Rapture #175: Some Updates on ETH Staking Related Topics

Without a doubt, the largest crypto event to happen this year will be the Ethereum mainnet merge with the beach chain, which is dubbed "the merge" for short. The merge is set to happy by June of this year, and I have written extensively about what I think the economic and market effects of the merge will be.

Economic effects

Just as a recap, ETH will likely become a deflationary asset (or close to it) post merge since the ETH coming into circulation via staking rewards will likely be less than the ETH burned via EIP-1559.

In addition to the long-term deflationary effects of just utilizing POS and not POW, there will also be an extreme short term deflationary event post-merge. From my understanding, for a period after the merge, users will not be able to access their staking rewards. Consequently, ETH will only be burned during this period via EIP-1559, with no inflationary pressure coming to ETH until access to the rewards are enabled. There has been no date set for when enabling access to these rewards will occur.

Market effects

Separate from the economic changes to Ethereum, I hypothesized that various coins of projects related to ETH staking would receive a bid this year regardless of the market environment as the buyers adopt the "ETH staking good" narrative and flock to the handful of coins where they can express a bullish perspective on that narrative.

On February 4th, I called attention to SSV as the coin I thought had the best asymmetric risk/return profile in terms of gaining exposure to the "ETH staking good" narrative. I am actually so bullish SSV that I decided to join the project as their Head of Network Growth on Monday.

The market has been waking up to SSV's potential as well. The coin is up nearly 60% since February 4th despite the rest of crypto being incredibly choppy. With only a $158 million market cap, I believe there is far more upside to SSV yet to be realized.

ETH Staking demand continues to increase

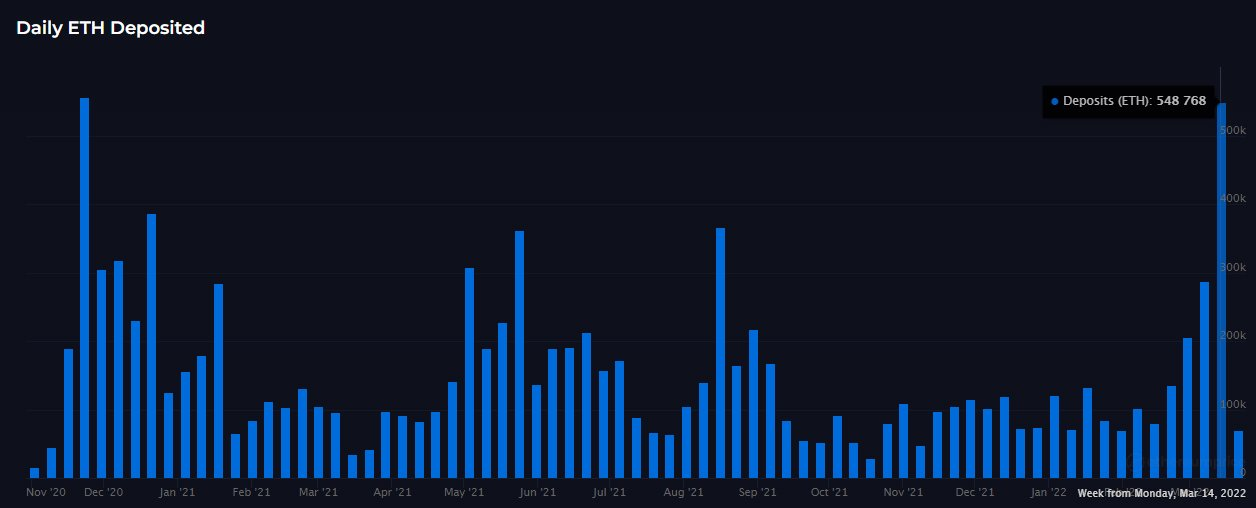

Not only have ETH staking plays been receiving more attention in the market, but actual Eth2 deposits are at their highest level since the beacon chain genesis.

This recent surge in deposits is likely aided by the fact that users can now collateralize their STETH (a liquid staked ETH position) from Lido onto Aave, borrow ETH against it, convert that ETH to STETH, and repeat the process. Traders view this play as low risk since they think STETH will continue to trade in line with ETH.

Takeaways

The Ethereum merge is the most important crypto native event to watch this year. While crypto has historically been focused on halving events for Bitcoin, as Ethereum has gained adoption, the economic changes to the network have become the new area of focus for the market.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.