Rapture #120: The Companies that will Bridge Wall Street and Crypto Part 1

Since I will be down in Miami for the renowned Context Investment Summit this week, I thought it would be interesting to cover the most impactful players in the market currently in position to bridge wall street with cyrpto.

The way I envision the bridging playing out is that Fintech firms and Wall Street will become the front end for cyrpto, driving clients into a financial system that is all based on blockchain technology on the backend. Crypto applications notoriously have bad user experiences, and Wall Street/Fintech have the existing distribution channels to best capitalize on the cost efficiencies crypto provides.

Of course, if Wall Street and Fintech do nothing because of the innovator’s dilemma, crypto will eventually build out easier-to-access front-ends. Yet the incumbents have some time before that happens.

If we do get a synthesis of Wall Street/Fintech and Crypto, there are currently only 6 institutions that can effectively own the bridge opportunity. I will be covering them in the upcoming 2 or 3 newsletters, as I want to get into the meat of what makes them special.

Fireblocks

Despite only being around since 2018, Fireblocks has amassed over 800 financial institutions as its customers, secured over $2 trillion in assets, and has raised $889 million. Fireblocks was the first major custodial solutions provider to bring MPC technology to the market in a major way. MPC technology makes managing funds in crypto far safer and easier than the previous custodial solution infrastructure. I might write a full Rapture on MPC in the near future.

While MPC and Fireblock's easy to use product played a prominent role in comapny's success, their unbelievable business development and marketing strategy really turned Fireblocks into the bellweather it is today. Fireblocks has been able to attract significant traditional financial institutions such as BNY Mellon and crypto native protocols like Aave as partners. Furthermore, Fireblocks has built integrations with nearly every major custodian and service providers to date, a process which is completely driven by BD.

In addition to their execution on BD, their marketing strategy has been exceptional. Two areas of their marketing strategy in particular I believe have been incredibly effective are social proof and email marketing.

The institutional market is incredibly herd like. If you get some big names on your platform, then the other lemmings will quickly follow. Fireblocks did an unbelievable job prominently showcasing case studies and video testimonials from prestigious customers on their website so that the entire industry knows their legitimacy.

Furthermore, in every single Fireblock’s employees signature, there is content that links to articles describing achievements of the company or more customer testimonials. Using the signature in one’s email as marketing tool is probably the most creative institutional marketing tactic I have ever seen.

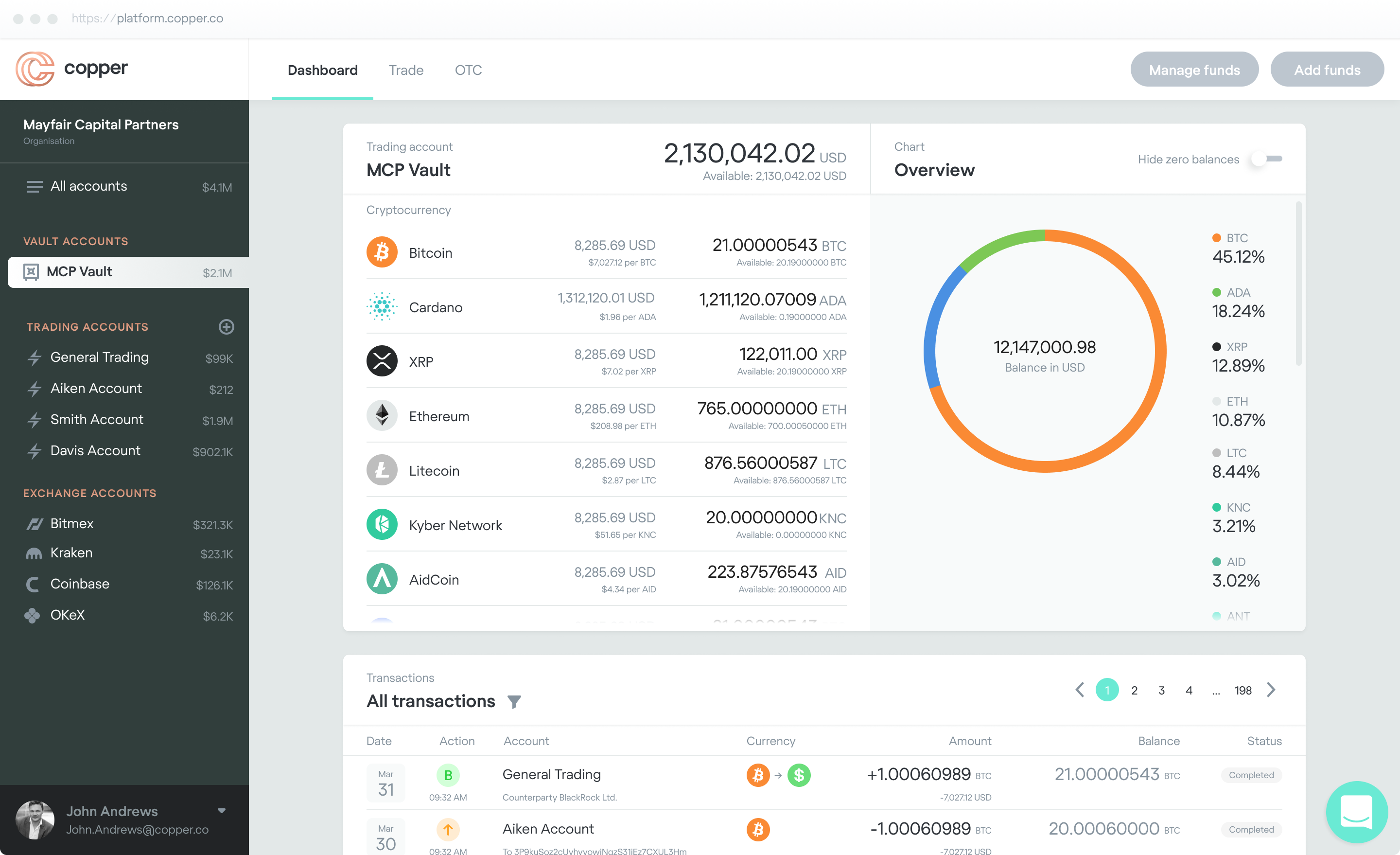

Copper

While Fireblocks integrates with other custodians, Copper is their own stand alone custodian with a unique feature called Copper Copper Connect, which acts as a gateway to Ethereum applications. Copper Connect is a direct competitor to Fireblock’s product, though Copper being its own custodian changes the dynamic of how the businesses compete since Fireblocks is not a stand alone custodian.

Copper has raised $85 million to date, which is significantly less than Fireblocks. Despite raising less money, Copper has been able to amass more than 400 clients, though their clients on average are much smaller. More than $50 billion in monthly notional flows through the Copper infrastructure, and customers of Copper often find that their product is the easiest to use out of any in the market.

Copper will need to continue to improve the Copper Connect experience and their BD pipeline in order to become the leader, but they are a rapidly growing competitor in the institutional market.