Rapture #230: Reflection

Well, we are approaching one of these key turning point moments in the market again. I believe we will shortly know whether this macro bear market was just a short term scare or if we are in for more sustained pain, which is my base case. The big event that had been driving the traditional markets in recent history, the lower than expected inflation print, is now behind us.

On the cyrpto side, the Ethereum merge date has been tentatively set for around September 15th since the goerli testnet merge was successful. The setting of this date means at least the initial hype phase for the merge is now over.

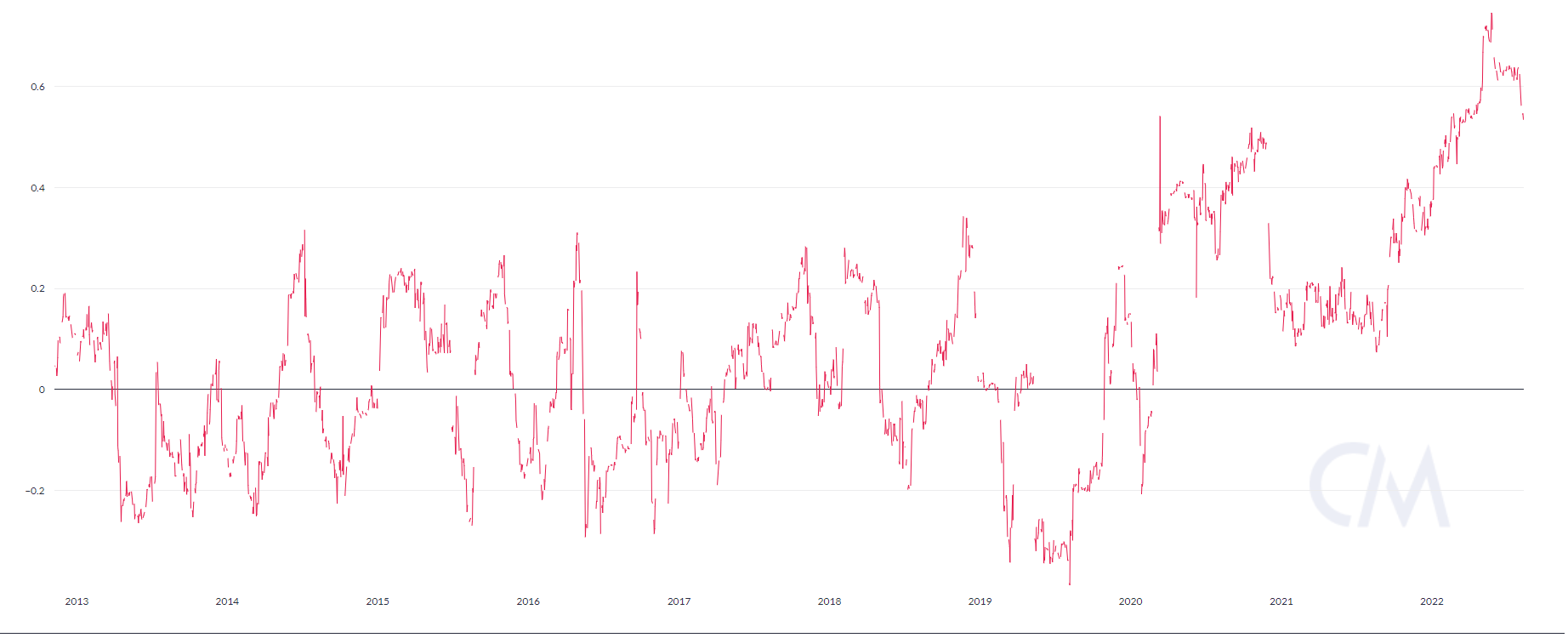

Markets still correlated

Correlations between BTC and the S&P 500 currently are still historically high at .5+, but are rapidly dropping, having peaked in late May at around .72. Still, these high correlations mean that if anything adversely affects equity markets, crypto will also likely faulter. Interestingly, US equities sit above their June highs, while BTC is still approximately 23% below its June high. ETH, the current driver of crypto markets, actually sits above its June high. Open interest for ETH is now higher than BTC, and 24 hour volumes between the two assets are getting closer by the day.

What I have done in this rally

In short, very little.

I recently liquidated my tiny ORCA position at a small profit. Overall, I still remain defensively positioned, as I am approximately 95% USD. Despite the recent surge in equities and crypto (ETH in particular), my base case is this current upswing is a bear market rally. Note that I have made barely any money off this upswing, and am keenly aware I have missed a 100%+ rally in ETH despite knowing the merge was an upcoming major event.

Furthermore, despite writing about how Ethereum staking related projects might beat out the bear on February 4th, I was not able to successfully capitalize upon making any trade to take advantage of this view. Though starting to make allocations in Ethereum staking projects, like LDO and SSV, would have been a bit premature on February 4th, every coin related to an Ethereum staking project has been on an absolute tear since the June crypto bottoms. LDO is up more than 5x, RPL is up more than 3x, and SSV is up more than 2x from their June lows.

I am still mulling over if I should work on developing a shorter term trading skillset to complement my mid-long term game. The largest issue here is that shorter-term trading is far more time intensive than just my mid-long term game. Still, I am considering setting aside 2 - 4% of my portfolio to try my hand at developing the skillset.

What is next

If the S&P 500 and ETH rip materially higher (i.e. 10% for the S&P 500, 20% for ETH), I will need to seriously reconsider the validity of my base case.

Maybe the Federal Reserve is indeed successfully executing a soft landing and there won't be significant economic pain or prolonged inflation. I doubt it, but being wrong is part of the game.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.