Rapture #242: Bear Market Punt

While I wait for the market to show its hand regarding its next big move (which I think will be down), I decided to try my second bear market punt. I discussed how I wanted to develop this skillset further in a previous Rapture.

My first was in ORCA, which at the time I bought, had recently surged to be a top 3 DEX by volume. Despite the high volume on Orca being only temporary (it was caused by the short term success of Stepn), I was able to exit the position at slight profit during a bear market rally.

Yesterday, I decided to allocate a small portion of my AUM towards SWEAT. While the position is small, I am already up approximately 15%.

I will utilize this post to explain my thought process on buying SWEAT.

What is SWEAT

Sweatcoin, an app that rewards users for physical activity, recently launched their token, SWEAT. Note that this app already had 100 million+ registered users prior to entering crypto.

The tokenomics of SWEAT are quite interesting. Users earn SWEAT via movement. Yet the rate of SWEAT users earn will decrease over time. There are movement validators who verify that the steps users submit are legitimate, and every 1,000 verified steps yields 1 SWEAT.

In the future, Sweatcoin sees FitBit, AppleWatch, and Peloton all being movement validators in return of receiving a transaction fee for all the transactions they verify. Furthermore, users are actually charged a fee if their activity consistently falls below a certain threshold. This fee will be determined by the SWEAT DAO.

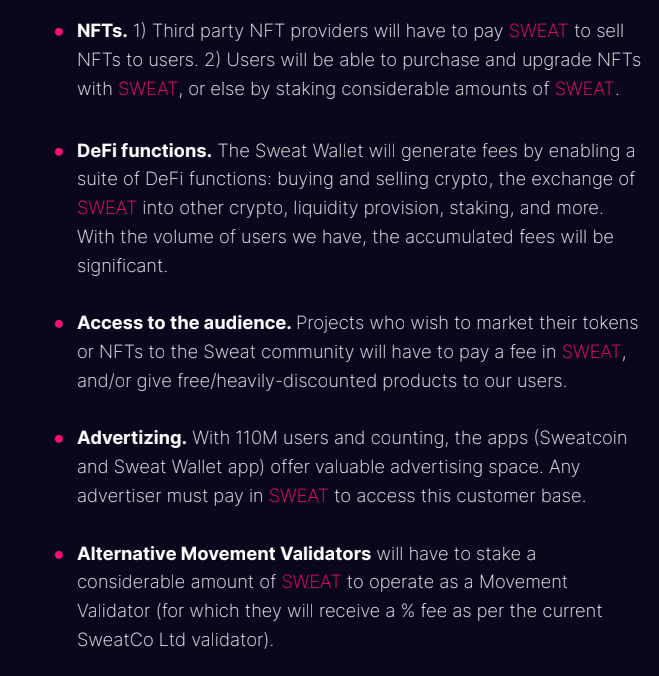

Sweatcoin is also introducing a buy and burn model, which has been an incredibly price accretive tool that other projects have utilized like Binance for BNB. The revenue generated by the activities below will be utilized for the buy and burn program:

Sweatcoin will also use the veSWEAT locked model for governance as influenced by Curve/Convex, which helps remove SWEAT from circulation overtime.

While I do think the token utility design is compelling, because we are in a bear market, I am not putting on any long-term fundamental positions. Consequently, my analysis of the tokenomics beyond the supply schedule, which does factor into my short term allocation decisions, does not have an effect on the trade I put on yesterday.

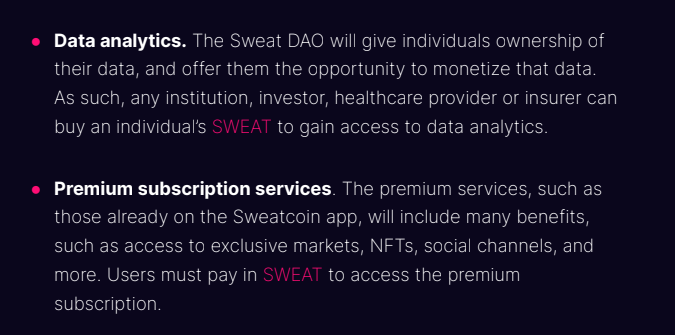

The tokenomics that mattered the most for my short term decision were:

This graph tells me there will not be a significant amount of SWEAT hitting the market anytime soon, so, despite the atrocious amount of tokens that will flood the market in future, I feel confident in playing hot potato for now.

Other factors

Already the Sweat Wallet, which is utilized for Sweatcoin's application, has more than 113,000 DAUs, making it the 5th most utilized dapp.

Furthermore, major trader cryptoinfluencers, from TheCryptoDog to CanteringClark, have been shilling the coin heavily in the past 24 hours.

Additionally, SWEAT's largest market comparable, GMT, has a market cap that is approximately 3.3x larger than SWEAT, despite Stepn (the project behind GMT) having far less users.

Finally, there is no major narrative in the market right now, and crypto degenerates, even in a bear market, always need to take their action somewhere.

Sweatcoin could fill that narrative gap. For now.

In a bull market, I might have even felt inclined to put on a much larger position in SWEAT.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.