Rapture #248: Market Update and Various News Items

Not much has changed price wise for the market since early June. BTC has traded incredibly tightly in a range of approximately $19,000 to $24,500. Recently, the volatility of BTC has even dropped below the S&P 500. This low volatility, low volume market is driving traders and hedge fund managers crazy.

Throughout this time period, I have watched many of the largest bears (Pentoshi, CanteringClark) flip bull, while some of the major fund managers that I most respect (Vance Spencer of Framework Ventures and Felix Hartmann of Hartmann Capital) are now pounding the table regarding the return of the bull.

The repeated narrative I have seen from these individuals is effectively "how much lower could we actually go?"

From my perspective, this market can still materially drop (i.e. 50%+) from current levels over the next 3 - 6 months. I put this bearish scenario as the most likely. In a bearish, downward trending market, the bulls are the ones that have to justify a reversal. I see no major narratives that have a legitimate shot of justifying a change in the long-term bearish trend (fed pivot, major institutional deployment into crypto, Russia/Ukraine war ending) and plenty of events that could cause yet another significant drawdown (terminal rate of interest increases, worsening energy crisis during the winter in Europe, Russia/Ukraine war becoming nuclear, oil prices surge, significant drop in earnings, BTC miner capitulation).

While crypto might bottom first, I don't think we are close to a bottom in most major risk markets and therefore I believe crypto has more to drop before it reaches its bottom.

I remain heavily risk-off, with approximately 97% of my assets in cash and am patiently waiting for the market to tell me what the next short-term trend will be.

Despite the market being relatively boring, there was a couple of interesting news items to come out this past week.

News

Yesterday, Mastercard announced that they will help banks offer cryptocurrency trading. Specifically, Mastercard will act as a bridge between Paxos and banks. Mastercard will handle the regulatory compliance and security of side of the partnership, while Paxos will enable the access to crypto. This news is significant because it displays how the infrastructure is being established that will enable banks to offer cryptocurrency trading to their clients during the next bull run.

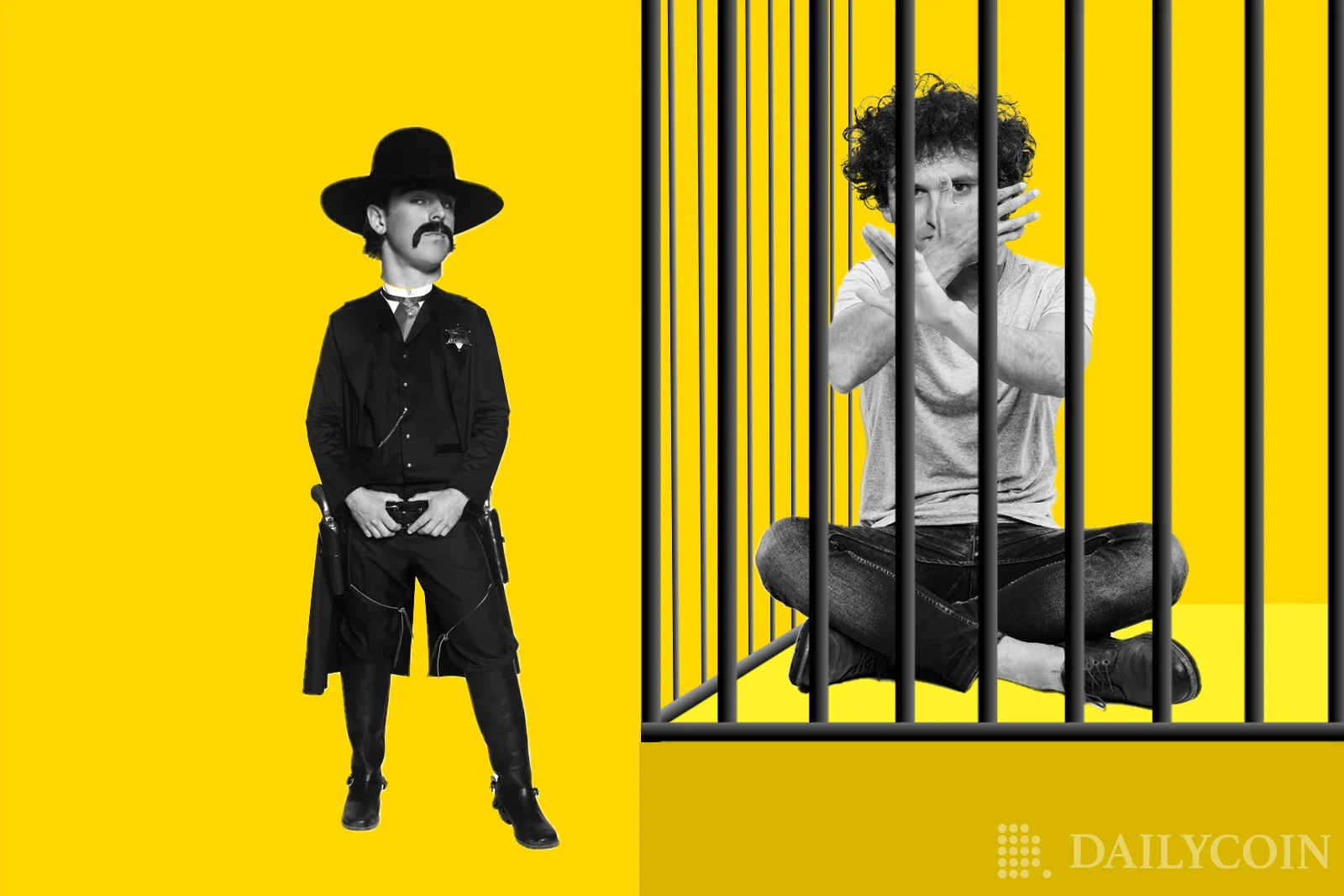

On October 17th, Texas regulators announced that they are probing FTX US and SBF for potential securities violations. In Rapture #236, I mentioned that one of the reasons that Sam Trabucco likely stepped down was because he saw pending regulatory action and SBF's embracement as the main character of crypto as something to be concerned about. Specifically, regulators are interested in determining whether FTX's yield-bearing accounts should be considered unregistered securities. Undoubtedly, these regulators will be looking to get a good senses of how FTX runs their businesses and be examining many internal communications. I am interested to see if anything comes of their discovery process. Note that nearly every major successful emergent tech CEO, from Bill Gates to Steve Jobs to Facebook, all faced various investigations as their companies disrupted the incumbents.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.