Rapture #249: Market Update and News Commentary

I will be (and already have been) decreasing the Rapture cadence in order to focus on something I am excited to discuss further soon. Right now, the aim to is to get Rapture out on a weekly basis.

With that being said, let's dive into a market update.

Crypto rallies

Well, we finally broke out of the sideways range that has occurred over the past week. The market chose to surge, and it had some nice short-term tailwinds to help it make that decision. The S&P 500 is up just over 4% in the past 5 days and top Fed policymakers indicated that they discussed pausing interest-rate hikes last week.

Volume today has been stronger than the past few weeks, hitting nearly $40 billion for BTC, though I would like to see that higher level be sustained or even increase for me to gain any sort of faith in this rally continuing into the medium term.

Until then, my base case this is a bear market rally caused by short liquidations.

Huge short liquidations

Today was the largest day for short liquidations since at least July 27th. More than $700 million worth of shorts were liquidated today, and more than $500 million of short liquidations occurred on FTX alone.

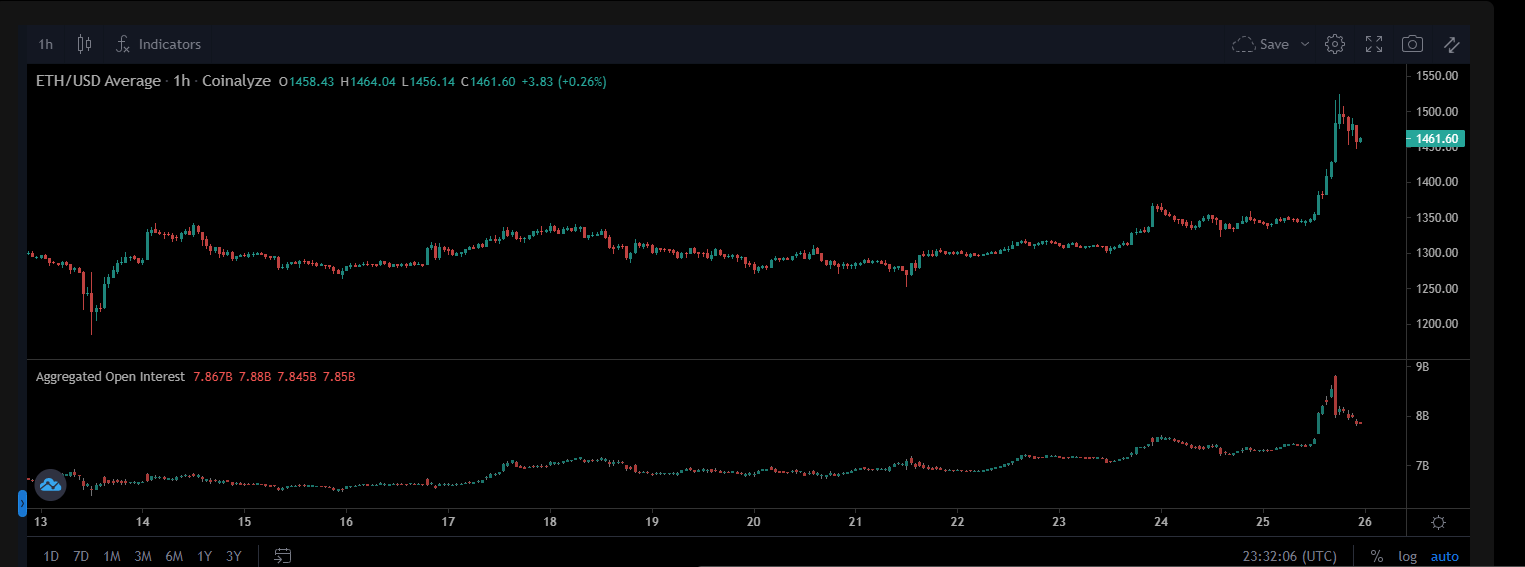

The change in ETH open interest tells a similar story. ETH open interest had been skyrocketing up until today, and the drop in OI indicates that a significant portion of these derivatives were short the price.

Until proven otherwise, my base hypothesis here is the market makers over at Alameda and other shops were short hunting rather than this move indicating any material change in trend.

Still, market participants regardless of their stance are happy to see some sort of action return.

FTX regulatory proposal

The hot news item that caused the most stir last week was SBF's/FTX's proposal for crypto regulatory standards. In the proposal, FTX called for blacklists rather than whitelists to become the standard to restrict addresses from accessing trusted actors, which is not explicitly defined. Additionally, FTX proposes a standard for how exploiters should return all but 5% of taken assets and that all customer assets should be returned. Another interesting item from the proposal was the call for all stablecoin issuers to be fully backed by US dollars or federal government issued treasury notes/bills.

Yet, the most controversial item in the proposal centered around FTX's suggestion for what regulators should do for DeFi. For DeFi, FTX suggested that centralized UIs should be regulated like centralized financial services while the backend DeFi protocol development itself remains as is.

Many crypto natives responded with ire to this point, claiming that SBF was just trying to create a regulatory moat around FTX. While undoubtedly he is, I think his proposal is reasonable and might be one that US regulators go for.

If all crypto had to give up was having to go through KYC/AML to access UIs for many crypto protocols in order to achieve regulatory legitimacy, I would consider that a huge win for the space.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.