Rapture #195: Genesis Q1 2022 Market Observations

By far, Genesis' quarterly crypto reports are my favorite research pieces that track institutional adoption.

Last week, Genesis released their Q1 2022 Market Observations.

You know the drill, let's dive into some of the major takeaways.

High level

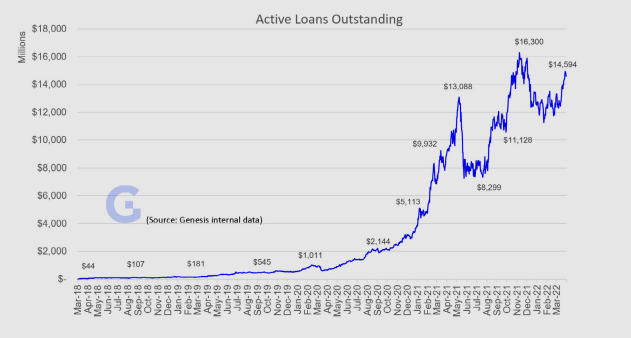

In Q1 2022, Genesis originated more than $44 billion worth of loans, had $14.6 billion worth of active loans as of the end of Q1 (17% higher than Q4 2021 and 62% higher compared to Q1 2021), supported $27.8 billion worth of derivatives notional value (up 33%+ from Q4 2021), and had $11.4 billion worth of spot volume traded.

Furthermore, cumulative loans on Genesis reached $195 billion and assets under custody increased by 23% throughout Q1 2022.

The main takeaways from these numbers is that derivatives notional value outpaced spot volume by more than 2x, displaying that institutions in crypto are opting for derivative products more than spot.

Derivatives

As I mentioned before, one of the biggest takeaways in this report is the growth of Genesis' derivatives business despite derivatives volume being industry wide down for the quarter. Interestingly, $4.7 billion of the $27.8 billion worth of derivatives notional value traded, or 17%, came from altcoin derivatives. This number was the highest yet for Genesis, indicating that institutional interest is expanding beyond BTC. Another datapoint to support this point is that the Genesis derivatives desk traded 61 different assets in Q1 2022,

OTC Spot and Custody

While Genesis' derivatives business is growing, spot volume traded actually decreased 63% from $30.8 billion in Q4 2021 to $11.4 billion in Q1 2022. This decrease in volume likely stems from the bearish market environment.

The number of customers onboarded onto Genesis' custody product (previously called Volt) increased by 36% compared to Q4 2021. Genesis states that many of these new customers are large public and private mining companies, VC firms, and traditional asset managers.

Unsurprisingly, SOL, the favorite L1 of tradfi entrants, was Genesis Custody's largest asset increase for the quarter at 70%. Additionally, custodied BTC increased 46% while custodied USDC increased 62%.

Conclusion

While Genesis' increase of market share in the derivatives market is encouraging, its precipitous drop in spot volumes could be a problem. I personally attribute the drop more to the market environment than a loss of market share by Genesis, but it will be interesting to see what spot volumes do once market sentiment shifts.

Additionally, the fact that Genesis started with mining companies and VCs before acknowledging their conversion of tradfi asset managers to the space indicates that a more crypto native audience still dominates the institutional world.

In my opinion, we are years away from most of tradfi widely adopting crypto.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.