Rapture #127: Where did Retail go?

Crypto is undeniably driven by the whims of retail. Yet over the past 6 months, there are clear indications that retail has been leaving the crypto markets. Considering retail buying is one of the largest drivers of crypto price, understanding the trends of retail is essential to understanding where we are in the market cycle.

Retail Trading Platforms see Drop in Crypto Revenue

Robinhood, one of the largest trading venues for crypto retail, reported their earnings last Thursday. While the earnings were disappointing across the board, their quarterly change in crypto revenue are particularly important to take note of. From Q3 to Q4 2021, revenue attributed to crypto trading dropped approximately 6% from $51 million to $48 million.

Yet Robinhood is not the only crypto platform to see a drop in retail demand. While Coinbase has not yet released their earnings reports, you can see from Nomics that their daily trading volumes have been decreasing, especially since about halfway through December 2021.

Across the board, trading venues that primarily cater to retail are seeing a decrease in the amount of demand for their services.

Google Trends

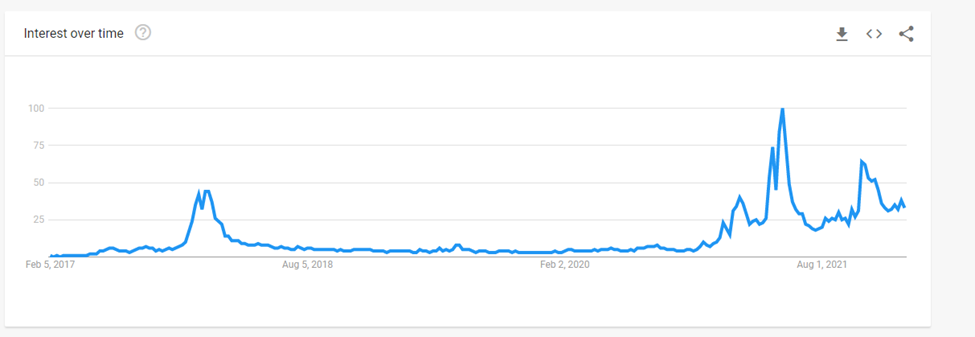

One of my personal favorite ways to track retail demand is via google trends, which effectively evaluates the changing rate of how often people are googling a specific key word. The word cryptocurrency was most googled in mid-May 2021, and there are currently approximately 2/3 less google searches today for the word relative to that time.

Interestingly, there was a local peak for searches of the word cryptocurrency in October, which was only 1/3 below the mid-May 2021 peak.

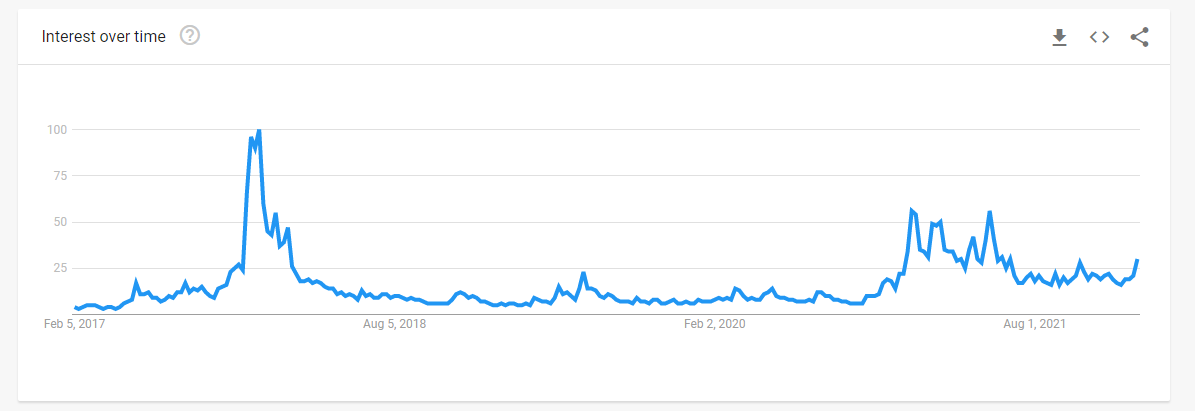

Just looking at the keyword bitcoin displays the loss of retail interest even clearer. While the yearly peak for searching bitcoin was also May 2021, it actually came nowhere close to surpassing the peak Bitcoin saw in late December 2017, which was close to 2x to the high in May 2021. Furthermore, Bitcoin searches have recently been on the rise in January 2022, though from an incredibly low level which is about 1/3 of the search demand than the May 2021 peak. Will be interesting to monitor if the rise continues.

Despite the most recent uptrend in google searches for Bitcoin, it is quite clear that retail currently does not have as much interest in crypto as they did last summer.

Of course, peaks in google interest usually indicate market tops, which can often be explained by retail euphoria, so parabolic rises reaching new heights is also not healthy.

Retail Currently Loves NFTs

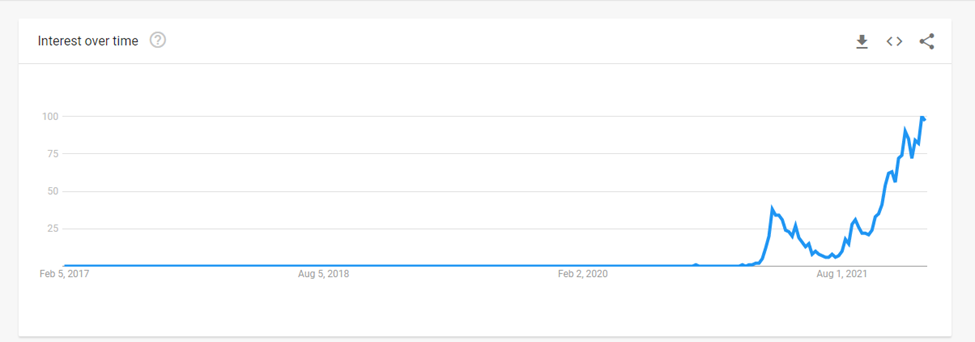

Without a doubt, a substantial amount of the retail trading action has been occurring in NFTs, as indicated by the incredibly high volumes platforms like OpenSea have been seeing and the google searches for NFTs going parabolic.

Much of the rabid price action that historically took place in Bitcoin/altcoins generally has moved to NFTs. Yet this phenomena makes me wonder if NFTs are like the altcoins of the last bull cycle, which peaked about a month after Bitcoin peaked in December 2017.

Takeaways

While retail has pulled back as indicated by the drop in volumes/revenue on retail trading venues and google searches on key terms like Bitcoin and cryptocurrency, it is difficult to discern if it is a temporary pullback or the early stages of a sustained drop as you saw in 2018. While there have been pullbacks in interest, the retreat so far has been shallow.

Of course, that is what trading is all about, betting that the shallow retreat will turn into a sustained winter or if it will reverse course.

What I can say, as a non-participating observer in this particular area of the market: NFTs look euphoric, which typically mean a crash is set to come.