Rapture #190: Devconnect and NFT Data

I just got back from a week in Amsterdam for Devconnect, and I can definitely say that if you want to know where the industry is going in terms of innovation, developer conferences like EthDenver/Devconnect are the places to be. At these events, you directly interact with the sources of innovation.

Multiple side events took place during Devconnect, including the ETHStakers conference/hackathon and a conference devoted to just MEV (Miner Extractable Value).

I spoke at the ETHStakers event on behalf of SSV and presented a list of ideas that the staking ecosystem can build on SSV. The most interesting idea I presented centered around staking the locked ETH on the Ethereum side of EVM compatible bridges, which would allow users to earn yield even as they utilize their wrapped ETH on a sidechain or Layer 2, via SSV, which dramatically reduces slashing risk for stakers.

I plan to refocus my conference attendance away from institutional events (Bitcoin 2022, Consensus, etc.) towards developer oriented conferences. Getting as close as possible to the source of innovative changes gives me a far deeper understanding of where this ecosystem is headed.

Now, back to our regularly scheduled programming. Today, I will be covering some NFT statistics produced by @punk9059, one of the best Twitter accounts in terms of covering NFT macro trends.

Floor prices

Punk9059 has created a super nifty google sheet that allows you to easily compare the floor prices of different collections. If you create a copy of the sheet, you can select different collections to compare from a drop down menu. My grandfather could use this google sheet, meaning that you can likely figure it out as well!

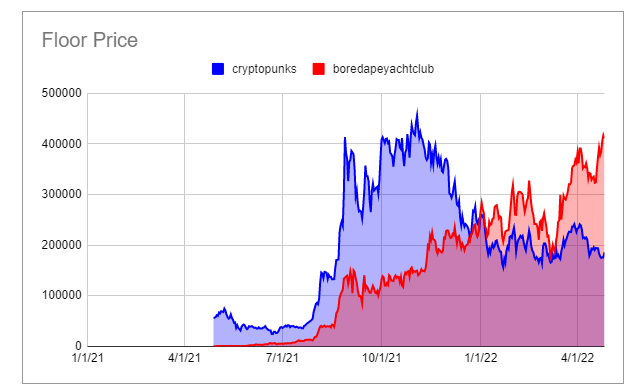

Just to show you what the interface looks like, for the following comparison I decided to compare the floor price of cryptopunks vs. BAYC in terms of USD since January 1st, 2021.

As you can see from this chart, floor prices for cryptopunks have affectively remained flat since the beginning of 2022, hovering around $200,000. BAYC's floor price on the other has continued to rise despite a bearish crypto environment, with their floor price now surpassing $400,000.

Though I don't personally speculate in NFTs, I do find this tool incredibly helpful for research purposes on how the top NFT collections are generally performing in a bearish crypto environment.

Top NFT collections holding up the market

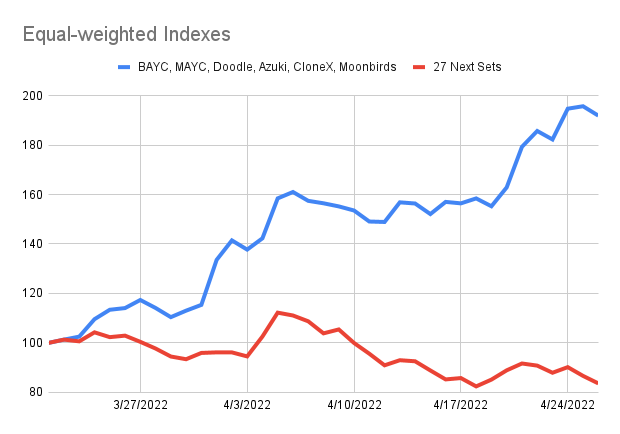

While certain collections are clearly doing well in a bearish overall crypto market, these NFTs are generally the exception rather than the rule. Based on the data amalgamated by @punk9059, only the top NFT collections (BAYC, MAYC, Doodle, Azuki, CloneX, Moonbirds) have been kicking an overall bearish trend, while the next 27 largest collections are actually down since the beginning of March 2022.

Despite the early success of NFTX (unfortunately I think the team has dramatically slowed in terms of development), there are still not many ways to play indexed NFT collections. Over the next 12 months, an index like financial product that tracks floor prices of various NFT collections, or sets of NFT collections, will likely be popularized so NFT dimwits like me can potentially play the market in a liquid manner.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.