Rapture #189: Ethereum Merge Delayed and Overview of Lido

We are undoubtedly within the eye of the storm period. Not much is happening. The market is (still!) trying to decide whether we go to goblin town or attempt take another shot at surpassing new highs, and many teams are heads down in buidl mode.

Still, there was one major announcement that occurred this past week: the merge to Ethereum 2.0 has been delayed (sigh). As with nearly all major technical developments on Ethereum, a delay should come as no surprise to anyone. I was personally putting the probability of the merge happening this summer at 60%. I still put the chances that the merge happens this year at 95%+.

I will cover the delay briefly here. Additionally, I thought it would be interesting to examine the business model of one of the most popular Ethereum staking players in the market, Lido. My role at SSV has me honed in on the Ethereum staking ecosystem and thus I have been researching the most successful market entrant to date, Lido.

Merge delayed

Tim Beiko, the Ethereum Core Dev coordinator (aka the face of the core devs) recently announced that the merge will no longer happen in June, but instead will likely occur a few months after June. New target: fall of this year.

This delay likely alters the launch of Ethereum's difficulty bomb as well, since that is slated to go live in June. The Ethereum difficulty bomb increases the difficulty of Ethereum mining, making PoW on Ethereum less profitable. The network will become unbearably slow because of the difficulty bomb if there are no changes by August.

Of course, the difficulty bomb will likely be delayed again to ensure there are no significant increases in block time prior to the merge being ready. The difficulty bomb is a tool used by Ethereum core developers to effectively force PoW mining to be deprecated on Ethereum, since it will cause mining to be not profitable.

Since the merge is the only major market wide event on the menu for this year, anticipation will have to build a little longer.

How Lido works

The basic idea behind Lido is that stakers deposit any denomination of ETH into the protocol and receive stETH, a liquid staking token, in return. stETH can be publicly sold on the open market, which is beneficial since normally users staking on Ethereum 2.0 would have their ETH locked until the unlocking event which will occur post merge.

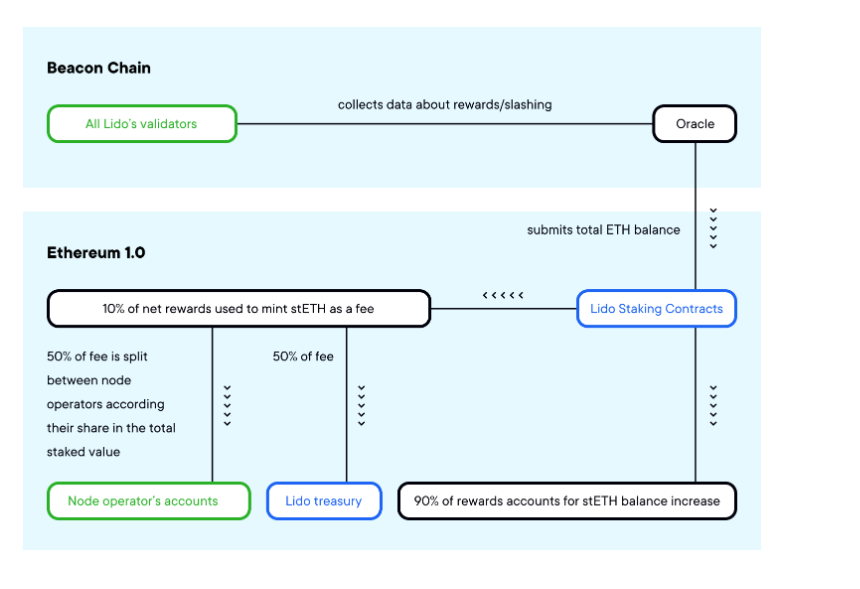

On the back end, Lido compiles all the ETH deposited by users and uniform ally distributes them in 32 ETH batches (the amount required to validate transactions on Ethereum) across their authorized node operators, which are approved by the Lido DAO. Furthermore, Lido has an oracle that updates at user's stETH balance based on its staking rewards and slashing events.

The Lido DAO takes a 10% fee (can be changed by DAO token holders) from the staking rewards earned by users. The fee is split between the operators (50% of the fee, or 5% of the staking rewards) and the Lido DAO (50% of the fee, or 5% of the staking rewards). The 5% of the staking rewards that goes to Lido DAO is used to fund further upgrades in the project and for an insurance fund in case anything goes wrong.

If you are interested in learning more about Lido in depth, I found this post helpful.

In future posts, I will quantify just how dominate Lido has become in the Ethereum staking space with their liquid staking product.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.