Rapture #252: FTX Goes Down

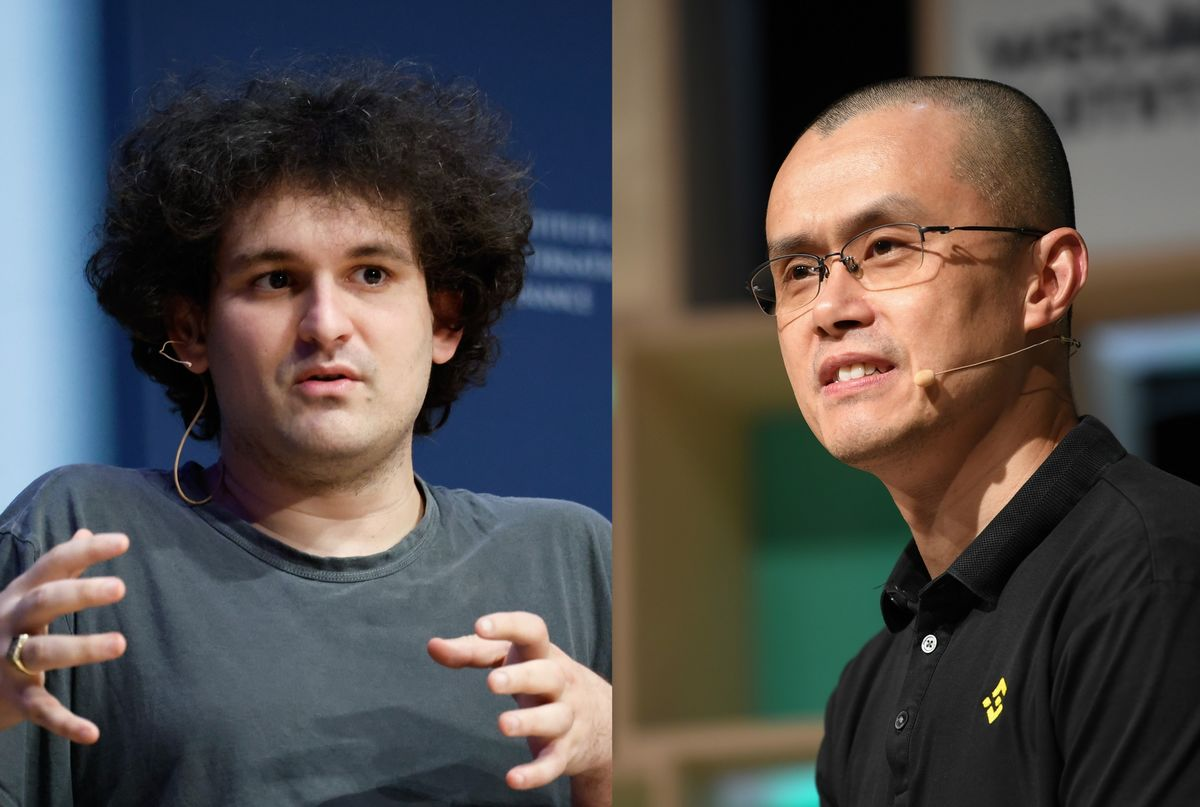

Wow, what a wild, wild week. FTX, the fourth largest exchange in crypto, was dethroned. FTX had the backing from some of the leading institutions in the world, including BlackRock and Sequoia. Furthermore, SBF (Sam Bankman-Fried) was one of the largest political donors to President Biden.

Both FTX and Alameda Research, the market making firm also founded by SBF, have filed for bankruptcy. Around the same time, FTX was hacked for seemingly $600 million and the FTX apps appear to have had malware associated with them.

My initial concerns about FTX and Alameda arose because of the conflict of interests that could easily rise when a market making business and a centralized exchange are controlled by common people.

This collapse I believe is by far the largest in the industry to date. While details are still emerging, here is what I think might have happened based on my research from Twitter and various news sources.

FTT token problems

FTX started facing issues when their token, FTT, began experiencing significant downside volatility. FTT started to tank as rumors were flying around on Twitter about FTX having problems. $14.6 billion worth of FTT was held on Alameda's balance sheet, the single biggest asset. Additionally, the third biggest asset on the books was a $2.16 billion of FTT collateral. Because FTT was posted as collateral, any sort of material negative price action on FTT would force a liquidation on Alameda and also cause significant loss in value of Alameda's AUM.

Additionally, Binance on November 6th decided to liquidate all the remaining FTT on their books, adding further downward pressure to the already sinking asset.

After CZ tweeted out the fact he was selling FTT, customers on FTX began withdrawing en masse to the tune of around $6 billion.

Binance offers to acquire FTX

Binance helped put FTX on life support, the company then offered to buy them out on November 8th.

Yet just a few days later, CZ rescinded his offer. SBF's net wealth consequently dropped 94% to $991.5 million in a single day.

The result of this move is that Binance now has solidified themselves as the market leader for crypto exchanges and basically controls the non-US market, with Coinbase now being the main player in the US.

Market effects

The implosion of FTX was the catalyst that finally broke the market's close to 6 months distribution pattern around $20,000, with BTC dropping to $16,500 and ETH falling to $1,000 before rising back up to approximately $12,000.

Typical volumes increased by nearly 10x during that time period, reaching a high of nearly $120,000,000 on November 5th and remaining at extraordinarily high levels for days.

This might be the beginning of the end for this bear market and might be the main capitulation event, though right now I am leaning more towards think there will be a long consolidation period. We will see.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.