Rapture #220: Ethereum Rollups Knocked Down and More Updates on Contagion

In bull markets, nothing can go wrong. In bears, nothing seems to go right.

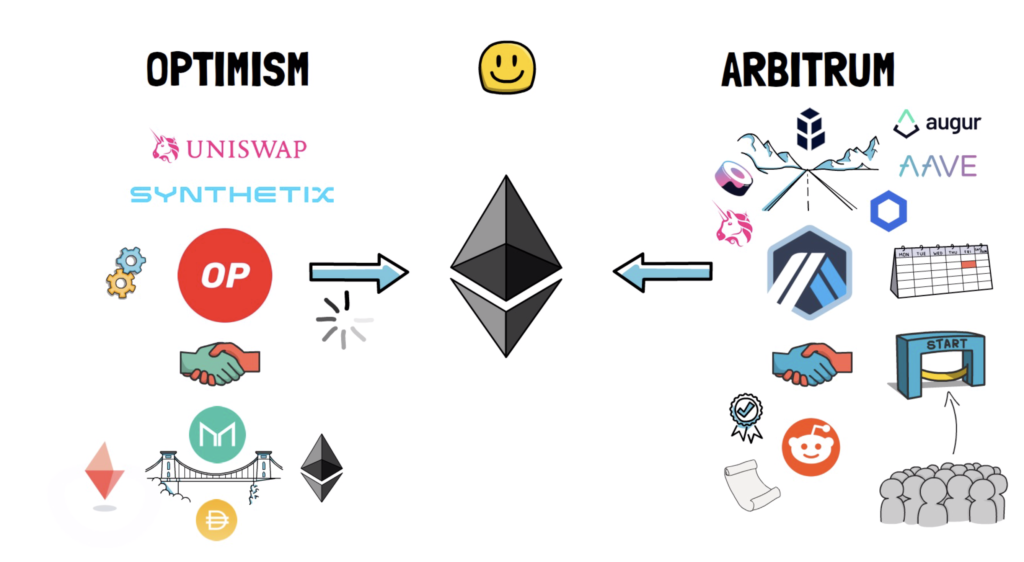

Over the past few weeks, the supposed solutions to Ethereum's scaling woes, rollups, have been hit with quite a few setbacks. Optimism RPC, StarkWare, and Arbitrum all had serious issues that I will discuss in this newsletter.

Not only are rollup solutions having serious issues, but more news has come out on what is happening with the major centralized lenders.

Rollups getting slammed

On May 31st, Optimism executed their anticipated airdrop. Note that Optimism is one of the most beloved rollup implementations, and many have high expectations for the solution to become one of the central reasons transacting on Ethereum becomes cheaper.

Because of all of the demand for airdrop, Optimism transactions were heavily delayed, displaying the L2 is by no means ready for any sort of substantial demand. I do think this setback is temporary, but definitely not a good look.

Yet Optimism was not the only L2 to experience issues recently. dYdX, the app that by far was the largest reason for StarkWare adoption, opted to leave the L2 to launch a Cosmos chain because of throughput issues. Undoubtedly, the loss of dYdX, the largest application built on StarkWare, is a serious blow to the L2.

Finally, Arbiturm recently opted to pause their Odyssey program because of a heavy load of transactions and increasing gas fees. The Odyssey program was meant to reward Arbitrum users with NFTs for utilizing the L2. Like Optimism with their airdrop, the claiming of these NFTs on Arbitrum caused capacity issues that led the L2 to have fees even slightly higher than Ethereum mainnet for a period.

While Optmism, Starkware, and Arbitrum have all experienced issues, I do believe that a roll-up centric future is on the horizon. These challenges can definitely be overcome.

News on BlockFi and Genesis hit by 3AC

Today, there were two major BlockFi updates. Earlier in the day, a leaked recording of a Morgan Creek Digital investor call revealed that BlockFi is currently being valued at less than $500 million. The investors on the call were also discussing formulating an equity bid of approximately $250 million for a majority of the company.

Yet in response to this leak, just an hour ago news came out that FTX now seeks to acquire BlockFi. The speculator in me thinks that this was Morgan Creek Digital's plan all along, as the investors in BlockFi are likely just looking to be made whole.

In addition to the BlockFi news, more information came out about another large centralized lender, Genesis. The leading centralized lender faces hundreds of millions in losses because of exposure to 3AC and Babel Finance. I have watched some leading executives at Genesis change their titles to try and remove themselves from being associated with the institutional lending business specifically, as heads will surely roll because of this event.

Takeaway

Bearish events in bearish markets. See you soon.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.