Rapture #99: Goldilocks now, Goldilocks Forever!

The OG crypto enthusiasts joined crypto because they hate the dollar. The US treasury is concerned that crypto weakens the dollar’s dominance. The Federal Reserve also believes that crypto poses a threat to the dollar.

There is a lot skepticism out there regarding what crypto will do to the dollar!

Why, then, do I believe that crypto leads to more demand, not less, for dollars?

Dramatic increase in dollars with, until recently, tepid inflation

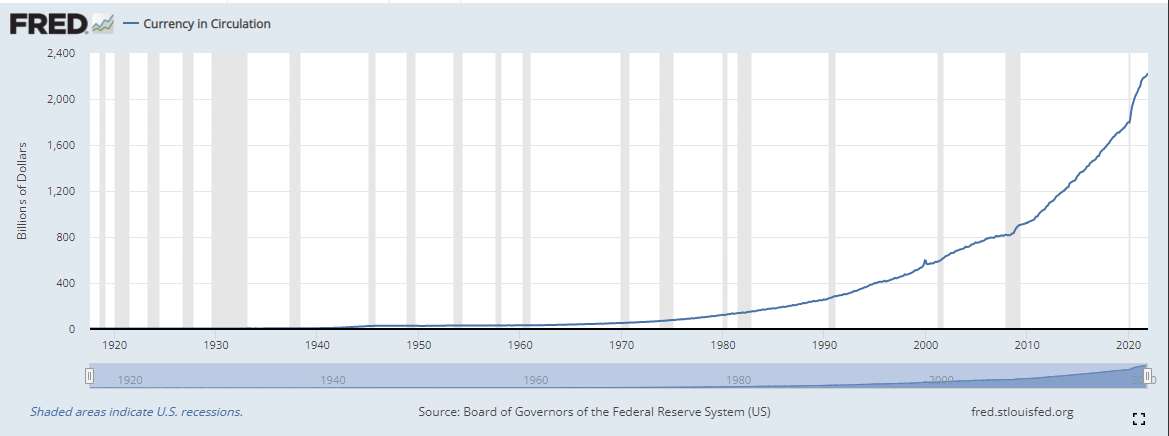

Since 2007, there has been an unprecedented increase in the amount of dollars in circulation, which has been driven by the federal reserve’s policy post 2008 and during the coronavirus. Despite this rapid increase of dollars in circulation, there has not been a significant increase in inflation until incredibly recently. The central reason why inflation has picked up despite the dramatic increase of dollars in circulation, even amongst relatively slow economic growth, is because demand for dollars globally has been incredibly high. Approximately 60% of all foreign reserves are US dollars and around 36% of our general government debt securities are held by foreign investors, which are paid for with US dollars.

Not only is the US dollar the most held currency in foreign reserves, but all global commodities are priced in dollars. If demand for dollars remains high, the Federal Reserve can continue increasing the monetary base without there being correspondingly high sustained inflation. Furthermore, the US can import far more goods than it exports and maintain high federal deficits without experiencing significant inflationary pressure on its currency.

Of course, the narrative is beginning to shift. As a percentage of foreign reserves, the dollar has been on a steady decline since 2001. Additionally, foreign holdings of marketable US treasuries has declined from approximately 50% in 2010 to 35% in 2021. If these trends continue, the US federal reserve will not be able to consistently increase the monetary base and have low interest rates without there being inflation. The goldilocks period will end.

Dollar denominated stablecoins could be the savior of the dollar

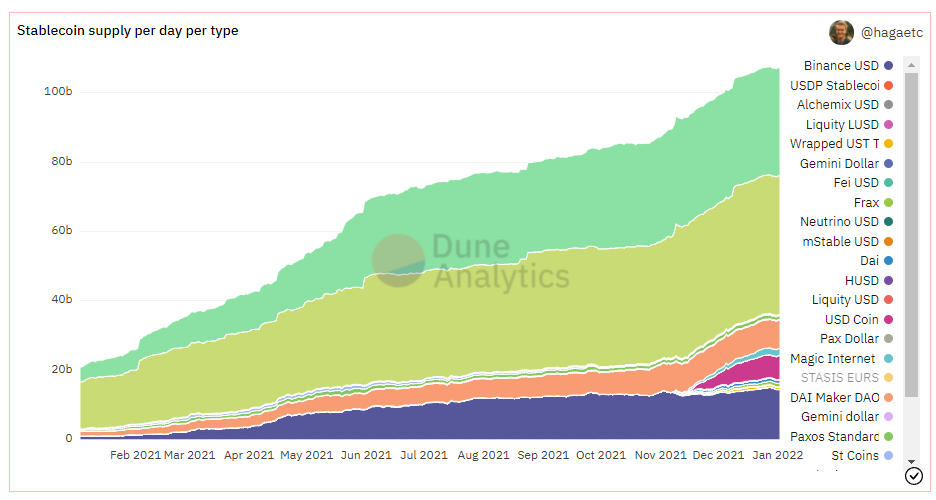

Yet dollar stablecolins, which are just crypto tokens that are pegged to the USD, could create a new source of demand for USD. In January 2021, the USD stablecoin supply was around $20 billion. Today, that number is around $105 billion, an increase of more than 5x in a year. This demand largely comes from the fact that people around the world park their money in stablecoins when they don’t want exposure to the price movements of other cryptos. Furthermore, once their capital is in stablecoins, it is far easier to send those stablecoins to lending protocols to earn yield or to family across the world than it is to execute those functions in the traditional financial system.

Fascinatingly, despite only being less than 8 years old, USD stablecoins equal about .5% of the entire US money supply. If demand for stablecoins continues to increase, and these stablecoins are backed by a composition of USD and US treasuries as Lyn Alden suggests, then stablecoins could be one way to not only increase the dollar's strength globally but also monetize US treasuries. USDP, USDC, and GUSD already use treasuries to partially back their stablecoins.

If demand for stablecoins continues to increase, and they are backed somewhat by treasuries, then the US could continue to maintain a goldilocks policy of dovish monetary policy paired with fiscal deficits and trade deficits without there being significant inflation. Regulation of stablecoins could easily lead to this scenario occurring.