Rapture #161: The Different Scaling Solutions

My old boss, Preethi Kasireddy, has recently been producing some excellent content. In particular, she wrote an informative guide explaining the differences between various scaling solutions.

I thought I would write up some of my core takeaways. If you want a more in-depth explanation, you should check out her post.

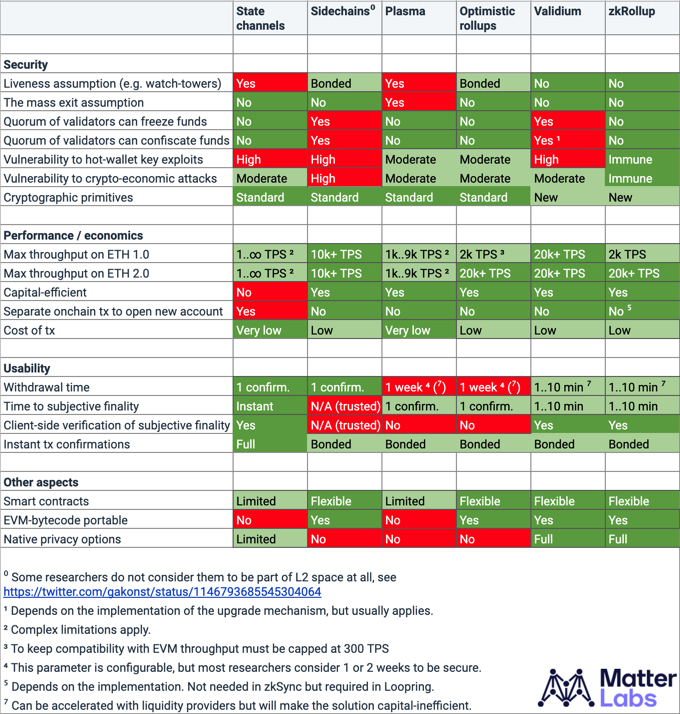

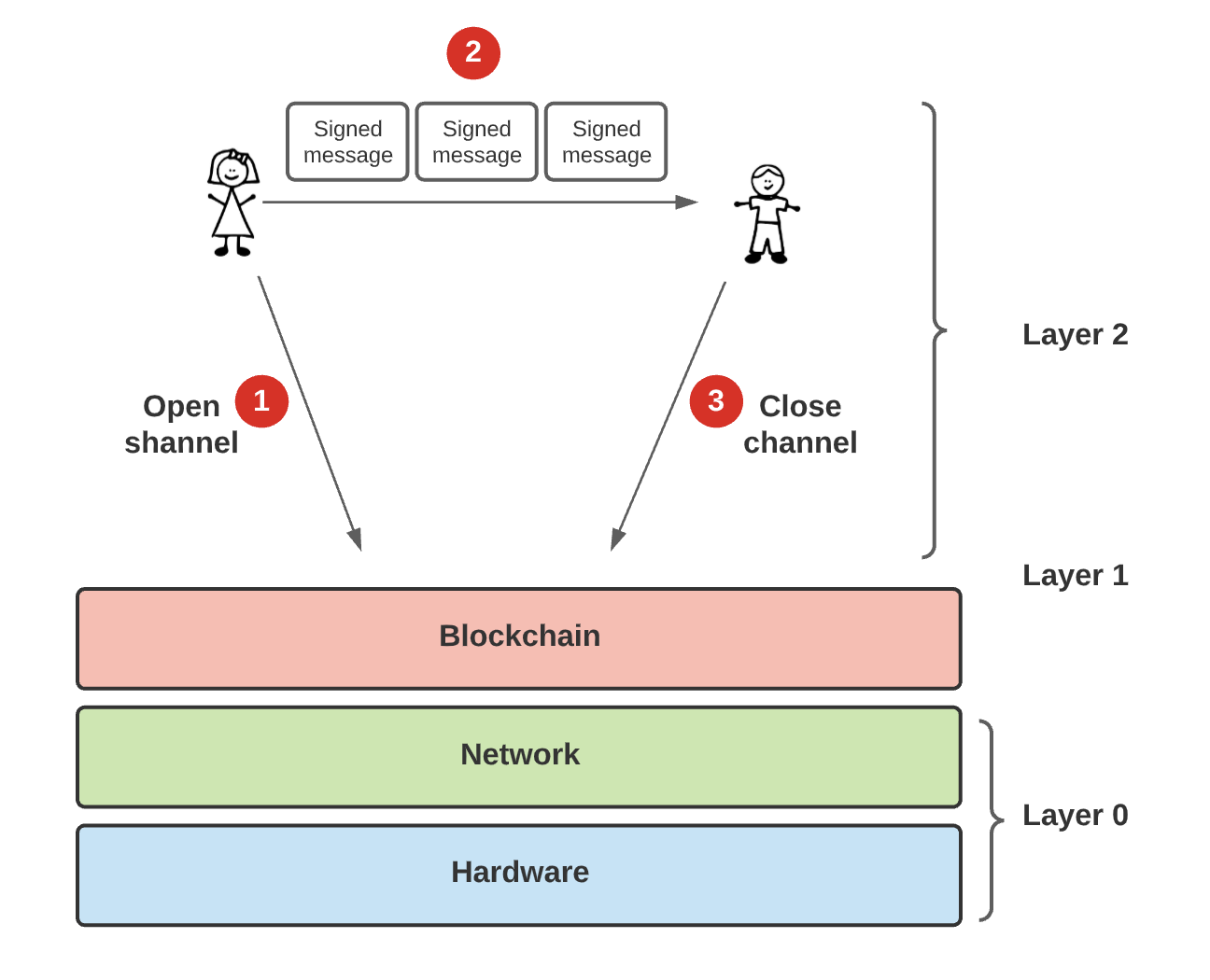

State Channels

The prime example of a state channel is Bitcoin's Lightning Network. State channels allows two parties to open a transaction pathway between two different parties. While a transaction on-chain is required to open and close the pathway, effectively an unlimited number of transactions can take place on that pathway when it is open off-chain. Thus, most transactions can happen off-chain, dramatically reducing the fees users incur.

Yet there are downsides to state channels. Specifically, they require users to lock to up liquidity in order to open the channel and protect against nefarious actors never actually paying the owed funds upon the closing of the channel. There needs to be watchers examining the state channels to ensure no nefarious actors are manipulating the state channels, which requires resources.

Sate channels are optimal when two parties have to execute transactions over a period of time, cheaply, and quickly. Yet they are capitally inefficient compared to alternatives.

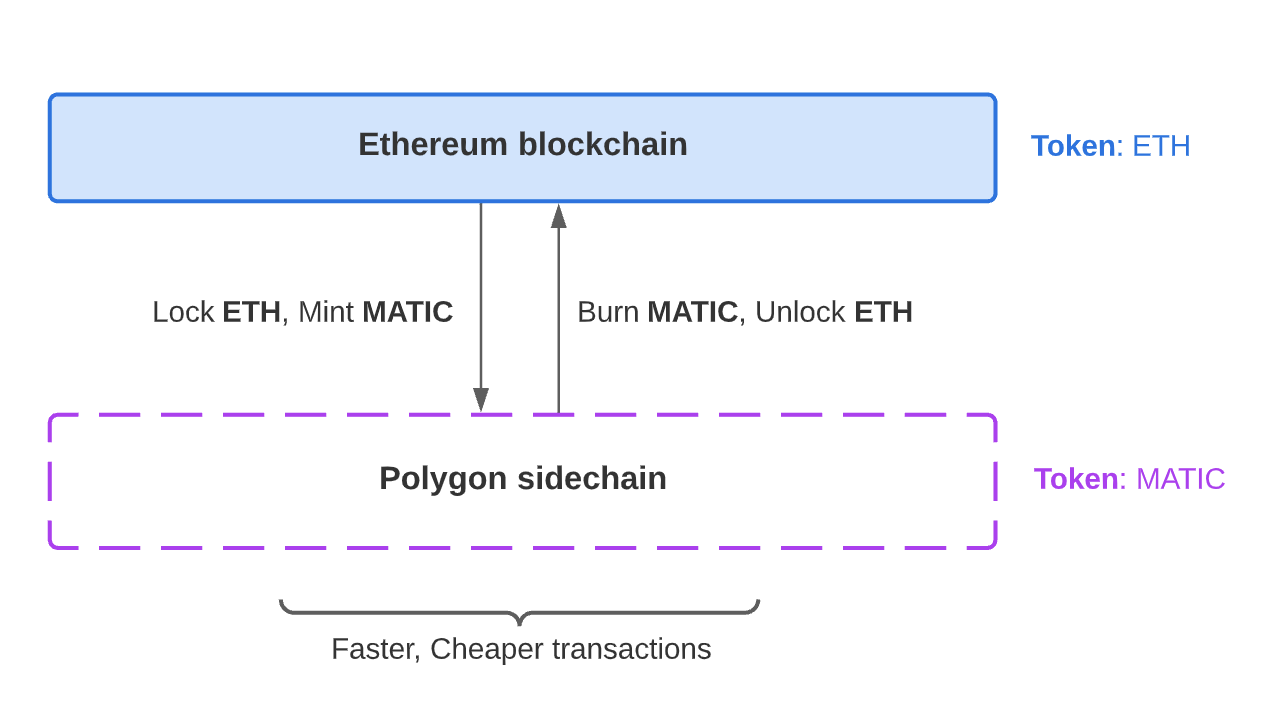

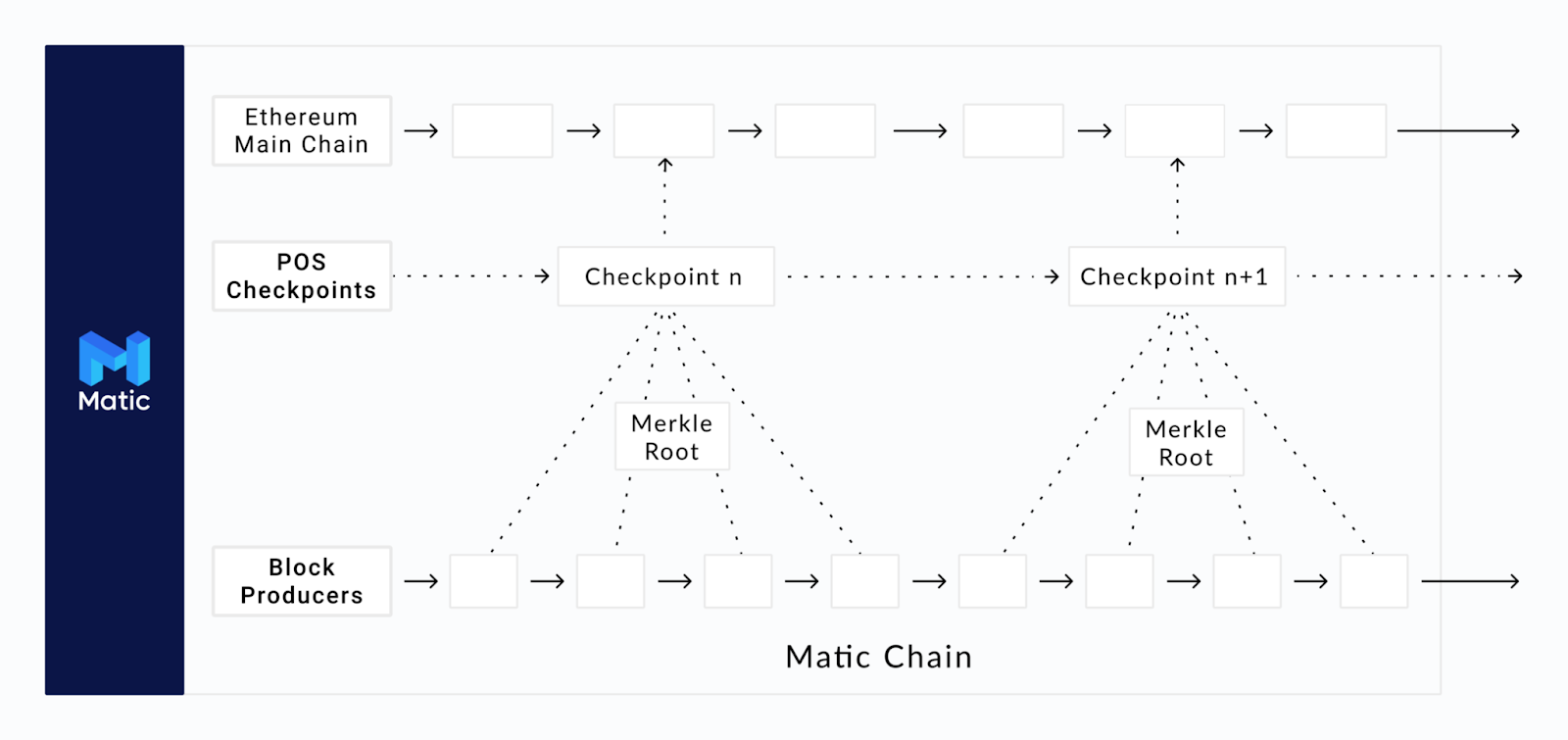

Sidechains

A sidechain is an independent blockchain that can bridge to another blockchain easily because they are compatible. Most sidechains, such as Polygon, are two-way pegged sidechains, meaning users can easily move their assets between Polygon and Ethereum. Interestingly, from a purely technical perspective Polygon actually is not just a sidechain to Ethereum since it periodically commits the state of Polygon to Ethereum, which is why they call themselves a commit-chain. In practice though, Polygon operates as a sidechain to Etehreum.

The tradeoffs of sidechains are they have their own validators, which are often far more centralized compared to blockchains with decentralized infrastructure like Ethereum.

Rollups

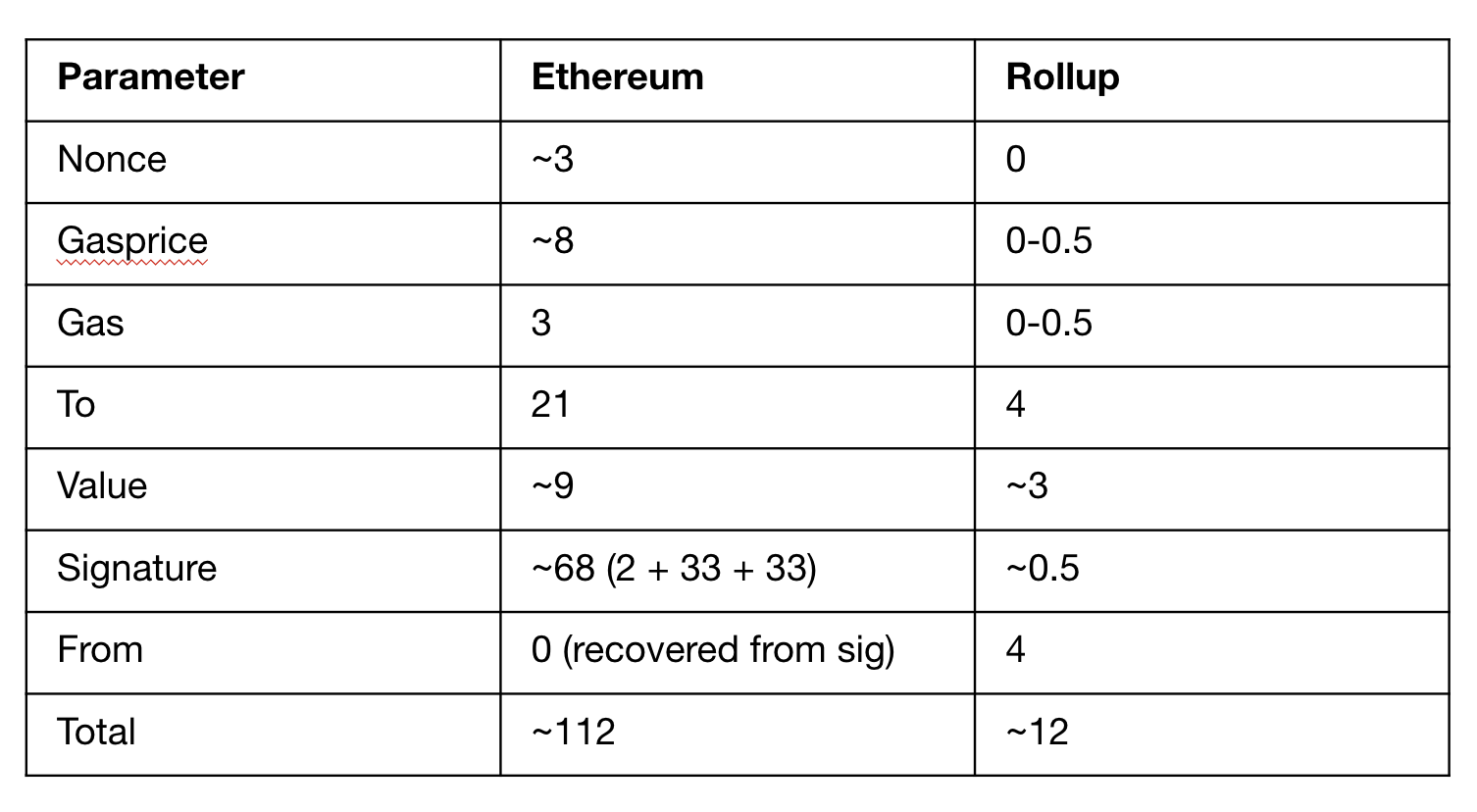

For rollups, transactions are being batched off-chain and an update is posted to the main blockchain. The transaction data of each batch of transactions is submitted on-chain. The amount of data submitted on-chain is the least amount required to validate locally the batch of transactions (i.e. the rollup).

Since the data is submitted on-chain, any entity can identify fraud, initiate transaction batches, or start withdrawals, making rollups more decentralized and accessible in nature compared to sidechains that rely on a smaller set of usually approved validators.

What is really special about rollups is that the execution portion of a transaction, which is the most data intensive, is moved to a rollup running a version of the EVM. Consequently, the transaction executes the same way as it would on Ethereum, but the costs are lower.

Yet there are distinct problems with rollups. Rollups don't scale infinitely, since some transaction data is still being stored on-chain. In fact, rollups are only estimated to boost Ethereum's TPS to approximately 5000. Furthermore, different rollup solutions are currently not composable with one another. Finally, there are single points of failure with rollups. Rollup solutions require there to be a sequencer, which is a node that actually batches the transactions and submits the result on-chain. Today, Arbitrum, Optimism, and StarkNet all rune their sequencer nodes themselves, though they all are thinking about how to decentralized the sequencing function.

For tomorrow's newsletter, I will go into some of the differences between the key rollup solutions.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.