Rapture #100: The DEX Wars

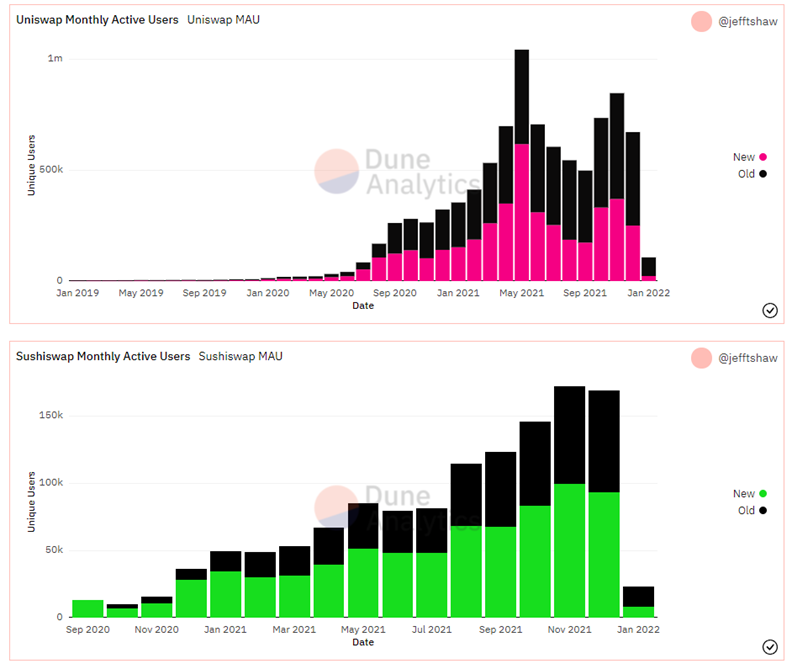

I came across a new query on Dune Analytics recently. The query produced charts of monthly active users by DeFi project, showing the amount of active users that were new to the application vs. old users who returned to the application.

Some of the data from these queries could explain the recent price movements in various DEXs, and thus I wanted to discuss their findings here.

Uniswap vs. SushiSwap: Fundamentals Playing a Larger Role?

Ah, our two favorite DEXs. While both DEXs have shown substantial growth in the past year, only SushiSwap consistently grew month over month in Q4 2020. Furthermore, more than half of SushiSwap’s MAU (monthly active users) have come from new users rather than old ones for the past 3 months, while new users only comprise approximately 41% of Uniswap’s MAUs over the past 3 months.

Of course, Uniswap has far more MAUs so it has a taller order to get their new user MAUs over the old user MAUs compared to SushiSwap.

Still, I do think the market is reacting positively to the user growth in SushiSwap. In the past 30 days, SUSHI is up 23.1% vs. UNI being down 9.0%. Interestingly, both have outperformed BTC, which is down 14% in the past 30 days, but SUSHI is clearly the winner. While there was some substantial “developer” (aka management for DAOs) changes that happened in this past month, with Joseph Delong who was previously CTO at SuhsiSwap stepping down, I do believe the user growth story is the more compelling one to watch.

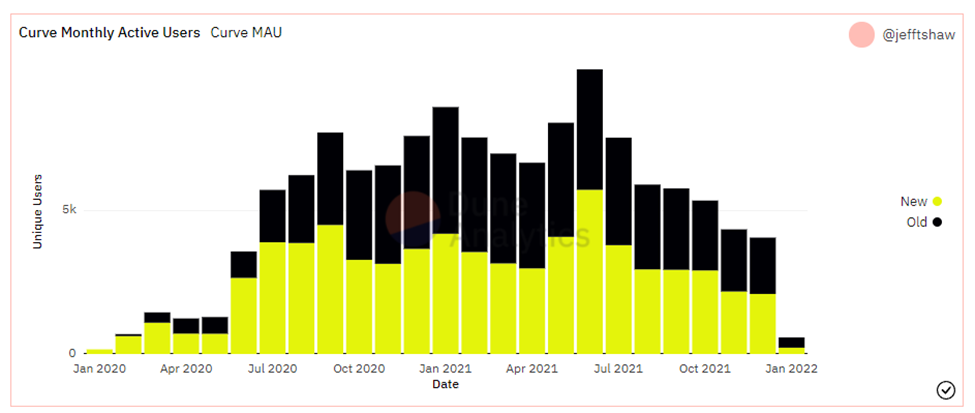

Curve Ball: Maybe not…

Yet neither SushiSwap nor Uniswap has been the prettiest DEX in the room this past month. That award goes to Curve, which is up more than 45% in the past 30 days. Clearly from the chart, you can see that Curve’s MAUs have been consistently decreasing throughout Q4 2021. Many attribute the price move in CRV to Convex, which is a platform where you deposit CRV and CRV LP tokens in order to receive more boosted CRV tokens, dubbed cvxCRV, and CVX tokens.

At the end of the day, once you receive cvxCRV, you cannot convert them back into CRV tokens. Consequently, cvxCRV trades at a slight discount to CRV on the open market. Effectively, Curve is getting users to lock up/trade in their good CRV tokens for cvxCRV, whose growth is largely supported by the growth in CVX’s price and the volume of the 3CRV pool since it receives fees from that pool. If the 3CRV pool’s volume decreases, this pyramid of cards will likely collapse.

But until then, Curve and Convex have designed clever ways for users to lock up their CRV tokens, dramatically reducing potential sell pressure and increasing buy pressure for CRV on the market since users want to receive rewards. Furthermore, Curve (ranked #2 on TVL) and Convex (ranked #3 on TVL) combined have a whopping $28.2 billion TVL, displaying users' interest in the farming.

If you aren’t knee deep in tokenomics, don’t be concerned if this Russian doll set is difficult to follow.

The main takeaway here is that despite falling MAUs, the clever tokenomics of Curve and Convex seem to be propping up its price for now and outweighing the fact that MAUs actually decreased through Q4 2021.