Rapture #241: Technical Differences Between Solana and Ethereum

Coinbase recently came out with an excellent post explaining some of the technical details of how Solana works. After reading this post, I came away with a much deeper understanding of the technical underpinnings of Solana.

Since Solana and Ethereum are often viewed as competitors, I thought I would take this post to describe some of the core differences between the two layer 1s.

Speed

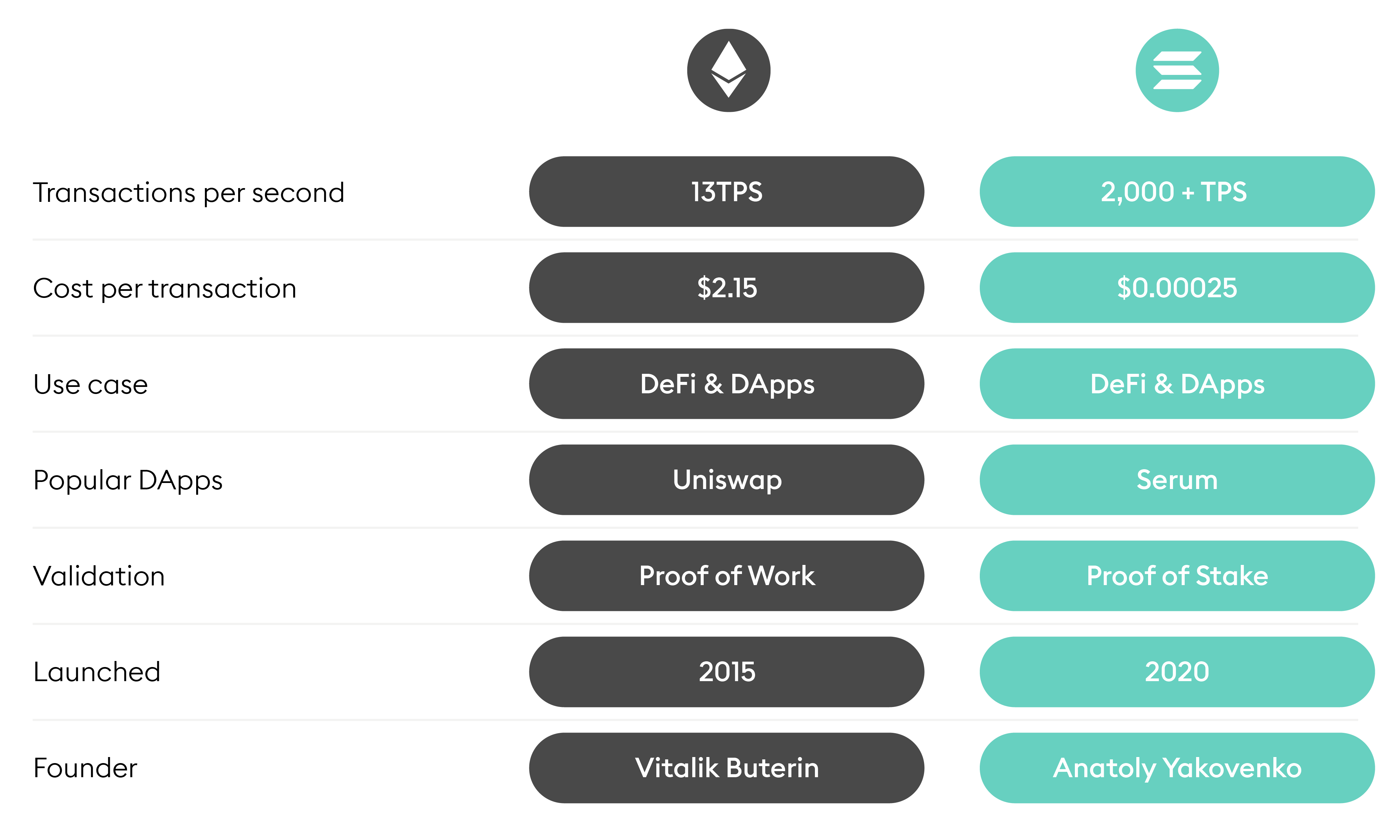

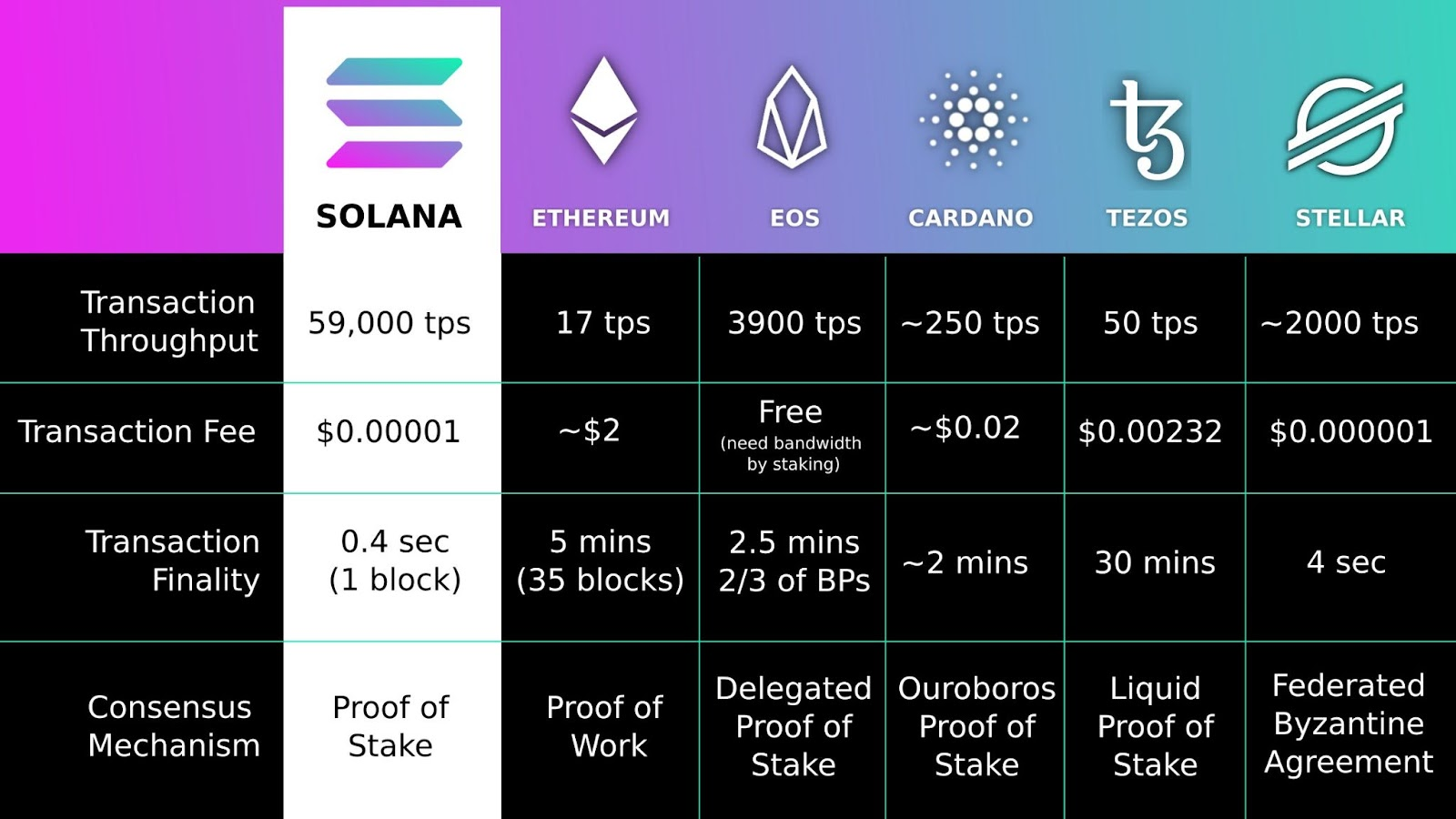

The main attribute Solana optimizes for is speed. In order to optimize for speed, Solana actually does not have a mem pool. Instead of having a mem pool, Solana allows transaction requests to flow directly to block leaders. Because there is no major waiting que for these transactions in the form of a mem pool, the transactions are validated at a much faster rate.

Furthermore, Solana allows for parallel execution of transactions, meaning that transactions can be verified outside of natural sequential order by time. This feature enables faster verification times.

Fees

Another significant difference between Solana and Ethereum is that Solana has a flat fee structure, unlike nearly every other L1. On Ethereum, rising demand for blcokspace leads to rising transaction fees, meaning that it is more expensive to utilize the Ethereum when it is busy. Regardless of how busy the network is on Solana, the user historically has paid the same flat fee (.000005 SOL per signature).

Of course, this flat fee structure is an attack vector for spammers, since one entity can submit a ton of transactions at a linear rising fee cost rather than an exponential rising cost. One of the main reasons Solana goes down so often is because of this exact scenario. Ethereum's fee market (where fees rise during periods of high demand) prevents this issue.

Yet QUIC, a transport protocol developed by Google engineers in 2012 that will reduce spam transaction verifications, is currently being implemented on Solana. QUIC effectively allows validators on the Solana network to rate limit incoming transactions, which means that they will be able to prevent streams of spam transactions. Validators by default run QUIC today, but the Solana team is still urging RPC providers to switch to QUIC. Once this occurs, Solana will likely have far less down time.

Another tactic Solana developers are utilizing to reduce spam transactions on the network is a prioritization fee, which has already been implemented on the network. The prioritization fees allows users to pay an additional fee in order to get their transaction approved faster, with 50% of the fee being sent to the leader validator and 50% of the fee getting burned. Clearly, this change was heavily influenced by EIP-1559.

Unfortunately, there is no well-defined market yet where users are able to accurately predict what prioritization fees are necessary to get their transactions included quicker. This UX on Ethereum is mostly handled by wallets like MetaMask, which largely abstract the complexity of these issues away from the user.

Takeaways

Solana optimizes for speed while Ethereum optimizes for liveness and security. Improvements to Solana have recently been implemented to reduce the downtime the blockchain has been experiencing.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.