Rapture #139: The Argument for why Inflation is not here to stay

Personally, I am not convicted on if inflation will continue to rise or these consistently 7%+ increase year over year prints will subside. Currently, I do not think the market is pricing in persistently high inflation, though that does not tip my opinion on the matter one way or the other.

What I will say is that I think the market is underestimating how the Federal Reserve will react to the perceived threat of inflation, as I have laid out multiple times such as in Rapture #137and Rapture #126. Still, examining the case for why the Federal Reserve might not be so dramatic in raising rates, and why inflation might not be persistent, is essential to weighing the validity of my hypothesis.

Thus, I thought it would be interesting to cover some of the data Byron Gilliam amalgamated in BlockWork’s Group newsletter yesterday. Note that, as I have done before, I am straight up reprinting Byron Gilliam’s research because I think it is so strong.

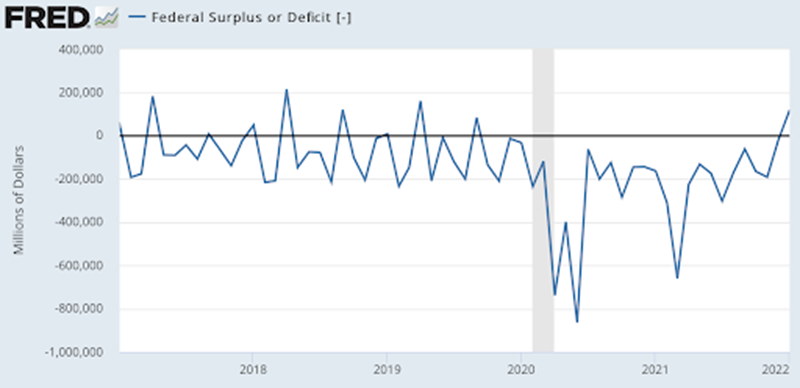

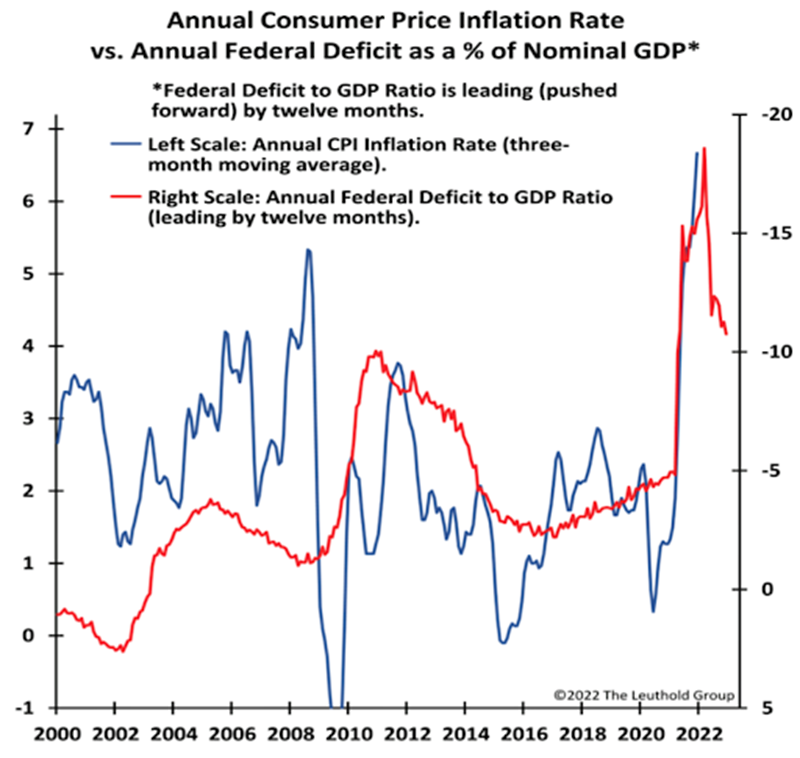

Budget Surplus

While the US government has consistently ran massive budget deficits since the beginning of covid, they are actually now running a surplus of $119 billion for January. Spending decreased by 37% and tax receipts are up 21% compared to a year ago, which are the factors the led to this surplus.

Historically, deficit spending has been a been a leading indicator for changes in inflation. The logic of this relationship makes sense, as less money enters the US economy when the government does not spend as much.

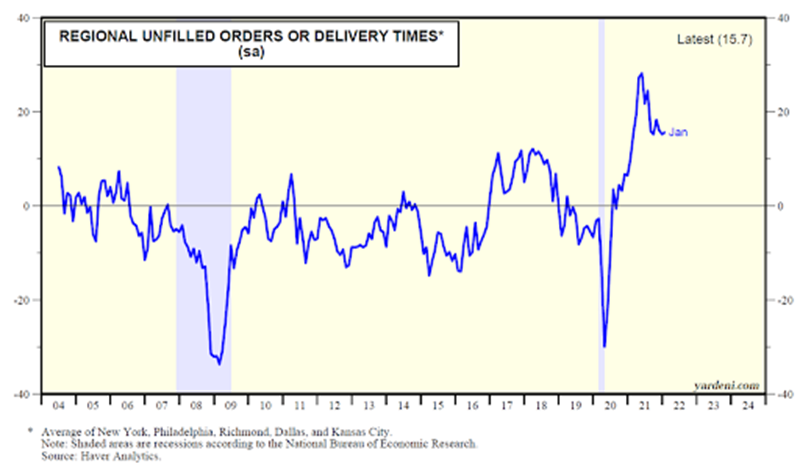

Decrease in Consumer Spending and Unfilled Orders

Yet the government is not the only one spending less. In fact, personal consumption expenditures are falling, though they are dropping from an incredibly high level. If this trend was to continue, it might lead to decreasing inflation numbers.

The drop in demand means that the supply side has more time to satisfy demand, which has led to regional unfilled orders or delivery times decreasing.

Note that, like the decrease in consumer spending, this drop is coming for an incredibly elevated historical level, so it is difficult to say what effects they will have on inflation in the near term.

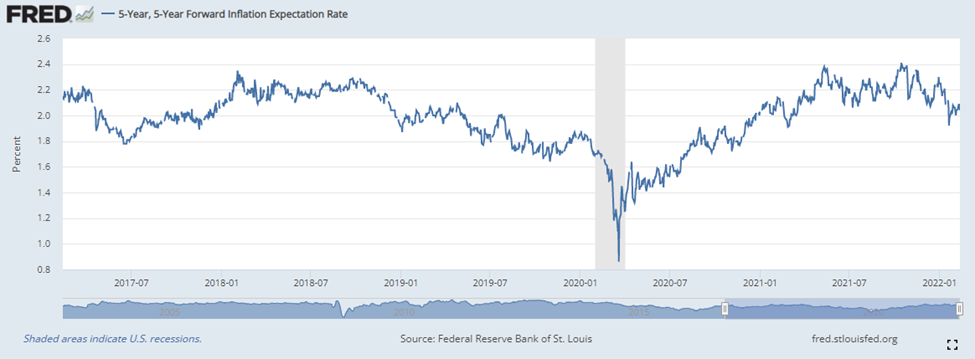

Inflation Expectations

All of this data has led many market participants to believe that inflation is indeed transitory. The 5-year forward inflation expectation rate is currently in downward trend.

Of course, these numbers could be overly optimistic, especially since they are published by the Federal Reserve who has a distinct interest in not letting inflation expectations get out of hand because that leads to people spending more in the short term since they expect prices to rise in the future which leads to… well… inflation!

Takeaway

There are some signs that inflation will indeed be transitory, though I have not yet bought into that narrative. The only narrative I currently buy is that right now Joe Biden and his team are intensely pressuring the Federal Reserve to do something (i.e. raise rates and do QT) in order to stop the rise in inflation, which is dramatically impacting their poll numbers negatively.