Rapture #169: The Big Day

Today was the big day! While Federal Reserve Chairman Jay Powell did not surprise the markets, there was some interesting information that could be gleaned from today's FOMC meeting. Both crypto markets and equity markets moved in complete lock step today, as both dipped during the meeting only to rally as the day went on.

Crypto's correlation with the S&P 500 has been decreasing as of late, so watching it move back in lockstep with equities indicates the correlation will hold tight during important events.

Despite the predictable rate raise, there is some interesting information that can be gleaned from today's fed meeting.

Federal Reserve thinks the US economy is incredibly strong

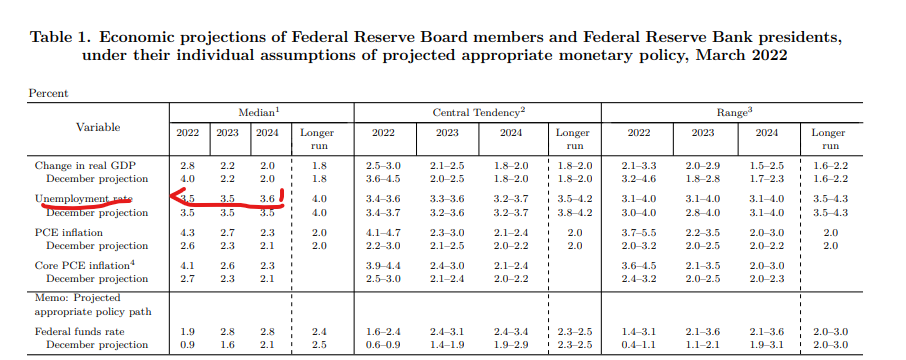

Right now, it is quite clear that Chairman Jay Powell is more concerned about inflation than he is about the economy. Despite 6 potential upcoming rate hikes, 7.9% inflation, and approximately $1 trillion per year of QT coming, Chairman Powell does not think "the probability of recession is particularly elevated." While Chairman Powell did cite the conflict between Russian and Ukraine as a risk, the projections the Federal Reserve Board disseminated display that they believe there is no recession anywhere on the horizon.

One can infer their lack of concern for an upcoming recession by the unemployment projections they made for 2022, 2023, and 2024 being below 3.7%. Since the Federal Reserve projects a strong economy, their likelihood of being more hawkish on rate rises, tightening, and other policies increases.

Federal Reserve thinks Inflation will come back under control

Based on their projections, the Federal Reserve believes inflation will come back under near targeted rates likely by the end of 2024, meaning that their target of getting to flat 2.4% funds rate within two years will be effective in lowering inflation.

From my interpretation, the Federal Reserve right now is projecting unattainable perfection in managing the economy. I do not see how rates are raised to a flat 2.4%, inflation comes down to under 2.5%, and unemployment remains below 3.7% in the near future.

I think anyone taking these projections at face value are being disingenuous with themselves.

Yield Curve Reaction

The 5 and 10 year yields are effectively equal at this point, with 9bps differentiating the two. Furthermore, just last week, the difference between the 2 and 10 year treasury yields traded within 21.9 bps of one another.

Yield curve inversions typically signify that there is a recession on the horizon.

Crypto's Reaction

Crypto held up quite well today, though there definitely was not a meltdown in the broader markets to put on significant pressure.

I am not bullish on crypto in the short to medium term. I have still not reallocated from my cash position, and think the environment right now is particularly worrisome considering traditional market's disconnect between projections and reality.

Of course, just because there is a bear market in traditional markets does not mean crypto cannot perform well. I think crypto will perform well in a traditional market bear, just not in the early phases.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.