Rapture #261: Barry vs. the Winkelvii

Hope everyone enjoyed the holiday season and new years. I personally was traveling a bit and got to enjoy some amazing hospitality in Austin, TX. If you have not gone, I highly recommend going. Amazing BBQ, terrific southern culture, and Whataburgers as far as the eye can see.

Regarding markets, crypto has barely moved since November price wise. The only action has been with ETH staking related tokens. LDO and SSV have been enjoying a "liquid staking" theme bid with the unlock happening likely in the Shanghai hard fork in March 2023. LDO is up more than 28% in the past 14 days while SSV is up nearly 20% in the past 14 days.

Despite the market offering little action, the industry definitely is not bored, as conflict between Barry Silbert's DCG and the Winkelvii twins' Gemini is heating up.

Let's take a deeper look at what is happening.

Gemini in trouble

Gemini, one of the major US based exchanges, is currently in trouble. The Winkelvii led exchange had a product called earn that allowed customers to earn interest on their holdings. Earn utilized Genesis, a DCG subsidiary, on the backend. Genesis is currently in financial straits because of its exposure to FTX.

Gemini has been trying to get back its customers capital from Genesis but, so far, to no avail. Cameron Winkelvoss is so frustrated with the lack of progress on this issue that he decided to tweet out an open letter to Barry Silbert. The letter tells the stories of users who deposited their life savings into the earn product. Cameron calls attention to the fact that Genesis owes Gemini around $900 million and accuses Genesis of misappropriating Gemini customers' deposits for "greedy share buybacks, illiquid venture investments, and kamikaze Grayscale NAV trades that ballooned the fee-generating AUM of [the] trust."

Furthermore, Cameron calls attention to the fact that DCG and Grayscale are commingled and everyone takes orders from Barry Silbert himself.

Finally, Cameron calls on Silbert to commit to working towards solving this problem by January 8th.

Silbert retorts

Silbert disagrees with the alleged facts Cameron presented. In a tweet response to Cameron, Silbert states that DCG did not borrow $1.675 billion from Genesis, implying that the two companies are not commingled. Furthermore, he declares that DCG has never missed an interest payment to Genesis. Finally, he points to the fact that DCG delivered to Genesis and the advisors of Gemini a proposal on December 29th and there has been no response.

Effects of this showdown

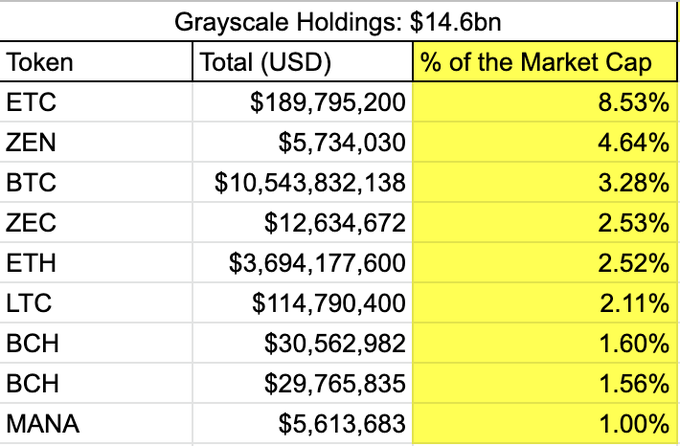

Clearly, Silbert and the Winkelvii are in a stand-off over this issue. If there is no resolution, Gemini will likely have to file for bankruptcy. If DCG does opt to sell a portion of Grayscale's balance sheet in order to cover Genesis creditors, you can see the tokens that will be most affected in the picture above, which has been taken from this thread. Many have stated that this action would be illegal because the two entities are separate, which is really the crux of the issue.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.