Rapture #116: Ethereum Macro Stats Update

Since so many of you liked Rapture #115: Effects of EIP 1559, I thought it would make sense to cover Josh Stark’s and Evan Van Ness’ The Year in Ethereum 2021 report.

So, let’s dive in!

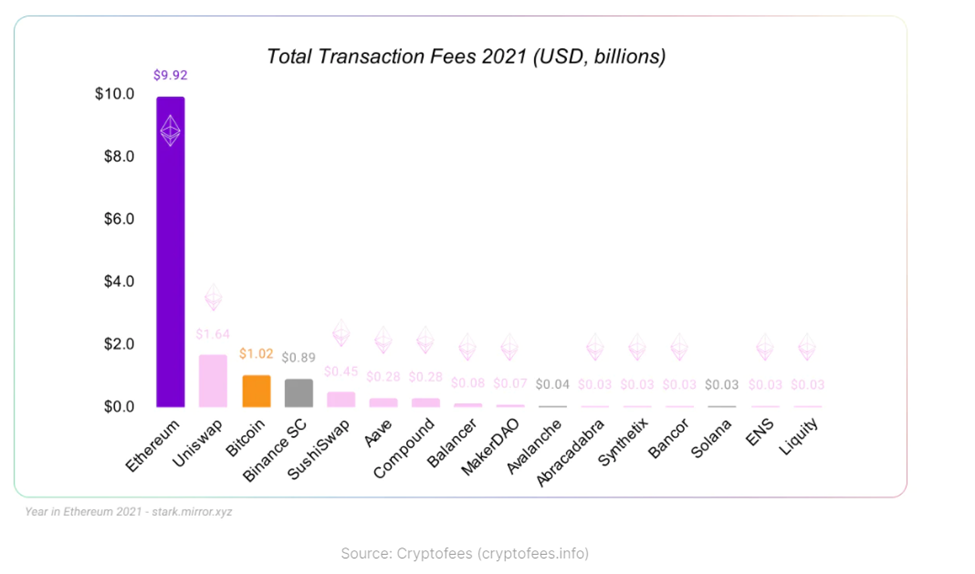

Fees, fees, and more fees

In 2021 in fees, Ethereum generated almost $10 billion in fees. That is more than every other major crypto project combined. While many believe that high fees are a negative since they impede continued user growth, the fact that users are willing to pay high fees displays the overwhelming demand for the network. It is sort of like that complaint that goes: “no one likes that restaurant, it is always too crowded.”

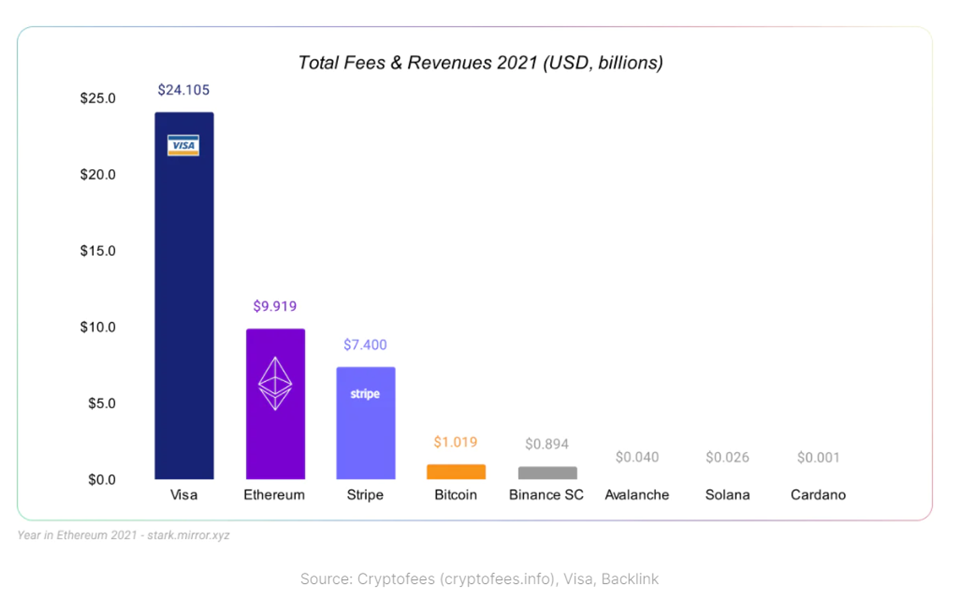

A more interesting chart is comparing Ethereum to traditional payment processing companies, like Visa or Stripe. While still trailing Visa, Ethereum surpassed Stripe in 2021 regarding total fees generated.

For being less than 7 years old, that is not too shabby!

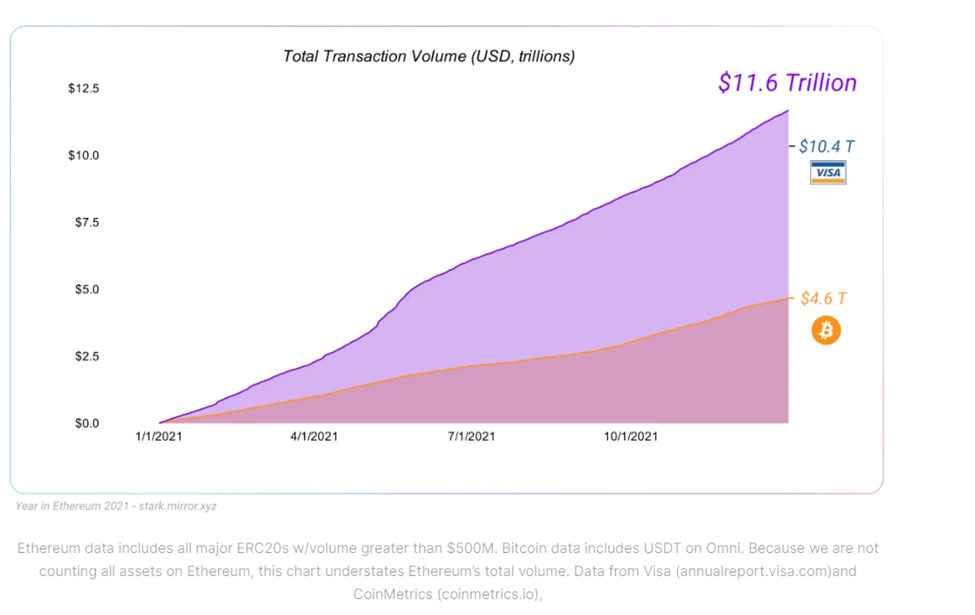

Total Transaction Volume Surpasses Visa

While Ethereum was unable to surpass Visa in total fees for 2021, it did surpass Visa in terms of total transaction volume.

In just 2021, Etheruem generated $11.6 trillion worth of transaction volume, compared to just $10.4 trillion for Visa and a measly $4.6 trillion for Bitcoin.

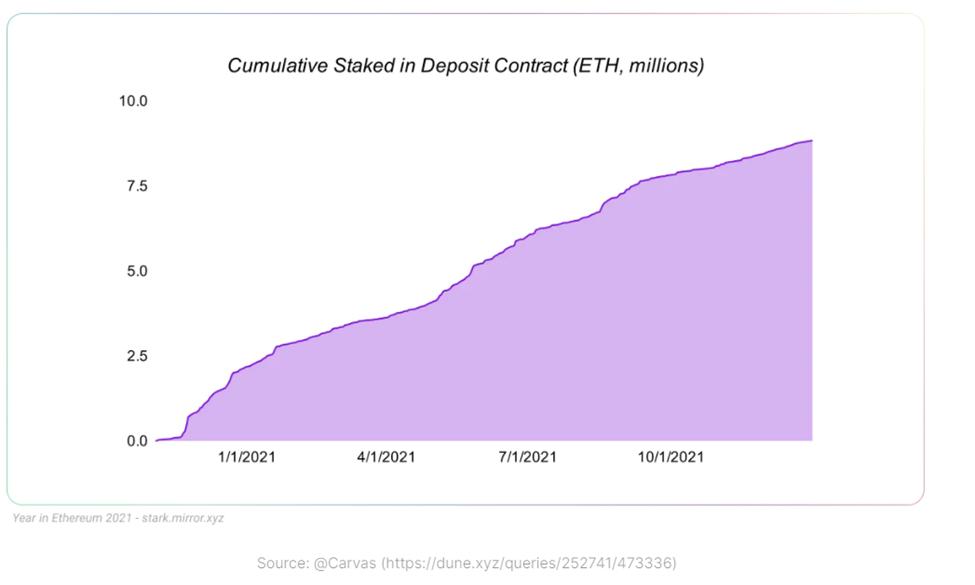

Staked ETH

Yet transaction data isn’t the only feather in Ethereum’s cap for 2021. As many of you all know, Ethereum is in the process of moving to proof of stake; a process that should be completed by the end of this year and likely in the first half.

Cumulative ETH staked surpassed 9 million, meaning that nearly $28 billion worth of ETH has been staked. That is a wild number, considering we don’t even know when those users will be able to access that ETH since it is locked until after Eth 2.0 merge is complete.

Investors clearly have a lot of faith that the merge will happen without a hitch!

Though there is bad news…

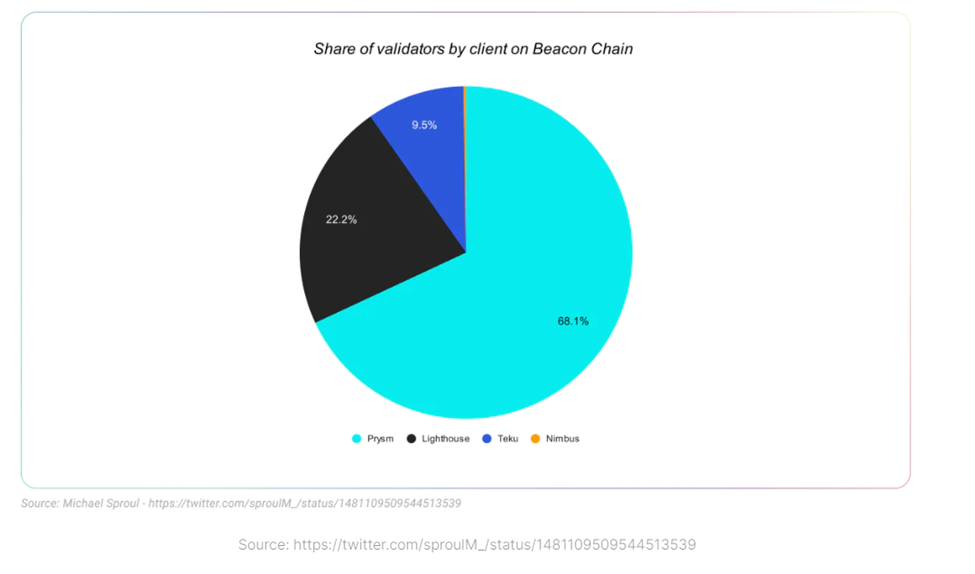

Yet there are still striking deficiencies in Ethereum to go alongside these wonderful areas of adoption. Specifically, to run nodes on Ethereum, you need a special application called a client. Nodes are sort of like the individual small bones that comprise a back. If you don’t have them, the entire structure fails. Thus, having applications to run nodes is paramount.

Yet today, more than 68% of validators are run by one type of client, Prysm.

If a bug is found in the Prysm clients, it would significantly impact the entire Ethereum network and the applications that run on top of it.

According to the authors of the report, it is imperative that no client should have more than a 33% validator share of the network.

Takeaways

While the demand for Ethereum is promising, the next few years will prove if the network has the capability to become the backbone for the global economy. Personally, I think it has the best chance out of any blockchain today, but that perspective can easily change as the ecosystem evolves.