Rapture #251: JPY, EURO, and GBP are Donezo Part 2

In Part 1, I discussed how GDP growth had stalled in Japan, the EU, and the UK while debt had skyrocketed. In an inflationary environment, rising debt and GDP stalling is incredibly toxic in terms of how the market views a country's sovereign debt and, eventually, its currency.

In Part 2, I will discuss why the destruction of the EURO, GBP, and YEN will be driven by a strong dollar, why the US has an interest in having a strong dollar for foreign policy purposes, and what I think will happen when the US largest allied countries' currencies collapse.

Dollar strength

Why is the dollar going up? Interest rate differentials and fear over the global macro environment.

Despite the majority of market participants' desires, the Federal Reserve is clearly remaining firm in raising rates higher and intends to keep them there for longer. I have talked ad nauseum in previous Raptures throughout 2022 about the fact that I thought the Federal Reserve was serious in its mission to reign in inflation, and today's speech by Jay Powell further drives home that point. In fact, Fed Chairman Powell clearly stated that terminal rates might even have to go higher than they are now.

Raising rates means higher yields for US treasuries, which are priced in dollars. Currently, the 2 year treasury has a yield of more than 4.6%.

The question that global investors are asking themselves right now: why am I not earning 4.6% yield by investing in the debt of the world's largest economy and the preeminent superpower? Furthermore, why do I have material exposure to other countries, many of which are resuming QE in some form or fashion, while their currencies are tanking against the dollar?

As long as the US GDP does not completely collapse, I don't see how investors won't view the 2 year treasury right now as one of the most attractive places to park money.

Furthermore, the US government has some interest right now in putting pressure on their allies to hold the line against the emerging Russia + China global faction. Raising interest rates and the constant threat of further hike keeps that pressure strong.

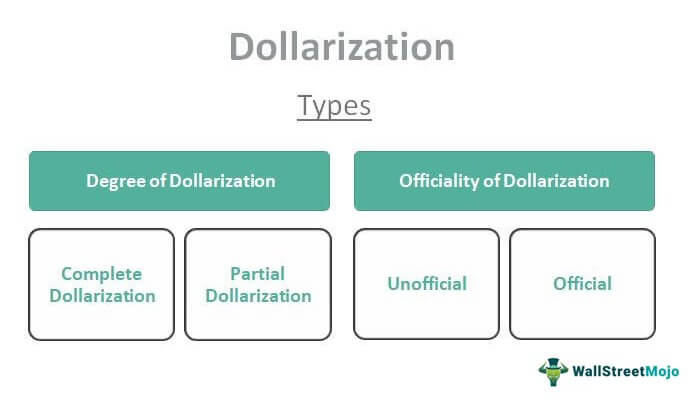

Dollarization of American Allies

The result of this conundrum in my opinion is an ever stronger dollar that is shoved down the throats of its allies, going so far as even potentially becoming the medium of exchange in America's allied countries. While that might seem far fetched right now, with the advent of the Federal Reserve's CBDC pilot program in 2023, from a technological perspective pushing the dollar through the global financial system will become even easier. Blockchain technology will make this process a breeze.

While I don't know if the US will get so far as to force other countries to adopt the dollar as a MOE, I do think the next phase in the coming years will be figuring out how to solve America's allies impending sovereign debt/currency problems with further dollarization.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.