Rapture #268: It's Lit Part 1

Another crazy couple days for the markets. Fed Chairman Powell came in more dovish than previously though stating that there is only a couple more rate hikes to go. Markets overall have reacted extremely positively. The looming threats that could shake this bullish momentum would be an earnings recession or a renewed upsurge of inflation. Both could happen at any time, though the earnings recession looks like it is taking longer to play out than initially thought. Commodity prices have been spiking since the beginning of the year though, which definitely could be an upward driving force to inflations.

Regardless, I am approximately 20 - 25% allocated right now. Still pretty defensive, but not completely convicted anymore we break the lows. While I talked about some of my altcoin allocations in my most recent newsletters, today I wanted to discuss my largest altcoin exposure: LIT, the token for the Timless ecosystem.

Tokenomics

First, the tokenonics of LIT are pretty darn attractive. The token only has a market cap of $7.3 million and a fully diluted valuation of $65.6 million. That being said, the fact that circulating supply is roughly 1/10th of max supply is concerning, as it means there will be many tokens coming to circulation via mostly farming in the future.

Yet the market cap for this token is so low that I am willing to overlook the future supply coming to market, which should increase by approximately 50% this year.

The lock modal on LIT is terrific. In order to receive the major boost on farming, users must lock LP tokens from the Balancer pools in order to receive veLIT. This differs substantially from most token lock modals, as this process incentivizes people to contribute liquidity to the DEX market in order to receive rewards rather than just lock some governance token. Liquidity tends to beget liquidity and is a prerequisite for a token really gaining widespread crypto native adoption.

Another interesting aspect of the tokenomics is that the farmed token comes in the form of something called oLIT. oLIT enables users to purchase LIT at a 50% discount. This rate can be changed by a governance vote. While a 50% discount seems a bit too high to me, the fact that there is more friction between a user receiving the farming rewards and negatively affecting the price of LIT through selling is definitely positive for value accrual.

Bunni liquidity engine

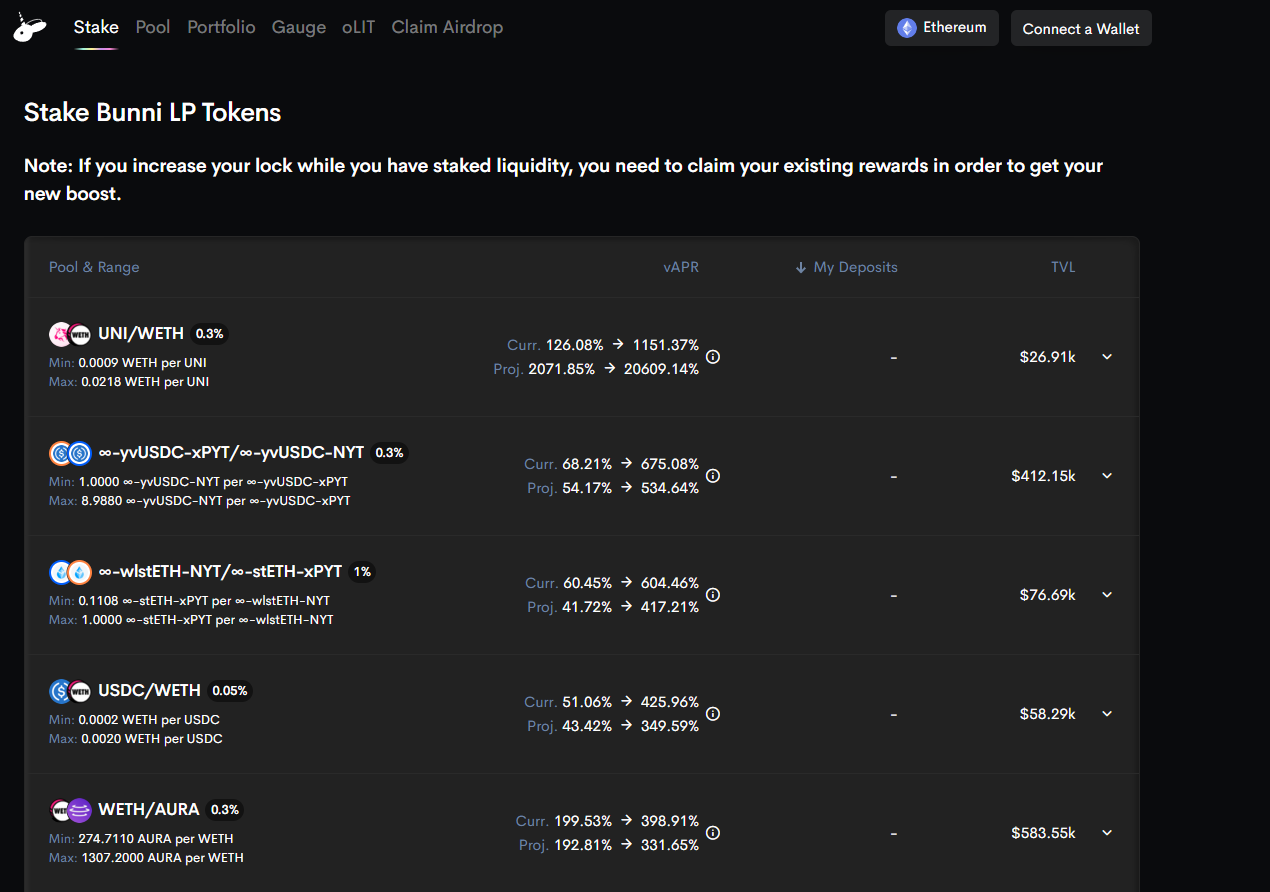

The first major project built for the Timeless ecosystem is the Bunni liquidity engine. The Bunni liquidity engine incentivizes users to contribute liquidity for certain token pairs on Uniswap within specific price range bands, which allows for more efficient LP markets.

I don't want to dive too much into the details because it will likely be confusing, but incentivizing liquidity within specific price range bands means that there is likely far less slippage for users who want to interact with that pool, meaning the market is far more efficient in terms of its market making function.

This modal is the big innovation that Bunni brings to the table. Bunni enables hyper efficient liquidity provisioning for typically illiquid altcoin markets through novel farming incentives. Already, Bunni pools are attractving far more volume than traditional pools on Uniswap despite being a fraction of the TVL.

For the next newsletter, I will discuss the yield specualtion tokens being innovated by Timless and also touch on the legitimacy for their team.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.