Rapture #209: Centralized Exchange Updates

With volumes low across the board recently, the current market environment is undoubtedly shaking up the crypto exchange industry. Certain exchanges did a far better job raising capital and releasing new products during the bull market than others, meaning they are better positioned for the bear.

As crypto volumes generally continue to be lackluster, I expect there will be a fair amount of consolidation in the centralized exchange market, with many exchanges even going out of business.

Record high number of trades for Coinbase

Because of the sell-off following Terra's UST collapse and the drop below the previous range, Coinbase saw a record number of BTC-USD transactions, processing 2.1 million trades on May 12th. Trade volumes on that day also broke yearly highs, though volumes have sank back down after the (in my opinion) local capitulation event. Throughout 2022, Coinbase has been handling on average 90% more trades for coin pairs compared to other major exchanges such as Bitfinex and Kraken,

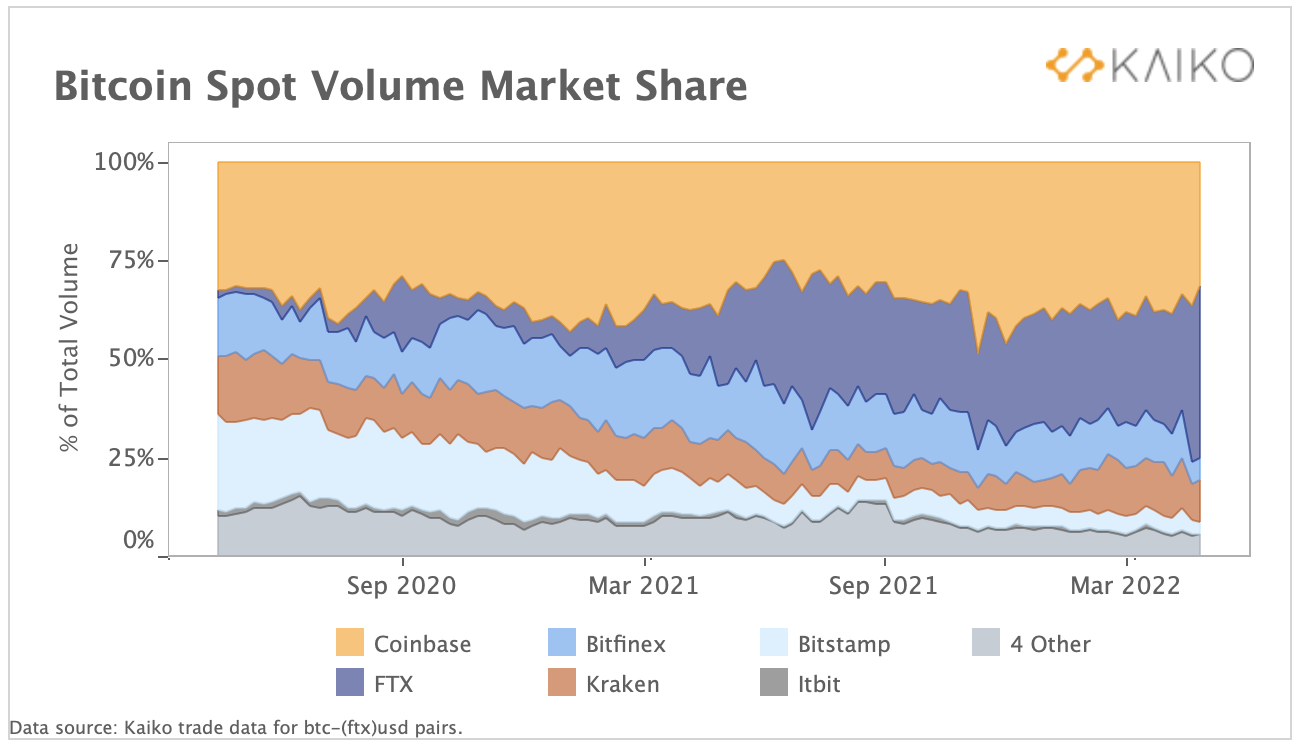

FTX surpasses Coinbase

For the first time ever, this month FTX surpassed Coinbase in terms of BTC spot volume. Over the past 18 months, FTX saw its market share rocket from 5% to 44%. While Coinbase's market share has remained relatively stable at 30%, industry veterans like Bitfinex and Kraken have undoubtedly lost marketshare to FTX.

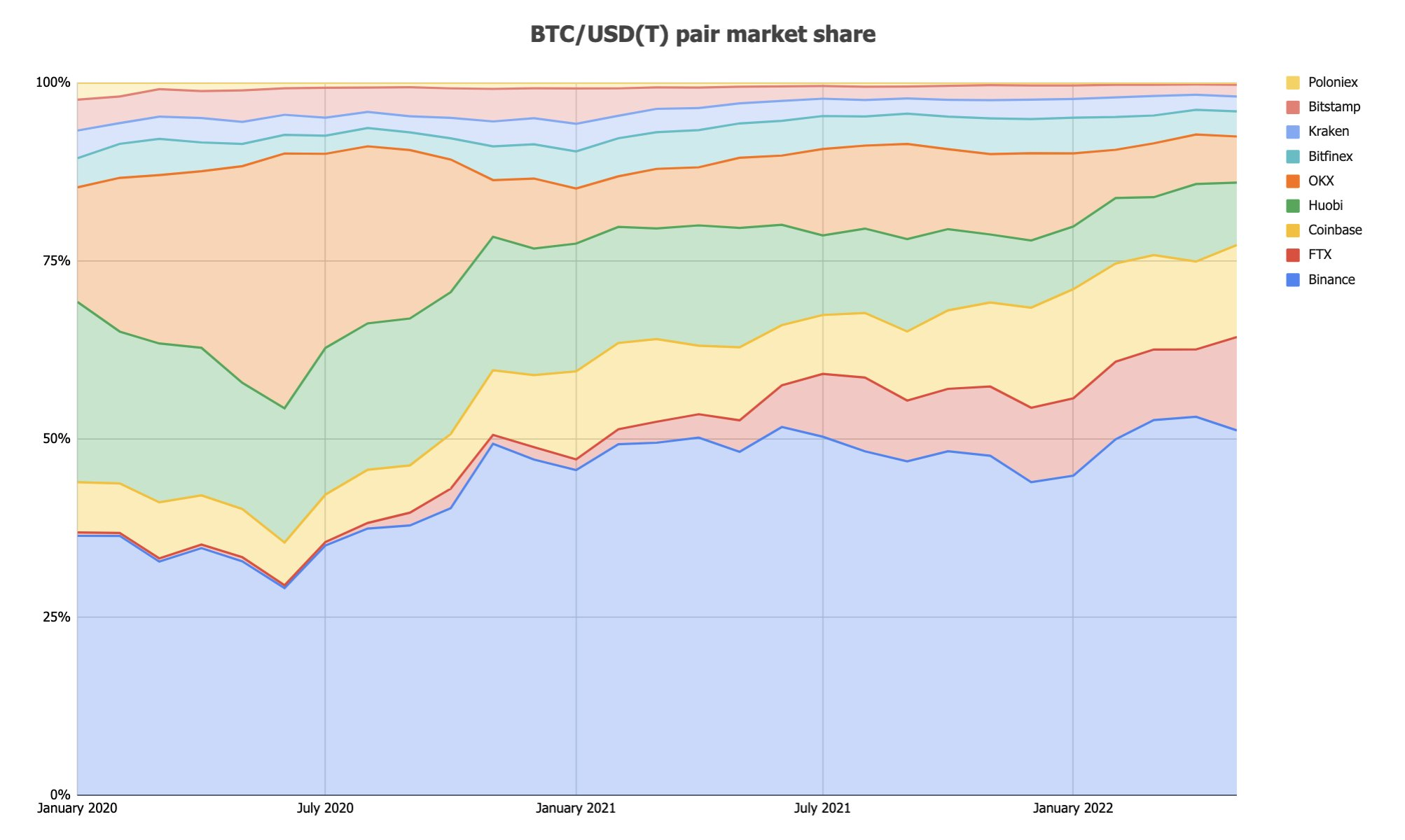

Of course, this gain in market share does not mean FTX is close to being on the same level as Binance at this point in time.

Even more interesting, FTX is the first centralized exchange making a serious play to expand into traditional asset classes like equities. This month, FTX.US began letting a portion of its users trade shares in companies like Coca-Cola, Visa, and Apple. Furthermore, Sam Bankman-Fried took a $648 million position in Robinhood this month as well, indicating his interest in becoming well-acquainted with retail equity brokerage firms.

SBF plans to use the $2 billion he raised from the middle of last year to the end of January to acquire brokerage firms in order to continue breaching into traditional markets.

Regional and previously leading exchanges flounder

While large multinational exchanges like FTX continue to expand, regional exchanges are floundering. Despite raising $250 million in May 2021, Bitso recently announced they were laying off 10% of their workforce. For those who don't know, Bitso is the most prominent crypto exchange in Latin America. Based in Mexico, Bitso previously pursued aggressive expansion in other LATAM countries like Colombia, Brazil, and Argentina.

Since 2019, 54 exchanges have been closed down. Most of these exchanges were operating in only one country or were regional players rather than global behemoths.

Even past industry leaders, like BitMEX, are having a difficult time. The derivatives focused exchange, which used to generate the most volume in crypto, had to lay off 75 employees, which was approximately 25% of their workforce.

Despite the crypto exchange industry being 12 years old, there have been few winners that have lasted as dominant players for more than a 5 year period.

Takeaways

I don't foresee FTX's dominance waning any time soon, bar anything happening to SBF (though he is increasingly becoming more aggressive towards regulators...).

Coinbase is still the easiest entry point into crypto for newcomers, and Binance's global footprint is not something that can be dismantled overnight.

While the exchange industry has seen serious overturn, I can't imagine those three players will be displaced anytime soon.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.