Rapture #187: Messari's Uniswap Q1 Report

Clearly, the industry is moving towards producing consistent financial reporting for protocols. Last week, Llama produced a report on Aave for the month of February. I covered the report in a Rapture newsletter.

Today, Messari released their Q1 2022 report on Uniswap. Let's dive into some of the highlights. Jerry Sun did an excellent job summarizing the report in this thread, and you can find the full report here.

Volume and liquidity

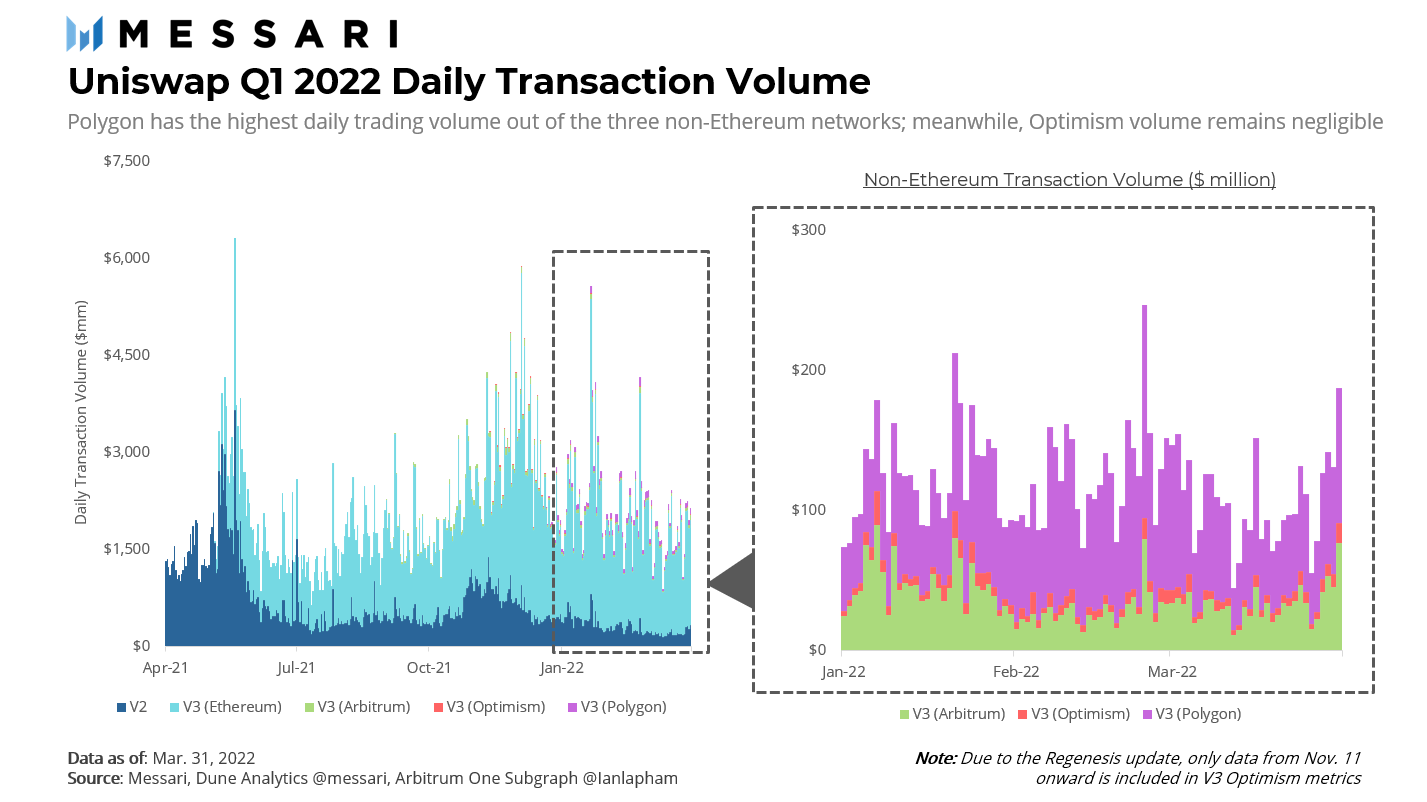

Volumes dropped significantly for Uniswap in Q1. In fact, they sank by 20% quarter over quarter. This drop should be no surprise considering crypto's lackluster performance in Q1 and the drop in volumes across all marketplaces like centralized exchanges, which saw an approximately 50% drop in volumes.

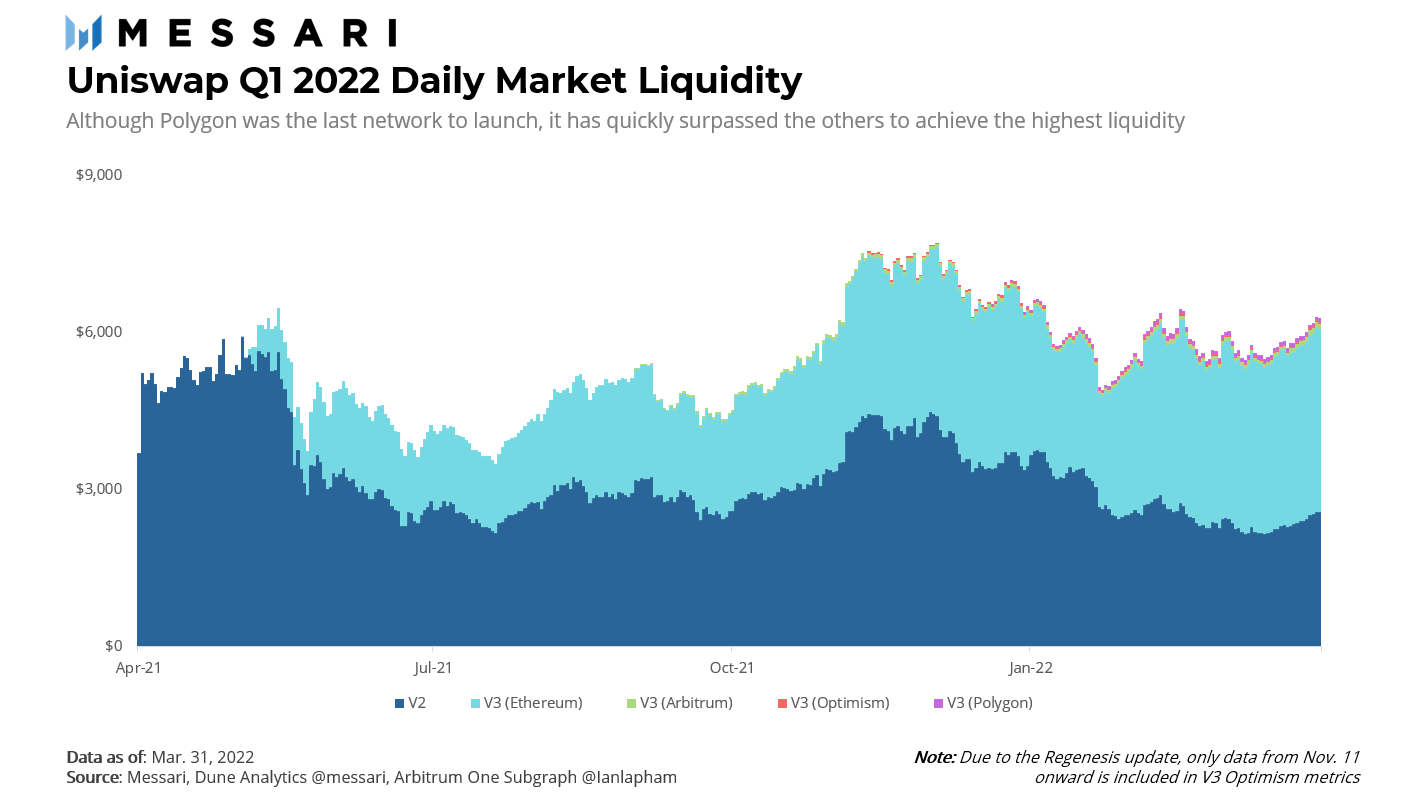

The highest liquidity market for Uniswap is now its V3 deployment on Polygon. Interestingly, liquidity dropped by a far lesser degree compared to volume. Uniswap V2 saw liquidity fall by 25.7% quarter over quarter, while liquidity on Polygon, Arbitrum, and Optimism actually increased 81.7%, 72.9%, and 34.7% respectively.

Grants

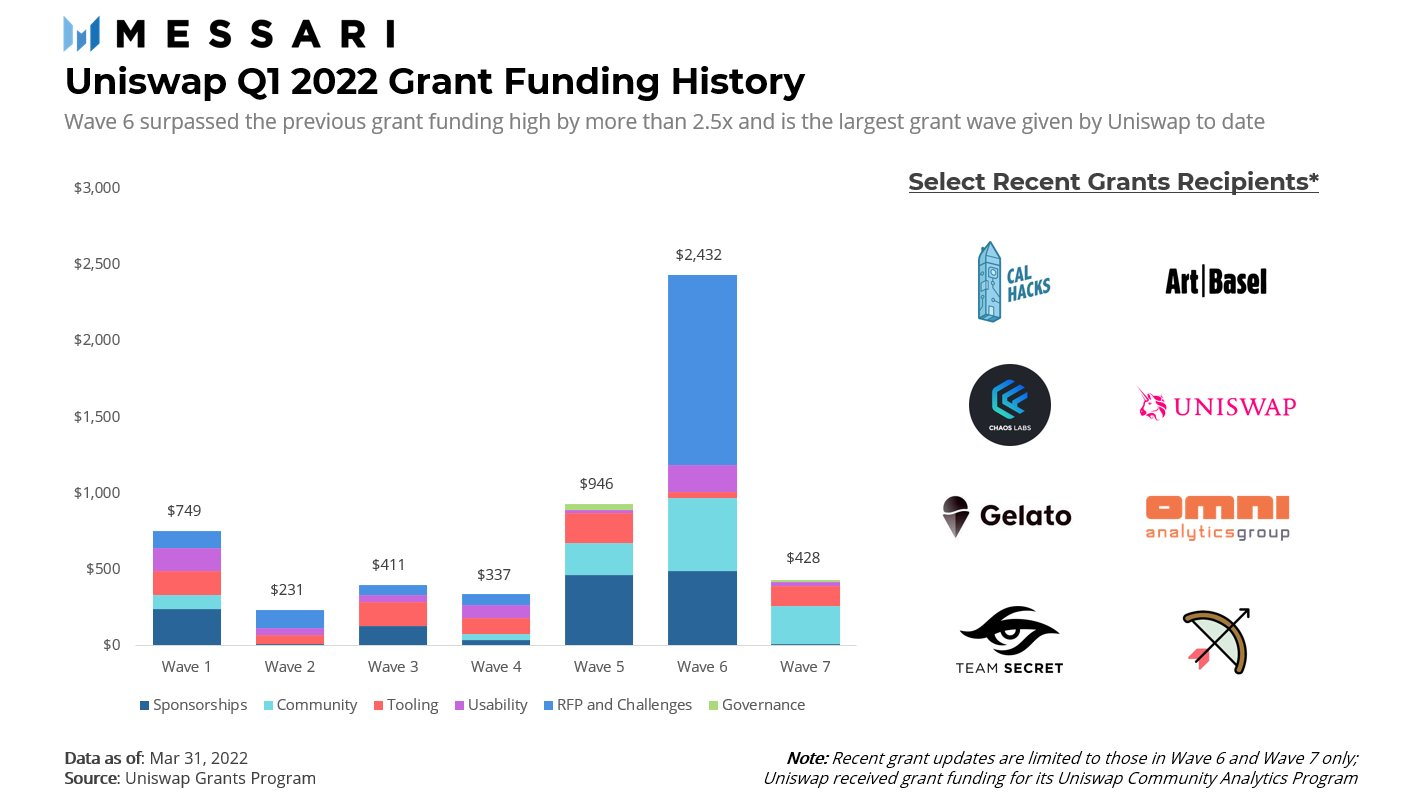

While volumes and liquidity dropped, grants hit a new all time high. Note that both wave 6 and wave 7 occurred in Q1. Nearly $3 million was allocated to teams via grants in Q1. The most notable grants were Other Internet ($1 million grant to research Uniswap's open governance), Unigrants Community Analytics Program ($250,000 grant for contributors who produced analytics for the protocol), Team Secret ($112,500 sponsorship for one of the top DOTA teams), and Art Basel ($68,500 grant for a booth at Art Basel to help users set up their first wallet).

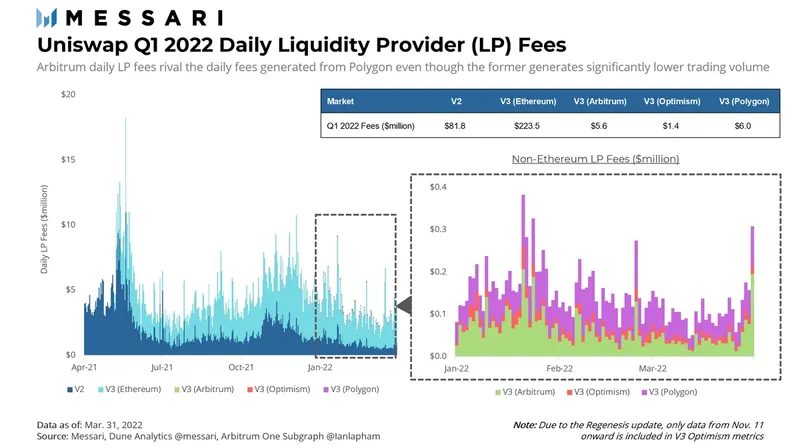

Daily LP fees

Daily LP fees, as to be expected with receding volumes, fell 36.2% in Q1 compared to Q4. Note that the Q4 numbers for Uniswap LP fees was a bit of an outlier, as they had increased 54% vs. Q3.

V3 (Ethereum) generated the vast majority of fees for Uniswap at $223.5 million, while Uniswap's V3 Polygon deployment generated the most fees out of any scaling solution at $6 million.

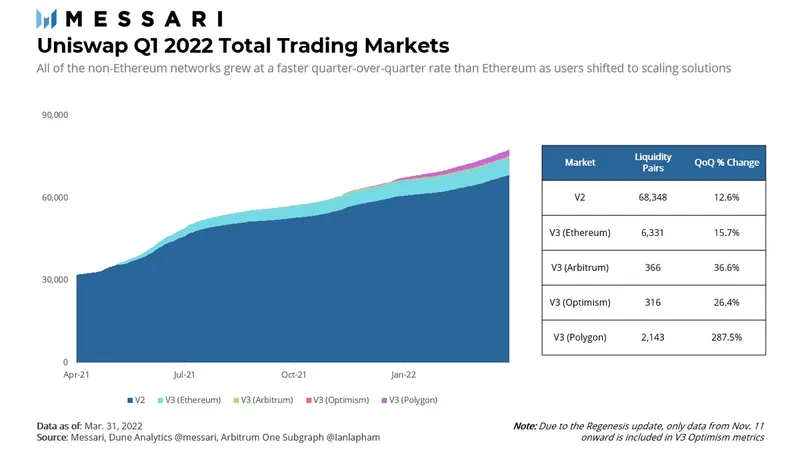

Total trading markets

New markets being created on Uniswap increased across all deployments, with Polygon seeing the most new liquidity pairs with a QoQ increase of 287.5%. V2 still has the most liquidity pairs out of any deployment at 68,348, but that is to be expected because it is the oldest deployment tracked.

Top 3 V3 markets

As one might expect, the top 3 V3 markets were USDC/WETH, USDC/USDT, and WBTC/WETH. In aggregate, these markets composed 61% of V3's volume. BTC, ETH, and stablecoins are also the most popular markets on centralized exchanges.

Takeaways

Despite a lackluster quarter overall, Uniswap's growth on Polygon is incredibly encouraging. Furthermore, grant funding increasing so much displays just how passionate the Uniswap community is in contributing to the ongoing development of the protocol.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.