Rapture #266: Crypto is a Geopolitical Battlefield

While I will get back to discussing why I like LIT and PENDLE, which I mentioned I allocated to in Rapture #265, there has been some major geopolitical movements within crypto during the past week that I feel deserve attention.

In Rapture #254 and Rapture #263, which I published on November 25th and January 12th respectively, I alluded to the fact that the next phase of crypto in my opinion will be heavily influenced by nation states operating in the background. The events of this week have only gone on to further my conviction.

So, what happened?

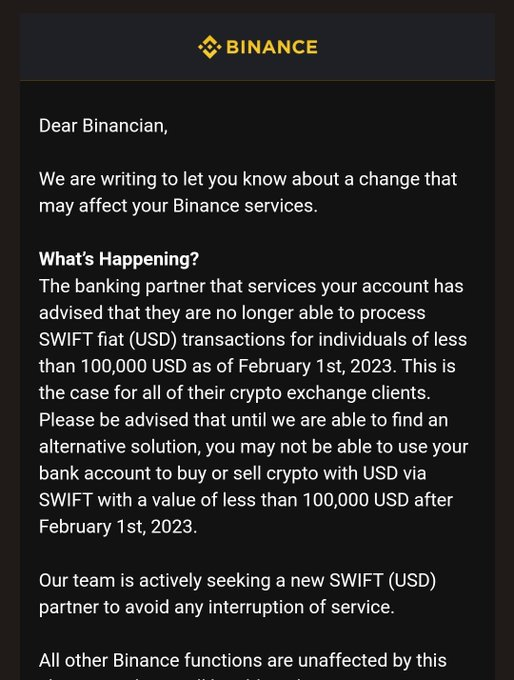

Binance deposits restricted because exchange cut off from SWIFT

Regardless of the reality of the situation, Binance and its founder CZ is seemingly becoming the face of Chinese international business practices: profitable, growth at all cost, and little respect for the international rule of law framework spearheaded by the US. Very much a catch-me-if-you-can attitude. Many in crypto believe that what they deem as the "Binance cartel" is currently the entity driving up prices.

Now, the influencers who are posting those accusations have clearly been mispositioned for this rally and are likely coping, but without a doubt there is an emerging narrative that something might be going on in the background spearheaded by Binance to push markets higher.

Regardless of the truth of this narrative, it is becoming quite clear that the US government is interested in curtailing the influence of Binance.

Earlier this week, Binance was cut off from SWIFT for USD transfers below $100,000 from their major banking partner, Signature. Users are also saying that EURO SWIFT banking has been cut off. Binance allegedely had been using Siganture via a shell company.

Furthermore, it looks like more East Asian based exchanges have also been cut off in the same way, from Huobi to OKCoin. Both Huobi and OKCoin are thought to be in the sphere of influence of Binance. Now, some non-east Asian exchanges have also been listed, like Bitstamp, so maybe Signature is truly pursuing a new policy for all of their crypto clients.

Still, my gut tells me that this move is one that is attempting to further segregate the centralized crypto market into an on-shore regulated market spearheaded by Coinbase and an off-shore market largely controlled by Binance.

Bitzlato bust

In addition to the Binance news, the US government busted the Russian co-founder of a Hong Kong based exchange Bitzlato this week. The DOJ alleges that Bitzlato was a safe haven for cybercriminals. Furthermore, FinCEN claims that Bitzlato allegedly laundered more than $700 million, specifically for Russian-affiliated ransomware groups with links to the Russian government.

Additionally, the Treasury Department stated that Binance was one of the top receiving counterparties from Bitzlato in the past couple years. Binance in response proclaimed that they assisted international law enforcement in support of their investigation.

Anatoly Legkodymov, the Russian co-founder of Bitzlato, had been living in Shenzen.

While the crypto markets reacted to the pre-announcement of this action negatively, with prices temporarily dipping significantly because of concerns that the action would be against Binance, post announcement crypto twittter was effectively laughing at the fact barely anyone had even heard of Bitzlato.

What most crypto twitter participants fail to realize is that, in my opinion, the US government is increasingly seeing the cryptomarkets as a geopolitical battlefield and thus are prioritizing targets based on that framework.

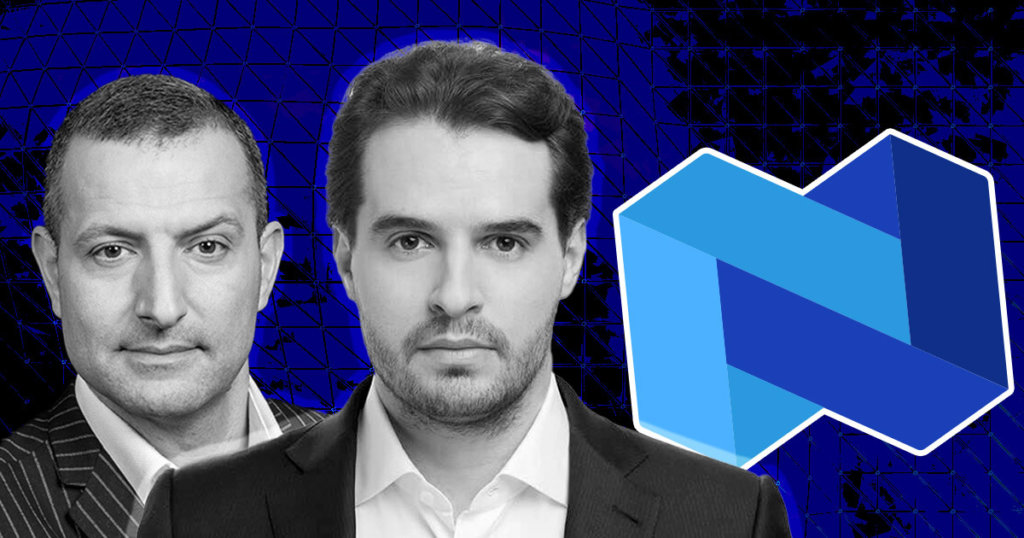

Nexo co-founders charged as an organized crime group in Bulgaria

Nexo, previously the last remaining major centralized lender now that BlockFi, Celsisus, and Genesis have fallen, now also looks to be finished. The co-founders and various directors of the company have been charged with money laundering, banking without a license, financial crimes, and computer fraud. Both British and Israeli security services have been working with the Bulgarian investigation, indicating just how international this case is.

While more information is likely to come out, the fact that Nexo is being pursued as an organized crime group by multiple nation's security services indicates that what Nexo was doing likely touched geopolitical issues.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.