Rapture #222: Market Update

For those who celebrate, hope you have been enjoying the 4th of July weekend. In today's Rapture, I want do discuss my market outlook.

While I am still bearish for now, I do believe there could be some respite in the future depending on June's inflation rates, which will come out on July 13th. There is a chance that the inflation rate for June will not be as bad as expected, and there are a few key signals indicating that inflation narrative might be changing shortly.

Let's dive into some of these potential signals.

Personal consumption expenditures on goods drop

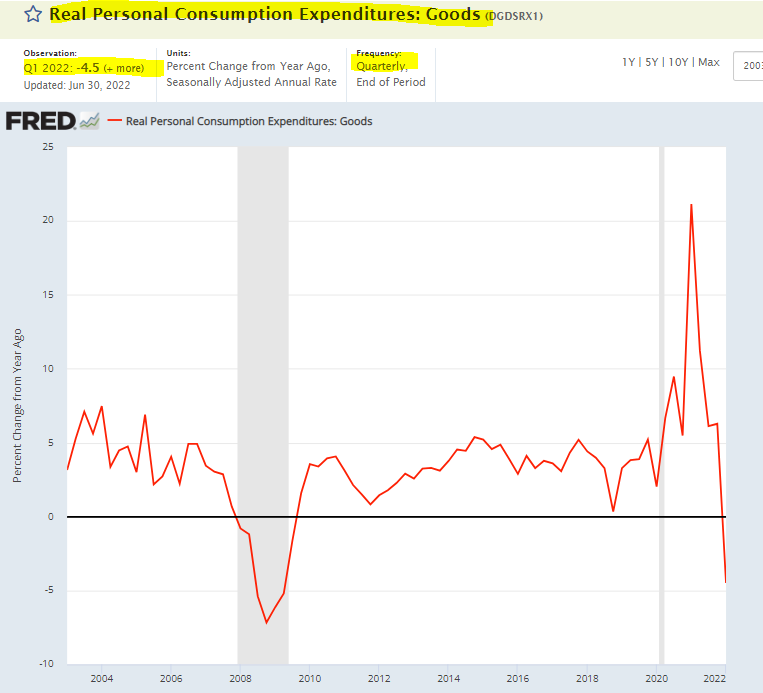

One indication that inflation might have already peaked or is peaking shortly is the precipitous drop in personal consumption expenditures on goods in the US. While actual levels remain extremely high, year over year changes are beginning to plummet.

Not only was there a drop in personal consumption expenditures on goods, but consumer sentiment is now the lowest its been since data on the topic started being collected in 1952. 79% of consumers expected bad times in the year ahead for business conditions, which is the highest since 2009.

People consuming less goods is a disinflationary force.

Commodities drop

Nearly all major commodities are down significantly in the past month. Natural gas is down more than 30%, copper is down more than 20%, and wheat is down more than 21%. While the yearly trends for these commodities is still high, the shifts in the past month could indicate a change in trend.

Decreasing commodity prices is a disinflationary pressure.

Federal Reserve changing tune

While in previous Raptures I discussed how anyone who believed the Federal Reserve when they stated that they could stop inflation without inducing a recession was being disingenuous with themselves (i.e. delusional), it seems even the Federal Reserve is coming around to the fact that a recession is now imminent.

Federal Reserve Chairman Jay Powell last week reaffirmed how the Fed is strongly committed on fighting and inflation. Furthermore, he indicated a recession is a possibility. This is Fed speak for recession on the horizon.

Recessions are definitely disinflationary.

Predicting political pressure

Politicians dislike inflation, especially when it is a top issue for voters. Yet politicians also dislike their voting bases having concerns over recessions. Currently, I still think the political pressure on the Federal Reserve will be focused on reducing inflation, as there are not enough signals yet that they should ease again to prevent the pains of a recession. Political reaction time is slow, and we are just getting to the phase where people are worried about a pending recession. They are not yet screaming about the economic pain they are currently experiencing.

Until that happens, and as long as the polls say inflation is the #1 issue, in my opinion political pressure on the Federal Reserve will still tilt towards reducing inflation rather than alleviating economic pain.

My take

This environment is extremely difficult. From a BTC drawdown perspective, we are at levels that I would have liked to redeploy had the macro environment been rosier. Since the macro environment still has the potential to deteriorate quickly, I cannot gain conviction in redeploying at these levels.

Unfortunately, this view is now consensus amongst allocators in crypto. There is not a crypto trading desk or crypto fund manager I have spoken with recently that is bullish and many are saying "6 months, then we will redeploy."

While many altcoins are still overvalued in my perspective, there are entire sectors that I believe are incredibly attractive should the crypto market overall improve, such as DeFi.

I am opting for caution, but I am the least confidant I have been in remaining 90%+ cash since around the end of January.

If the inflation narrative changes because of disinflation and we do not clearly enter a recession, which everyone is clamoring for, assets, including crypto, will likely rip up. The issue is even if that happens, that rapid rise could be temporary if inflation picks back up or a recession causes sever economic issues.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.