Rapture #113: Every Company will have a Token

Eventually, every company will have a token, the same way that every company now has a website. This past month, Walmart filed new trademarks indicating that the company would offer users a digital currency. That’s right, Walmart. If Walmart is in the process of creating their own digital currency, how many other companies do you think will follow them in the coming years?

You might be asking yourself, why will traditional companies even want to tokenize? I thought I would compile some of the supporting arguments behind why a company would be interested in releasing a token.

Hype

If you haven’t noticed, crypto is for the cool kids now. Doing anything with crypto is an easy way to get a ton of press. Furthermore, traditionally stodgy corporations see crypto as a way of potentially reinvigorating their brand. While this trend started with Kodak years ago, brands that have lost their sex appeal such as RadioShack and now Walmart have recently announced crypto projects. Heck, Facebook even knew that it was necessary to change their name to Meta. Every company wants to be cool, as being cool yields cheap affiliate marketing.

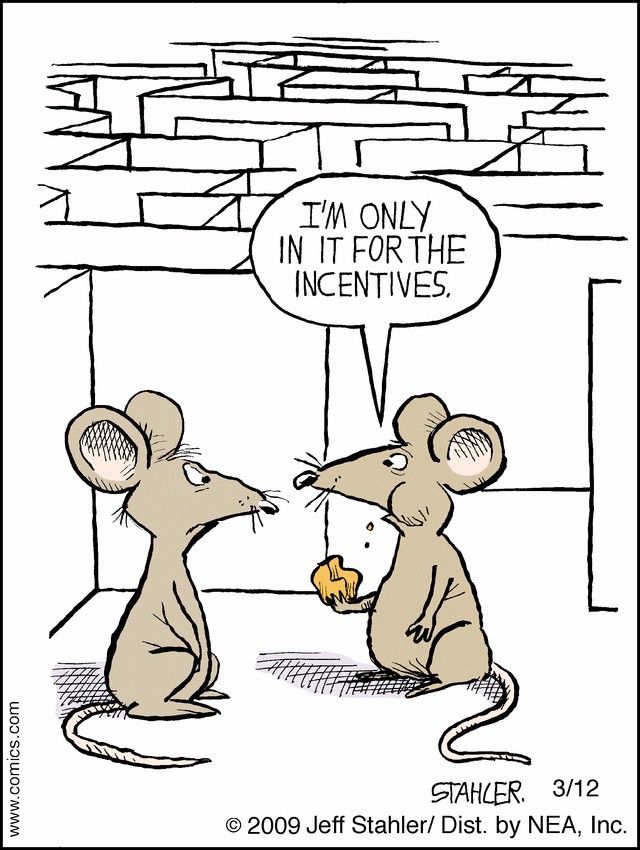

Tokens Align Incentives Between a Business and its Consumers

Currently, consumers have little incentive to be loyal to any company. What do they get for being loyal, especially if the company’s products and services are no longer superior to their competitors?

Token distributions change this dynamic as users will now be compensated for their loyalty in the form of a token that trades on a secondary market. Now, just like crypto projects do today, companies can give their consumer a token that loosely tracks the success of the company. If I as a consumer now hold an asset from a company that will theoretically increase in value if that company is successful, how likely am I now to be loyal to that company? I posit much more likely.

Tokens are far better than normal discounts, as they create new value for the consumer.

Cost of Capital is Zero

Corporations must pay pesky interest rates when they issue debt. When they issue equity, they dilute their current shareholders. But what if they distribute tokens, keep some for themselves, and those tokens trade on a secondary market? Suddenly, the corporation has effectively garnered new funds that cost the business entity nothing to create. Furthermore, there is currently no underlying obligation/expectations tied to that token, like the forking over of assets to debt holders in the case of bankruptcy or dividends with equity holders.

Token Sales are Recognized as Revenue

If a company opts to sell tokens, the SEC has already set the standard that the selling of tokens should be recognized as revenue on the income statement. Not only can the corporation create the tokens out of thin air, but if they sell them, that is immediately new revenue to add to their income statement.