Rapture #275: All in

Over the past couple weeks, I decided to redeploy all of my cash back into crypto. My largest position by far is ETH, though I did pick a handful of altcoins that I think will dramatically outperform once the crypto bull picks up steam. I could always be wrong, but the current set up in my opinion heavily favors extremely bullish price action returning to the market.

Crypto's price reaction to banks failing, the Federal Reserve dramatically increasing their balance sheet, widespread discussion of the floundering fiat system, and increasing spot accumulation has given me the confidence to believe that we are now in a new bull market.

While contagion could cause a short term extreme risk-off period like the covid crash in March 2020, I think the likelihood of such an event is small and thus feel comfortable being fully allocated.

I will briefly address each point here that has led me to this allocation decision.

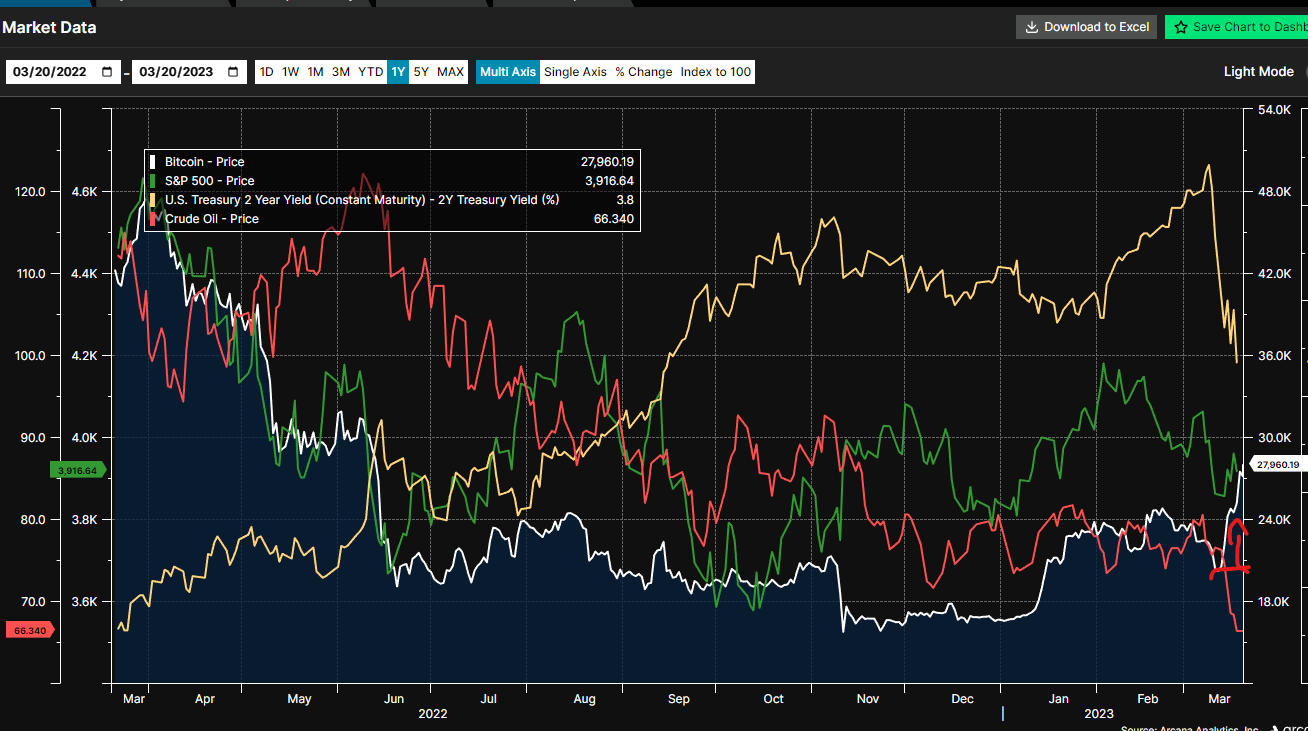

Crypto's price reaction to the banks failing

Unless you are leaving under a rock, you know that major US and European banks effectively failed over the past couple weeks. The largest one to likely hit people's radar was Credit Suisse, who was recently put into a shotgun merger marriage with UBS by the Swiss government without the approval of shareholders (lol to all the people who thought we live in a capitalist society where the government couldn't do such a thing).

For the first time at the major global scale, crypto, at least for now, showed that people were beginning to believe in the alternative to fiat currency thesis. While nearly all other asset classes dropped precipitously, crypto rocketed higher.

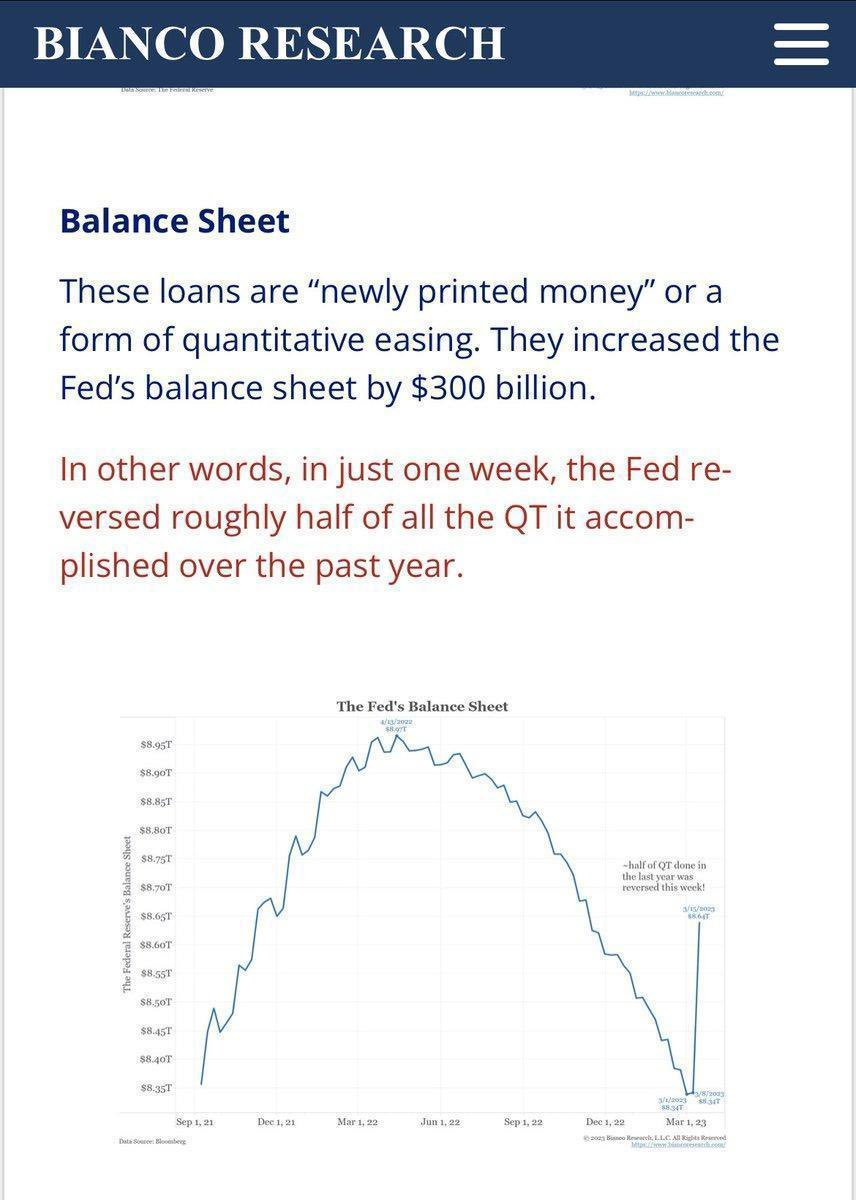

Federal Reserve dramatically increasing balance sheet

One of the main reasons that crypto prices shot higher could be the dramatic unwinding of around half of the QT the Federal Reserve has pursued in the last year within one week week.

Whether you believe crypto is a risk-on asset or a fiat hedge, an increasing fed balance sheet could be interpreted as bullish in both scenarios.

Widespread discussion over fiat failures

Not even 3 years ago, crypto people would get laughed at if they discussed the failure of fiat. Now, because of Balaji's presentation in Singapore and his recent tweets, the failure of the king of fiat itself, the USD, is the topic de jure.

Nearly every major podcast touched on his tweets, and even one of the founders of Facebook felt compelled to respond. CNBC was covering the topic as well. While I don't think the USD will fail within 90 days (Balaji's postulation), everyone is now talking about it. The more people believe that fiat and the dollar could fail, the more the prophecy becomes self-fulfilling.

Google searches for Bitcoin are picking up worlwide substantially.

Increasing spot accumulation

Crypto's price has been increasing on materially higher volume (roughly 2x from a month ago). Furthermore, the rally has been led by BTC, which usually is the market leader when transitioning to the early stages of a multi-year bull market.

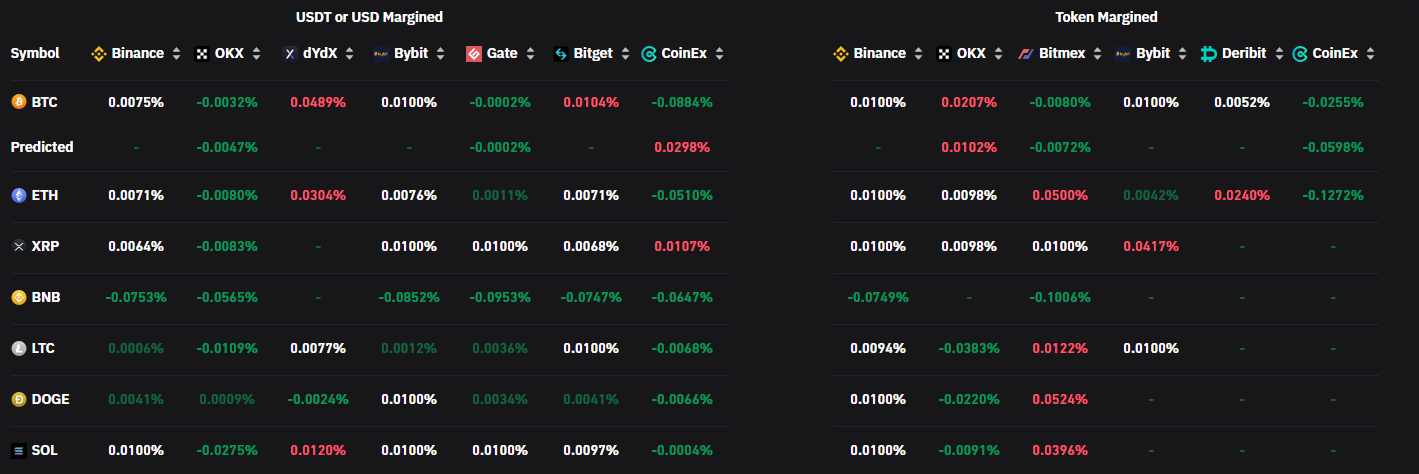

Funding rates are still close to zero and in some cases are even negative, indicating that the derivative market is not too bulled up on leverage.

Conclusion

I am in a position where I can sustain myself even if I am widely off the market and we decrease in value 50%+ from here in a quick manner. That being said, I think the existing fiat system will treat these banking issues now or in the near future with a resumption of QE, which could send crypto prices much higher.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.