Rapture #115: Effects of EIP 1559

Now that it has been more than six months since EIP-1559 was implemented, I thought it would be a good idea to dive into some of the effects the change has had on Etheruem. Note that if you need a refresher on what EIP-1559 did for Ethereum, you can check out this post I co-authored with James Beck in June 2021.

If you are too lazy to read the full blog post, the quick summary is that EIP-1559 changed the transaction fee model for Ethereum so that some ETH now burned (i.e. destroyed) in every transaction.

Now, lets dive into some data!

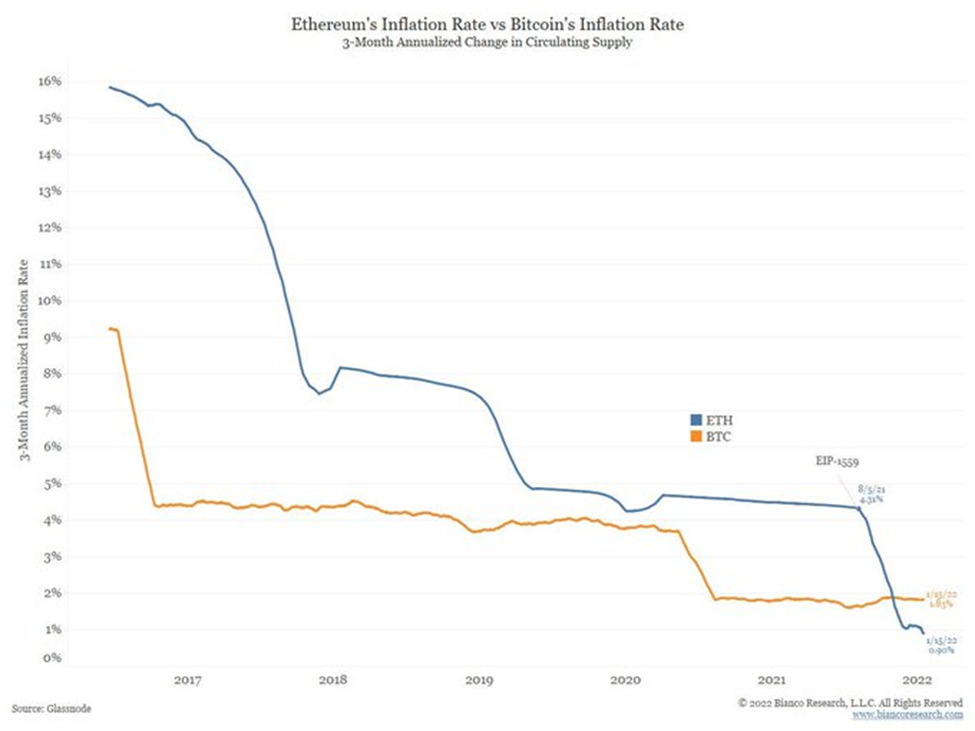

Significant Drop in Inflation Rate

While many knew that the inflation rate of new ETH entering the market would drop, few predicted that within less than a year the inflation rate of ETH would fall below BTC.

Clearly, EIP-1559 has done wonders in turning the narrative around ETH into one about it being a store of value. Now that its inflation rate is lower than BTC, it will be hard for BTC maximalists to say that BTC remains the optimal store of value in the crypto market. Furthermore, once Ethereum moves purely to proof of stake, which will happen this year, ETH will likely become a deflationary asset.

In a world where nearly every fiat currency is currently experiencing inflationary pressures, having a deflationary asset could be attractive to allocators looking to hedge their risk to fiat.

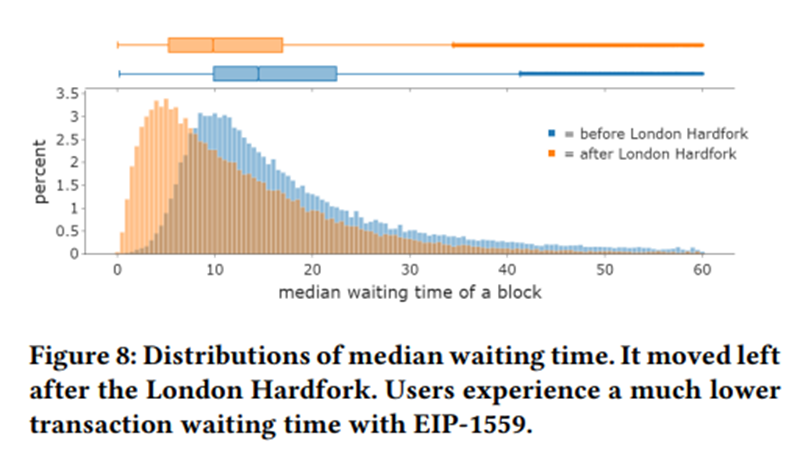

Waiting Times have Decreased

While the market primarily focused on the fact that EIP-1559 created a new deflationary pressure on the asset, the central reason why the core developer opted to implement EIP-1559 was to make fees more predictable. Now, fees tend to move around within a narrower band than before, and thus the volatility of fees has decreased.

Furthermore, the median waiting time for having a transaction approved has decreased, meaning users are having their transactions approved faster.

EIP-1559 has also yielded other benefits, such as a reduction in stuck transactions.

Takeaway

While I was initially concerned about EIP-1559 adversely affecting certain pieces of core infrastructure in Ethereum that are timing dependent, such as Oracles who provide price fees on a consistent basis, so far the change has clearly added two crucial benefits to the network.

In a world of inflation, and with a significant chance many major fiat currencies will collapse in the next decade (read Ray Dalio’s Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail), any deflationary store of value asset will become attractive when there is a paucity of productive investment opportunities. EIP-1559 changed the narrative for ETH, ensuring the digital asset along BTC will be viewed as a store of value.

Additionally, EIP-1559 provided significant UX improvements to utilizing the network by reducing the median waiting time per block.

I am touting party line here, but so far I do think EIP-1559 was the correct decision.