Rapture #194: State of Ethereum Q1 2022 Analysis Part 2

Continuing the theme of yesterday's Rapture, today I will go through more of Bankless' Q1 2022 state of Ethereum report. Yesterday, I covered the adoption that occurred on the Ethereum protocol itself and within the DeFi ecosystem.

For today's post, I will discuss the report's findings regarding the growth of the NFT ecosystem on Ethereum and the increasing adoption of L2s on Ethereum.

Let's get to it!

NFT Ecosystem

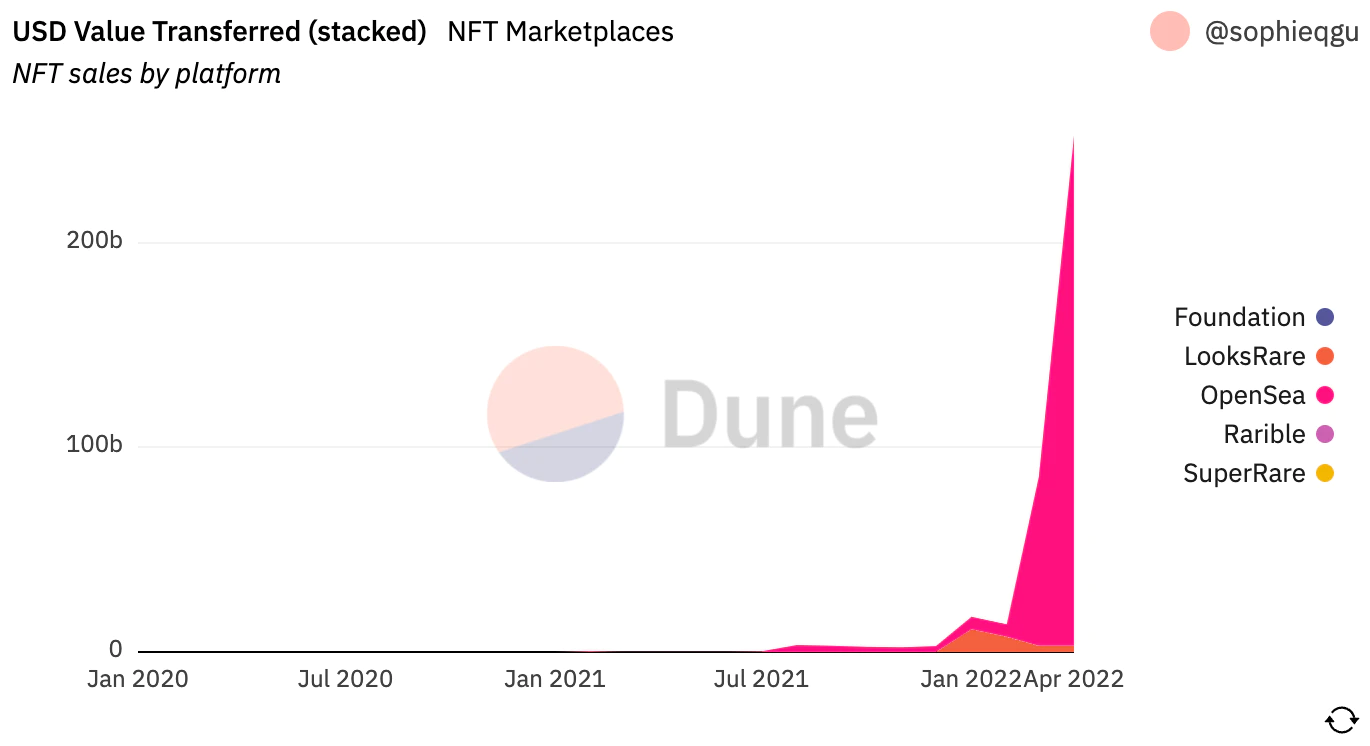

NFT Ethereum based marketplace volumes increased parabolically, rising 19,290% from $606.3 million in Q1 2021 to $116.4 billion in Q1 2022. Furthermore, these volume numbers are actually conservative considering they only track the trading volumes of the two largest generalized NFT marketplaces on Ethereum, LooksRare and OpenSea.

Even more interesting, there were 226,176 unique wallets that either sold or bought an NFT during Q1 2022, meaning that on average $514,643 worth of volume could be attributed to each unique wallet. Clearly, there is a hardcore community of NFT traders out there.

In addition to volumes rising dramatically, the number of unique wallets holding NFTs also increased substantially. In fact, the number of unique wallets holding NFTs increased 306% from 981,315 in Q1 2021 to 3.98 million in Q1 2022.

NFTs were without a doubt the largest driver of adoption for crypto this past year, and these numbers help contextualize that story. The rise of new marketplaces like LooksRare and the establishment of YugaLabs are just some of the reasons why NFTs exploded.

Layer 2 Ecosystem

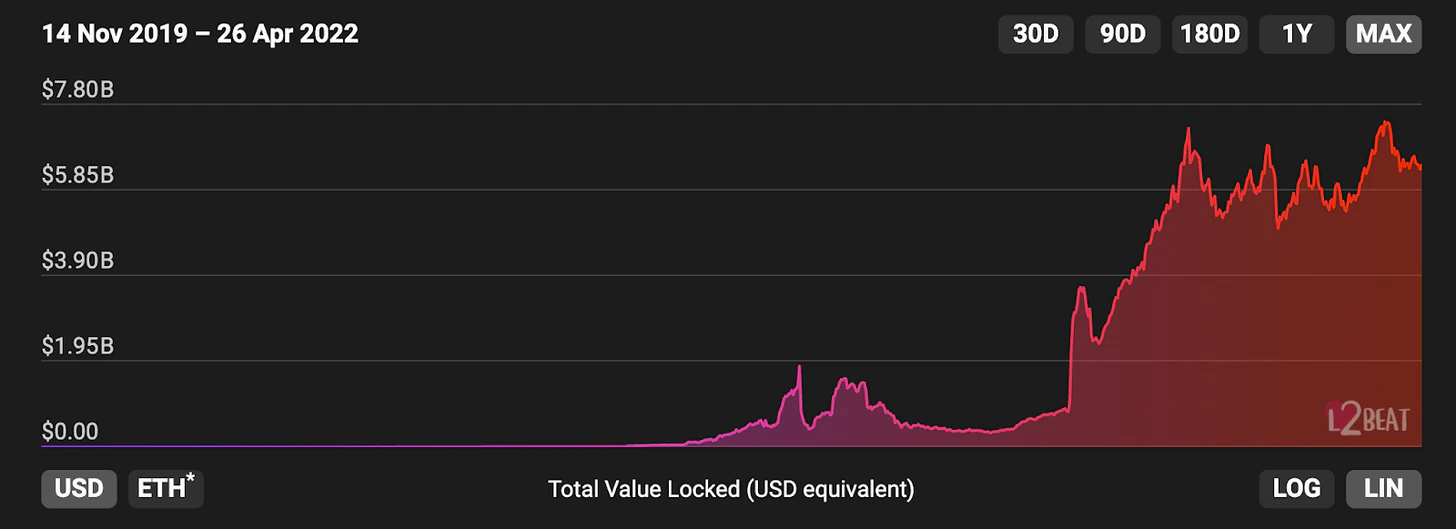

NFTs were not the only hot area of Ethereum from Q1 2021 to Q2 2022. In fact, Layer 2s saw surging adoption during that time frame across all metrics.

L2 TVL increased 964% from $686.9 million in Q1 2021 to $7.3 billion in Q2 2022. More than $23 billion in assets, including $4.2 billion worth of ETH, has been bridged from Ethereum to L1 blockchains and L2s.

TVL is not the only metric that proves L2 adoption is rising. The average monthly active addresses for Optimism reached 31,100 for Q1 2022 while the average monthly active addresses hit 483,077 on Arbitrum.

Optimism generated $5.7 million in network revenue for Q1 2022, while Arbitrum hit $9.4 million in network revenue. Network revenue in this scenario tracks the total fees user's paid to execute transactions on these L2s.

Derivatives exchanges have been some of the largest drivers of L2 adoption, as GMX, Perpetual Protocol, and dYdX have all deployed on various L2 solutions. They are now 3 of the 5 biggest decentralized perpetuals exchanges by volume. Each one of the aforementioned exchanges specializes in perpetual swaps.

Yet perpetual swaps are not the only derivative product to have gained adoption utilizing L2 technology. Lyra and Dopex, which specialize in options trading, combined have more than $119 million in deposits, and both have been deployed on L2s.

I believe that L2 adoption will continue to increase regardless of the macro crypto environment, since lower fees is a boon to any crypto native.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.