Rapture #198: Uniswap Liquidity, so Deep

Recently, Dan Robinson (Paradigm) and Gordon Liao (Uniswap) released a report analyzing the liquidity on Uniswap. Now, I will start off by saying that there is likely some bias in this research considering Paradigm was a lead investor in Uniswap and Gordon works for Uniswap.

Still, with the researchers open sourcing both their code and their data, and by their reputation, the findings are likely close to being accurate. That being said, the market depth comparisons are not quite apples to apples considering Uniswap utilizes an AMM structure while traditional exchanges use order books, meaning the researchers had to make a new calculation in order to directly compare. I did not look at this equation in detail, but if anyone does, let me know what you think.

Additionally, I would have preferred to see more comparisons over time to show that Uniswap has had deeper liquidity across most of the major market pairs throughout different parts of the market cycle.

Still, the research is incredibly insightful, so let's dive into what they found.

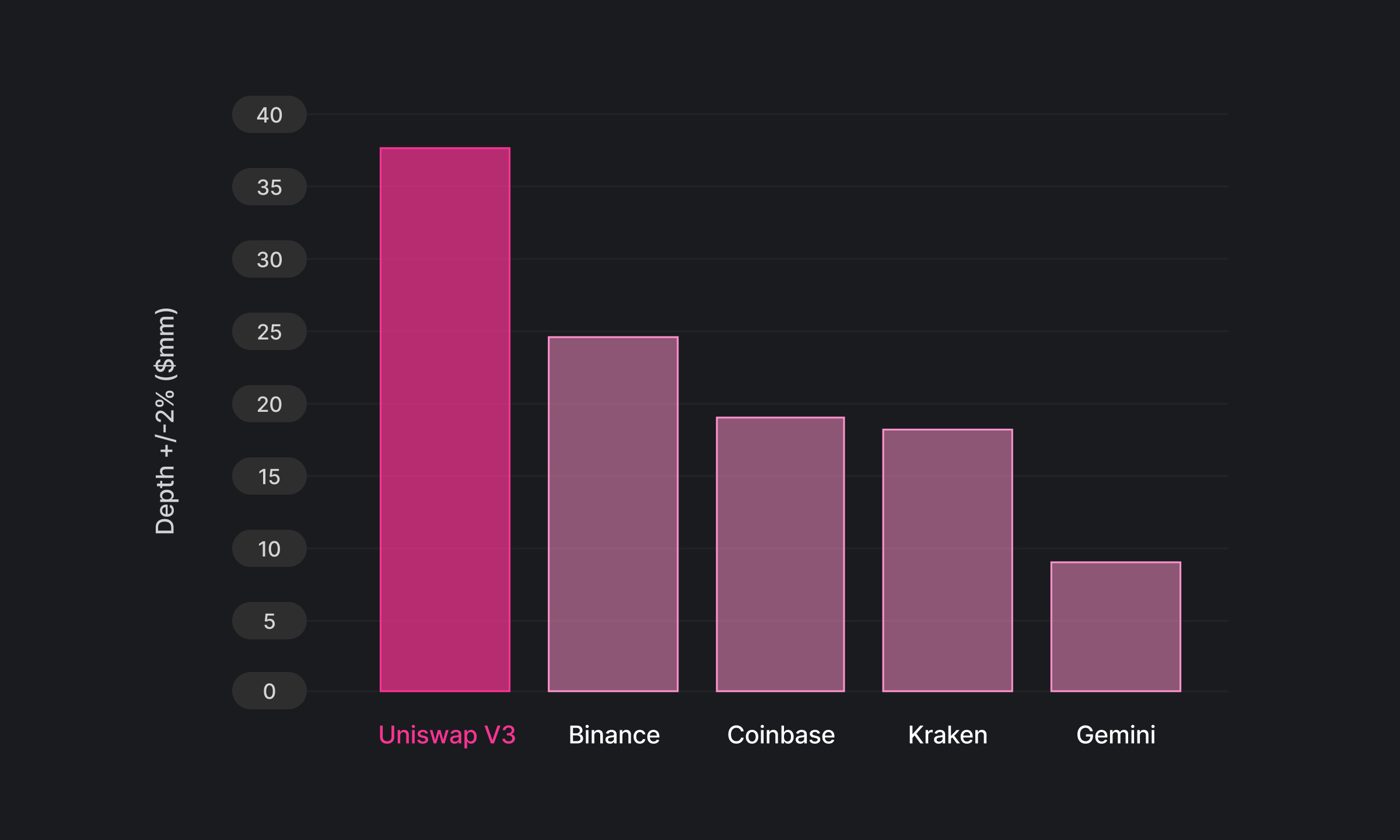

Greater market depth across major pairs

Uniswap V3 has greater market depth for ETH/USD, ETH/mid-cap tokens, and stablecoin/stablecoin pairs compared to the largest centralzied exchanges.

For ETH/USD, Uniswap has ~2x more liquidity than both Binance and Coinbase. For ETH/BTC, Uniswap has ~3x more liquidity than Binance and ~4.5x more liquidity than Binance.

For ETH/mid-cap pairs, Uniswap has on average ~3x more liquidity than major centralized exchanges.

Finally, for USDC/USDT, Uniswap v3 has ~5.5x more liquidity than Binance.

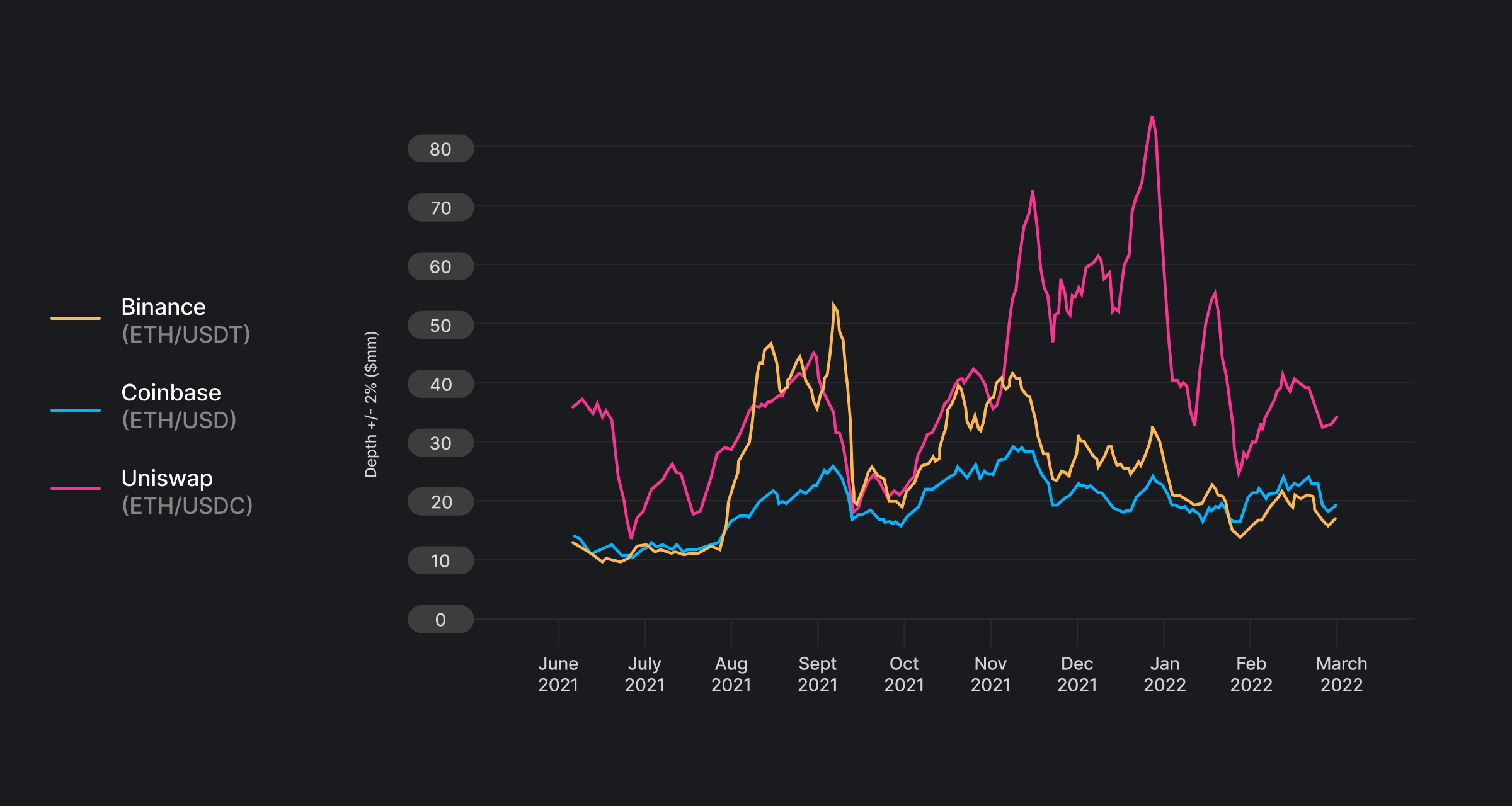

Further analysis of market depth and duration analysis

Interestingly, Uniswap has had greater depth on ETH/USDC compared to centralized exchanges for quite some time.

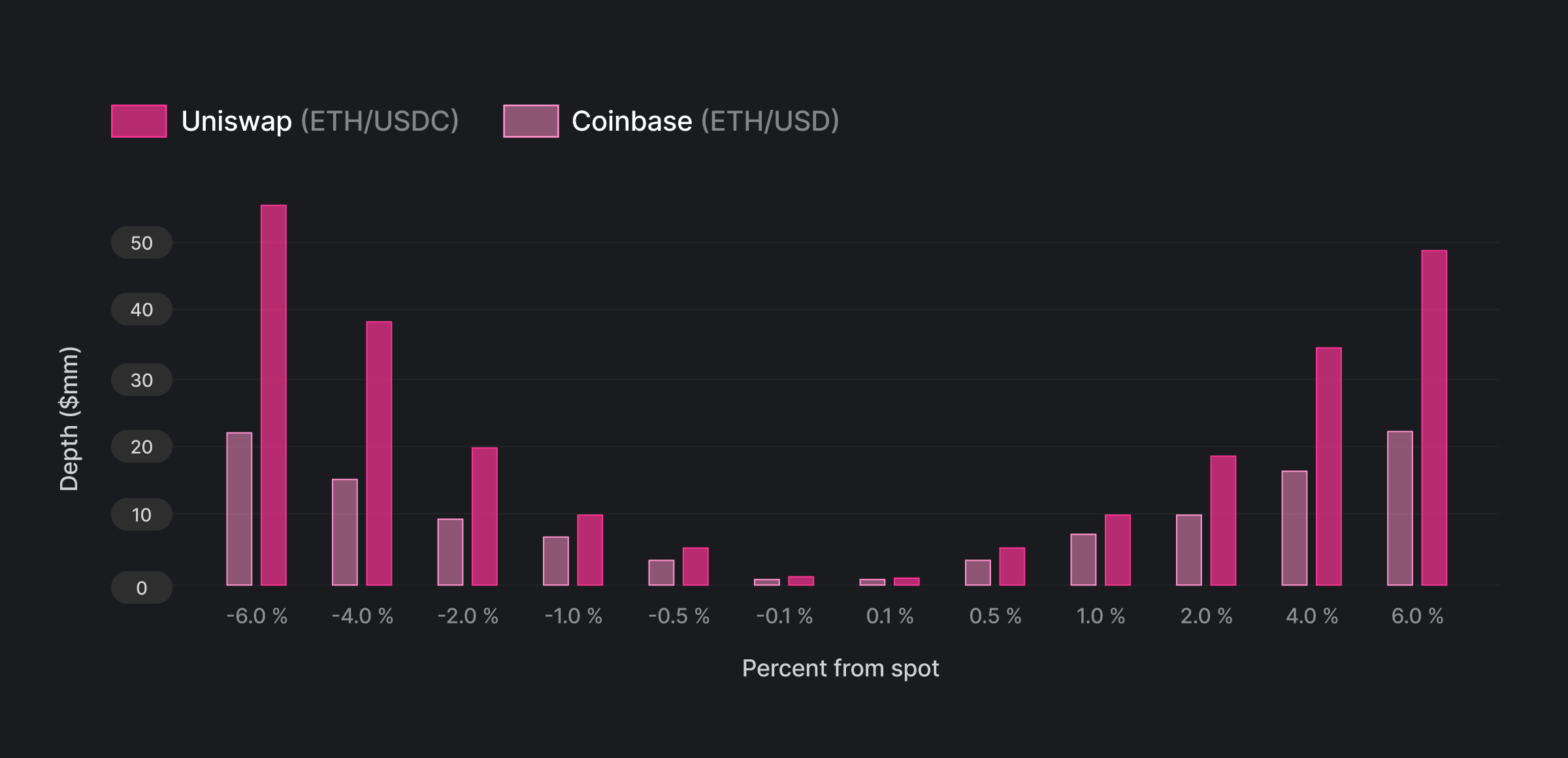

For the ETH/USD market, higher market depth can be seen across all price levels.

Of course, including gas costs and fees might alter these results a bit.

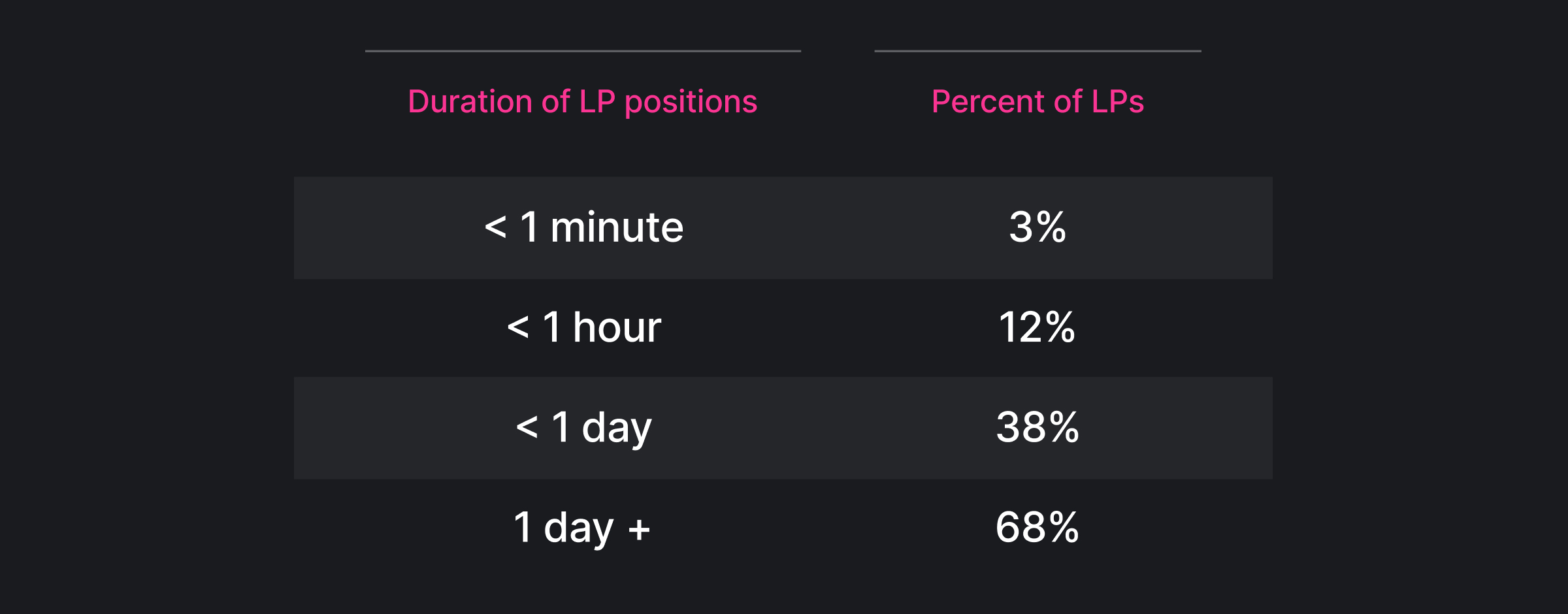

Separate from the market depth analysis, the researches include some data on the duration of Uniswap v3 LP positions, which tracks how long LP positions are held.

The big takeaway here is that 68% of LP tokens are held for more than 1 day+, indicating some sort of liquidity stickiness. I would be very interested to see further break outs over longer time frames, as the market makers creating liquidity on the various exchanges typically have long term contracts.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.