Rapture #250: JPY, EURO, and GBP are Donezo

This past week, I have been practicing a presentation I will be giving to a group of family offices in Barcelona at a conference hosted by Real Vision in a couple weeks. The title of the presentation is "The Point of No Return for (Most) Fiat Currencies:

Why Dollar and Crypto Adoption is Primed to Surge in the Coming Years."

The thesis of this presentation is that over the next few years (conservatively), I believe that a combination of JPY, EURO, and GBP will likely go through a severe currency crisis that will be tied to Japan's, EU member countries', and the UK's pending sovereign debt crisis. The result of these crises will be a surge in USD and crypto demand.

I thought it might be interesting to share some of my supporting points for my thesis here for Rapture subscribers.

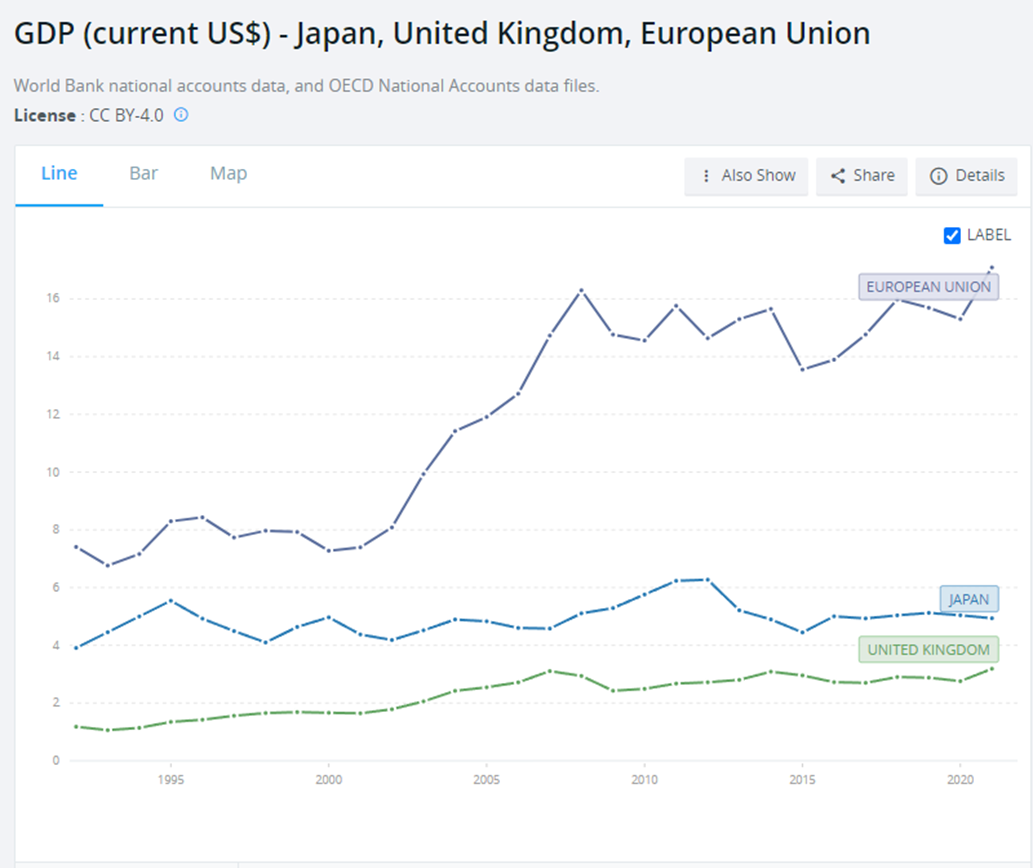

GDP growth has stalled

The GDP growth chart for the EU, Japan, and the UK is truly shocking. While many know that GDP growth effectively stalled in Japan during the early 1990s, I don't think people realize just how much the UK and the EU have also struggled from a GDP growth perspective ever since the 2008 financial crisis.

The UK's GDP in 2021 was $3.187 trillion dollars, which is only a hair higher than their GDP in 2007 when GDP reached reached $3.106 trillion. The EU's GDP was $16.3 trillion and the EU's GDP only recently surpassed that number recently, hitting $17.09 trillion in 2021.

Nearly a decade and a half's time passed yet GDP barely grew.

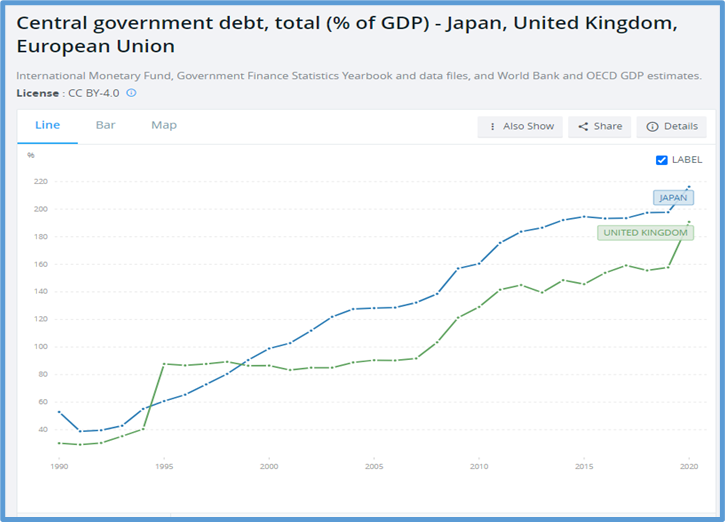

Debt has skyrocketed

Despite GDP growth stalling, central government debt has skyrocketed for Japan, the UK, and the EU. Japan had a central government debt to GDP ratio of 220% in 2020 (now above 266%) and the UK had a central government debt that surpassed 190% in 2020.

While the EU area governments debt to GDP ratio was lower at 97.2% in 2020, that ratio is still incredibly high compared to historical standards.

Debt has dramatically increased despite growth stalling.

What this means in an inflationary environment

Typically, during an inflationary environment like we are in now, central bankers attempt to reign in inflation by increasing interest rates. Yet because debt to gdp is so high in America's allied countries, any significant raise in interest rates can cause a sovereign debt crisis. If markets begin to lose faith in a government's ability to pay back its debt, the country's sovereign debt is sold, which means the interest rate on the debt must go higher to attract buyers, which means more of a country's GDP must go to servicing the interest on the debt. If the country's GDP is not growing, there is a much higher likelihood that the market loses faith in that country's ability to service its sovereign debt.

In this scenario, countries really have two end options: default (which causes massive economic pain) or printing money to pay off the debt. The printing of money contributes to even higher inflation, and thus a country enters an inflationary spiral.

This inflationary spiral is my base case for a combination of Great Britain, the EU, and Japan over the next 3 years.

In the next Rapture, I will discuss how these inflationary spirals will lead to greater adoption for the USD and crypto.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.