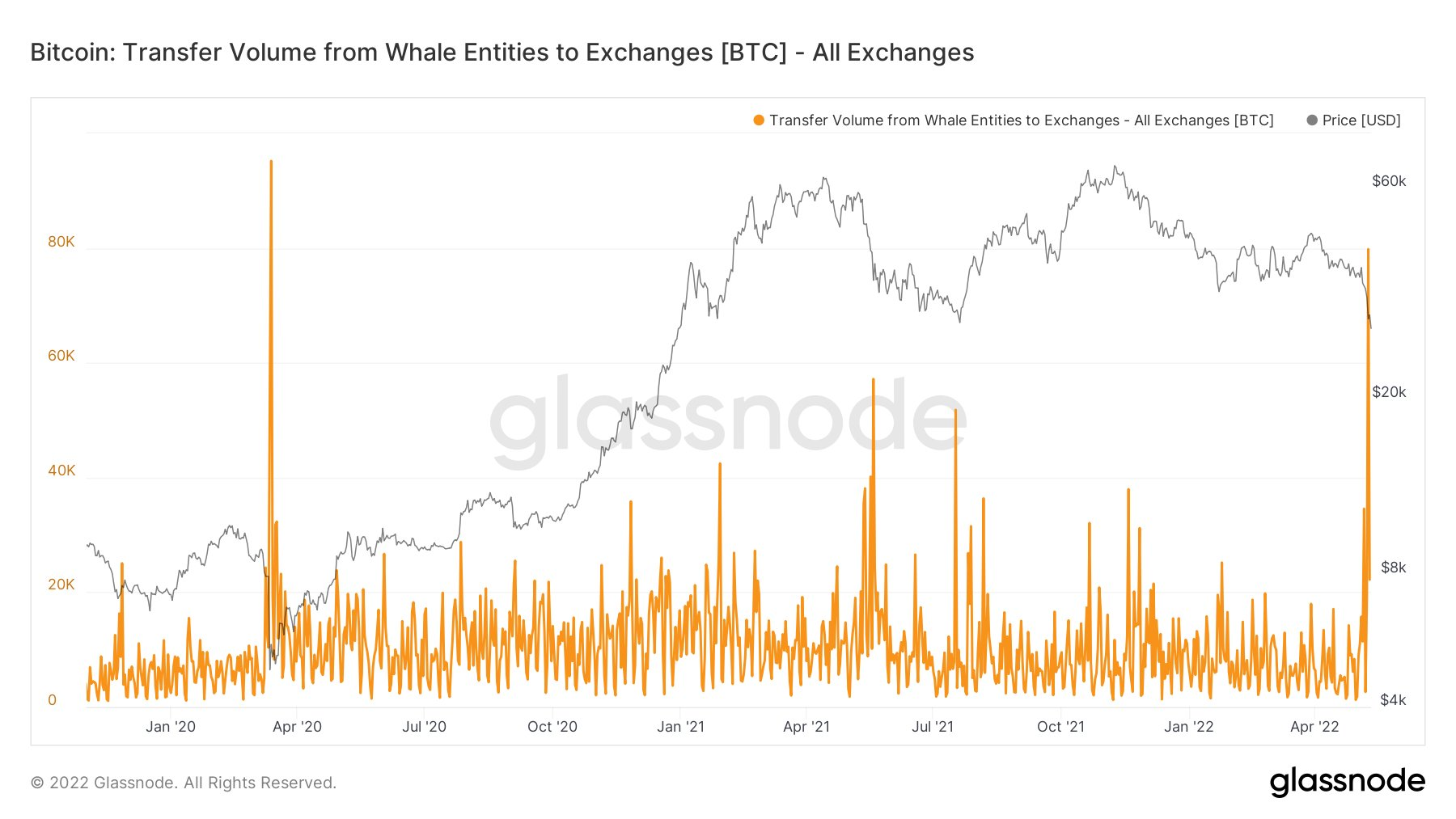

BTC transfer volume from whale entities to exchanges

In addition to a surge in exchange volume being an indictor of bottoms, quite a few local bottoms have also correlated with jumps in transfer volumes from whale entities (i.e. large BTC holders) to exchanges. The March 2020 bottom and July 2021 bottom occurred with huge jumps in this metric.

This metric is another way to measure capitulation. This time, it hones in on large players who often need to liquidate significant positions. With all of the whale games going on, institutions often try and find the liquidation points for their competitors and move the market to those points in order to profit from short positions. Once those liquidations occur, the low hanging fruit is now gone.

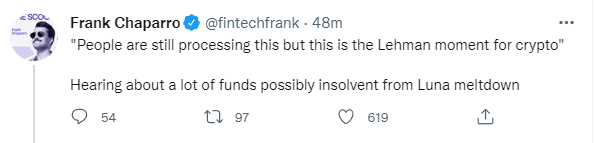

Rumors of major funds going belly up

Already, many of the top Delphi Digital guys have posted they personally lost 90% or more of their net worth or their crypto holdings to the Luna fiasco. Frank Chapparo, probably the top reporter in crypto, tweeted he has been "hearing about a lot of funds [that are] possibly insolvent from the Luna meltdown."

Fund blowups can be a sign of market capitulation.

My takeaway

While there are certain signs that capitulation, which is usually the indication of a bear market ending, is behind us, I am not convinced. Equities are still tanking and the macro environment remains extremely bearish. Crypto has not been around during a bearish macro environment, and thus we have no idea how it will react.

Better to be safe than sorry, at least for my own portfolio.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.