Rapture #146: Crypto Sentiment is Cooling

What a wild ride the last few weeks have been in the market. While everyone is focused on macro events, from the potential Russia invasion of Ukraine to interest rates rising, few are actually discussing the clear decelerating interest in crypto that can be inferred from sentiment indicators.

Not only has the rate of growth in users for most crypto applications significantly decreased (check dune analytics dashboards and dapprader for stats), but nearly all the sentiment indicators show waning retail interest at this point in time.

Of course, sentiment indicators are tricky because many would argue that they are lagging indicators to price, yet they are still important to track as they paint a clear picture of how the masses currently feel about crypto.

Social Media Stats

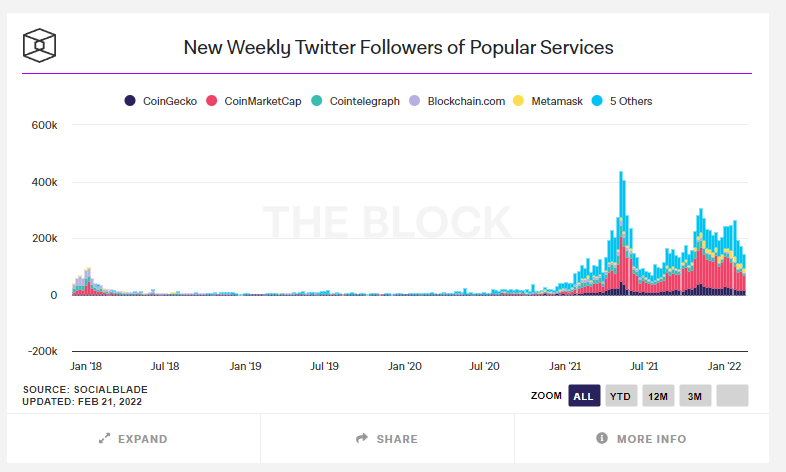

Weekly twitter followers for many of the most popular services in crypto are on a clear downtrend. Note that a peak in January 2018 and downtrend from that point indicated an extended bear market, though the peak in May earlier this year did not indicate a cycle top.

The peak of Bitcoin prior to the run up in Quarter 4 occurred just under a month before new weekly twitter followers peaked. That being said, the reversal from the bottom of new weekly Twitter followers occurred effectively at the same time Bitcoin reversed its downward trend in July 2021.

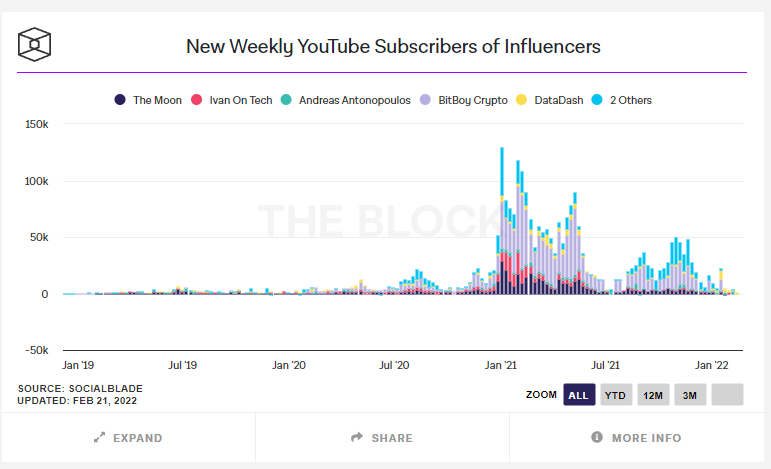

Interestingly, other social metrics paint a very different picture of how retail interest has changed over time.

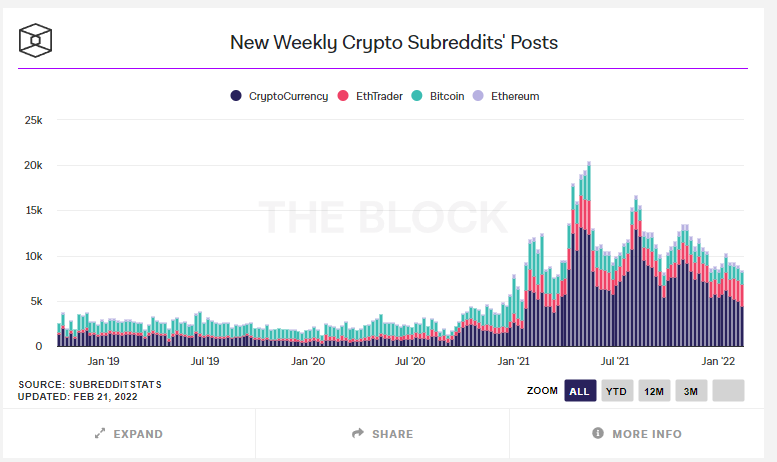

For instance, new weekly YouTube subscribers of influencers has been on a steady downtrend from January. Furthermore, new weekly crypto subreddits posts peaked in early <ay and has been on a steady downward trend ever since.

Web Traffic

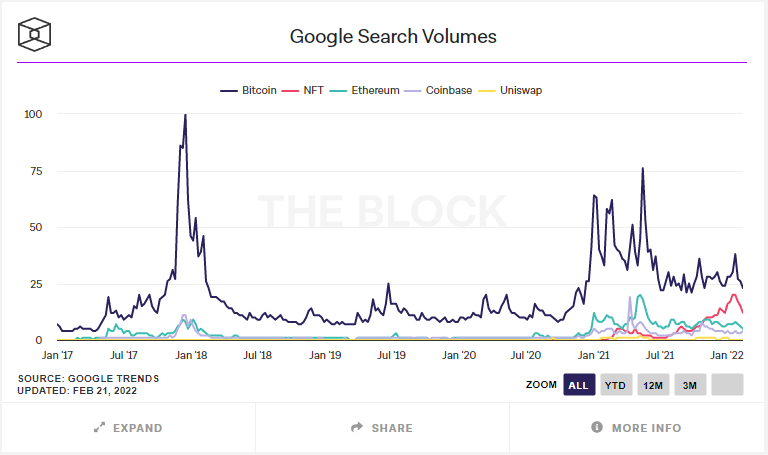

Google search volumes tell a similar story to YouTube subscriber and crypto subreddit rates. Effectively, google search interest for Ethereum, Bitcoin, and Uniswap peaked in early to mid 2021. Since then, search interest for those key words has been on a downtrend.

NFTs bucked the trend by peaking in January of this year, though now search interest is also in a downtrend.

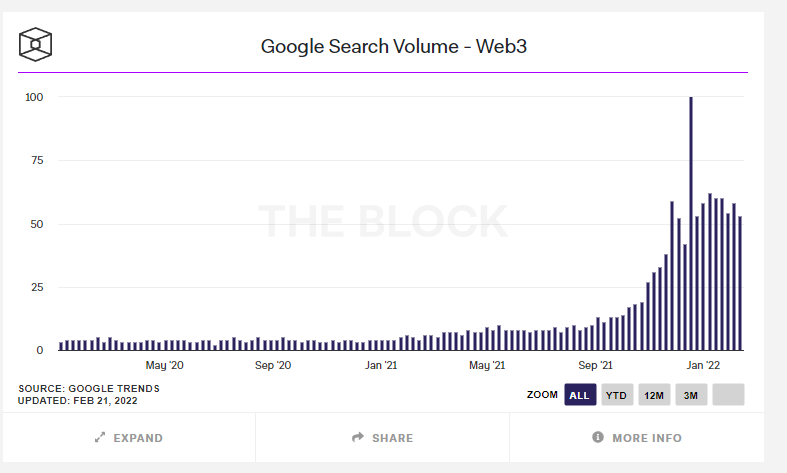

Search volume for the term Web 3 tells a slightly different story, as interest remains high for this phrase.

Web 3 remaining high tells me that Silicon Valley/traditional tech remains interested in crypto, since that demographic is typically the one I have seen the most use the term Web 3. Web 3 is not a mass retail term.

Takeaways

Once again, the relationship between these metrics and crypto prices is complicated. Clearly, retail interest has been decelerating. Nearly every metric tells that story. Historically, bear markets have come when retail interest decelerates and remains at a low point for a sustained period of time.

With consistent new retail inflows held off because of lack of interest, the players in today's market are largely institutional, which leaves the market on hard mode. Consistent retail bid makes for a far easier trend to buy into, while institutions trading amongst themselves yields more shenaniganry.