Rapture #199: Regulatory Updates

We are on the outskirts of goblin town at this point, having broken our previous YTD low of $35,180. The breaking of $30,000 would undoubtedly confirm to me we are in goblin town, which is crypto talk for a prolonged bear market.

Better than expected CPI numbers on Wednesday (i.e. 8.5%, which was March's mark, or lower) could give us some temporary respite. Alternatively, if the CPI numbers are higher, that could be the catalyst that sends us plundering into goblin town.

I will save the longer goblin town post for if we reach that point, though I do think we will.

For now, I wanted to comment on three regulatory related news items: the SEC beefing up its crypto enforcement unit, Nvidia having to pay SEC $5.5 million for allegedly failing to disclose crypto revenue boost, and US sanctions being issued against a crypto mixer.

SEC beefing up its crypto enforcement unit

Gary Gensler seems to be signaling that the era of sabre rattling is coming to an end, with a new era of enforcement set to begin. The SEC announced that it plans to approximately double its enforcement team focusing on crypto by adding 20 new positions, which will include supervisors, trial counsel, fraud analysts, and investigators.

Specifically, this unit will be focused on investigating possible securities law violations involving crypto offerings, crypto exchanges, crypto lending, NFTs, DeFi platforms, and stablecoins.

Already, the SEC enforcement unit has pursued 80 actions to date, generating more than $2 billion in monetary relief.

SEC Commissioner Hester Pierce questioned the agency's move, though she has little power when it comes to combatting Chairman Gary Gensler.

Undoubtedly, enforcement actions should rise in the coming years. Only a Republican controlled SEC in my opinion could shift the agency's focus away from crypto.

Nvidia pays $5.5 million to SEC

Though Nvidia neither admitted guilt nor denied guilt as a condition of the settlement, the chip company did opt to pay the SEC $5.5 million rather than let the complaint go to court.

The SEC alleged that Nvidia had not communicated that cryptocurrency mining was a material aspect of the company's growth throughout 2018.

According to the SEC, NVIDIA's disclosures "deprived investors of critical information to evaluate the company's business in a key market."

Undoubtedly, this action represents the SEC's increasing scrutiny of any company involved in crypto.

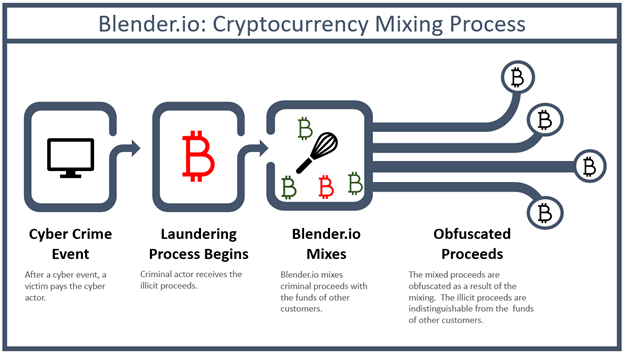

US Treasury issues sanctions on Blender.io

For the first time ever, the US Department of Treasury's Office of Foreign Assets Control (OFAC) sanctioned a virtual currency mixer, Blender.io. Blender was utilized by North Korea hacking group, Lazarus Group, to cover up their tracks after the Ronin exploit.

As a result of the action, "all property and interests in property of the entity above, Blender.io, that is in the United States or in the possession or control of U.S. persons is blocked and must be reported to OFAC."

This action has major implications for other mixers, like Tornado cash, which has a publicly traded token.

I do not think Blender will be the last mixer targeted for sanctions.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.