Rapture #158: Uniswap Continues to Gain Market Share on Polygon

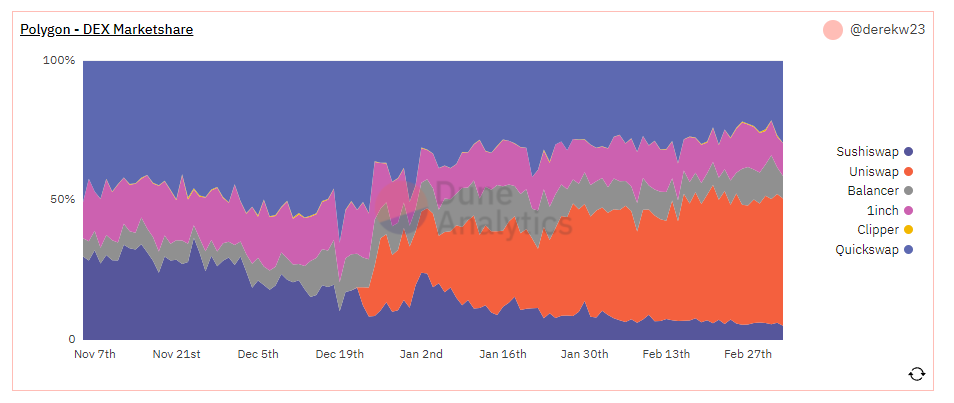

I saw a terrific thread posted by Derek Walkush yesterday, who works at the venture fund Variant. In this post, Derek outlines how Uniswap now has more than half the market share of DEX trading on Polygon. Additionally, Derek offers a compelling argument for why Uniswap is dominating the Polygon DEX market.

Let's dive into some of the numbers Derek amalgamated and see if the conclusions he comes to make sense.

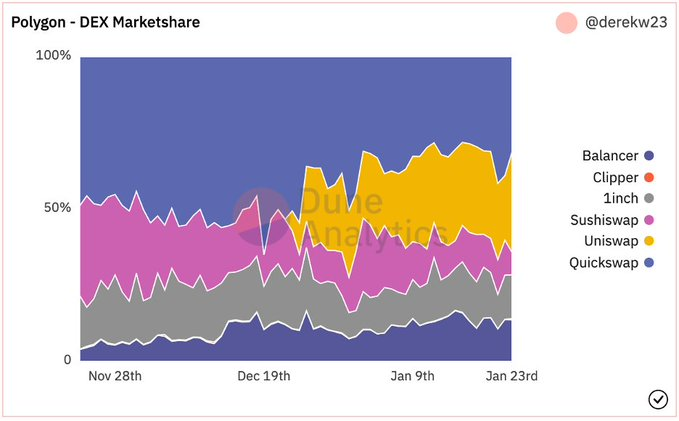

Uniswap started out far behind

Initially, Uniswap started out well behind the other DEXs on Polygon. Yet within the first week, the most recognized DEX quickly took approximately 30% of the DEX market share on Polygon. Uniswap was able to take this market share mostly from SushiSwap and QuickSwap.

Clearly, the brand recognition of Uniswap played a large role in its quick adoption on Polygon, as the the product differentiation between UniSwap, QuickSwap, and SushiSwap is minimal (in fact, the QuickSwap UI is a straight rip off of UniSwap's v2 UI).

Despite market share growth, TVL growth still lags

Interestingly, despite Uniswap growing its market share on Polygon so quickly, their TVL still significantly lags their competitors on Polygon. While UniSwap's TVL, which is now around $160 million, roughly 2xed in early February, it still is approximately around 1/5 of QuickSwap's TVL and 1/2 of SushiSwap's TVL. This deficit in TVL compared to QuickSwap and SushiSwap is likely because UniSwap is far more frugal in terms of giving out extra rewards for pooling liquidity compared to their competitors, who have robust token incentives for using their DEXs on Polygon.

UniSwap's dominance comes in spite of its lack of token offerings

While Uniswap is currently the top DEX by volume on Polygon, they offer far less coins than their competitors. In fact, only 34 tokens are listed for trading on Uniswap's Polygon deployment compared to 269 tokens for QuickSwap and 169 tokens for SushiSwap.

We can deduce from these stats that Uniswap is attracting the most volumes in the most significant asset pairs, such as ETH and USDC. Additionally, we can deduce that coin offerings is not the driving factor of volume for these DEXs on Polygon.

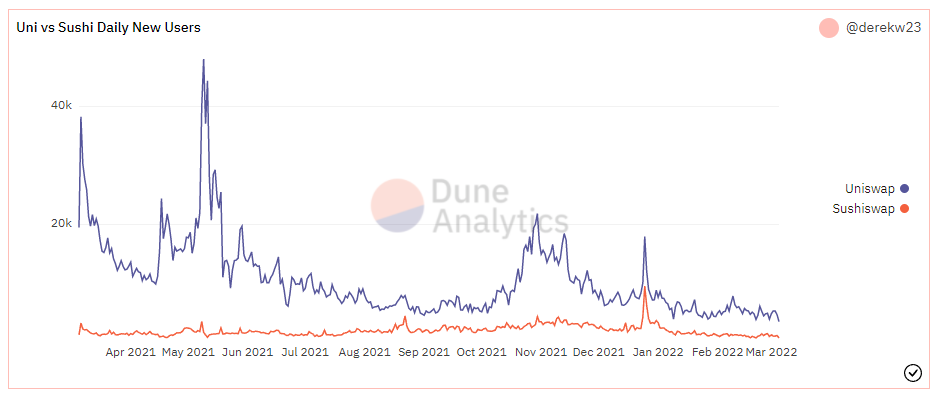

Where is Uniswap's volume coming from?

Uniswap is doing a better job of attracting new users to their DEX compared to their competitors. In the graph above, you can clearly see that Uniswap is consistently doing a better job of attracting new users compared to SushiSwap.

Takeaways

My takeaway is similar to Derek's interpretation of the data, which is that Uniswap's brand is so powerful that it is able to attract users to its Polygon deployment without token incentives.

Project brand is increasingly become a larger attractor of users in crypto. Since most the technology is open source and thus can be easily copied, brand plays a much larger role in crypto than other industries. This realization will only become more commonplace overtime. In a few years time, community building will likely have a higher premium than even solidity development.

Disclaimer:

The Content on this email is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer by Rapture Associates or Mattison Asher or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Rapture Associates, Mattison Asher, and its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.