Rapture #197: Personal Trading Reflection and Post FOMC Pump

As many of you know know, I have been pretty bearish starting in late November of last year, and quite a bit more bearish since the beginning of the year. While BTC has held on better than I have expected the past few months with all of the macro turbulence, I cannot say the same for altcoins.

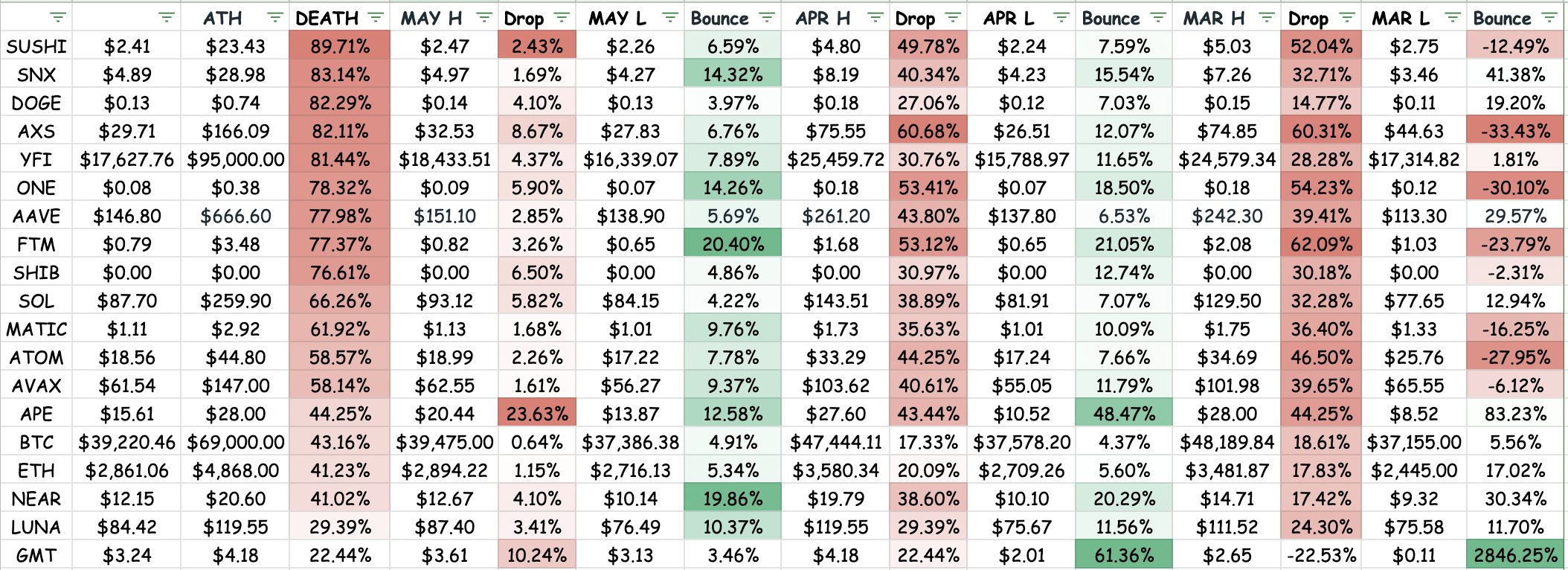

My favorite play in the last bull market, AXS, is down a whopping 82.11% since its ATH in early November. Despite my well timed first sale of approximately 50% of my AXS position, which was the vast majority of my portfolio throughout last year, at $125, and my second sale of the other roughly 50% of the position at $55 (not as great but alright), my portfolio is down around 40% from its ATHs using some quick math, which is about the same drawdown BTC and ETH have experienced from ATHs.

Now, 2021 was a banner year for me, where I outperformed BTC by more than 10x (at least by initial calculations) and ETH by multiples (will have exact numbers shortly as my track record review by Marcum should be finally finished in the next two weeks).

Still, in retrospect, I would have preferred to have kept my drawdown to the 20 - 25% range. Not optimally selling my second lot of AXS, especially as my conviction was that we were in a bearish market environment, is the main culprit. Lessons learned, one's trigger finger should always be quicker in a bearish environment, regardless of the yield one is earning on a staked asset.

Currently, the question, as always in bearish environments, is when do I redeploy?

Right now, my answer is: likely not in the immediate future. My base case is further downside.

I am devoting my time to doing fundamental research on coins that I think will be well positioned in the next bull market to outperform BTC and ETH. When I do decide to redeploy in size, I will first be scaling into ETH, which has some serious bullish catalysts on the horizon with the merge and post merge drop in inflation.

That being said, I constantly follow the markets, and thus have some words on the crypto rise in the past 24 hours.

FOMC pump

The market reacted positively to the Federal Reserve raising rates only 50 bps and specifically stating that a 75 bps is ruled out in the next few meetings. In my opinion, this relief will be temporary. Even if this bump led to a rally, I do not think the news in itself will be enough to shift our bearish trend to a sustained bullish one that leads us to new ATHs.

At the end of the day, crypto is searching for new narratives. Significant product innovation has stalled, user growth is slowing, and the macro environment remains bearish for risk-on assets. A sustained rally by equities could give crypto some relief, but even then I think it will be temporary and that we have not reached the lows for the bear market.

The Federal Reserve is doing its best to create a soft landing with the increase in rates, but I think they will have a difficult time taming inflation without creating a recession. Even if they perfectly managed the market, I don't think there are enough sexy new innovations in crypto to reignite a new base of buyers to enter.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.