Rapture #110: Token Distribution Trends

Lauren Stephanian and Cooper Turley recently released research that covered the change in average token distributions overtime. Considering I spend a lot of time on tokenomics and found this report particularly interesting, I thought I would share some of the central findings the authors uncovered.

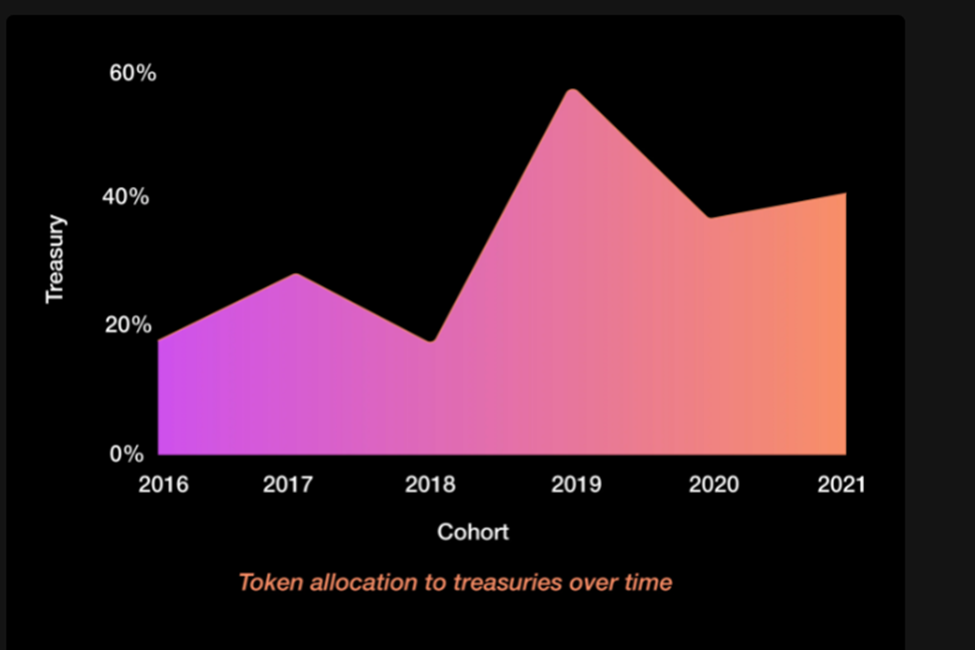

Treasuries

The number of tokens allocated to the treasury in an initial distribution event has risen overtime. In 2021, the average allocation going to the treasury of a project is just over 40%, which is significantly higher than the approximately 20% average it was in 2016. Note that the funds held in a project's treasury can only be moved by a governance vote, at leas if the DAO is truly decentralized.

In case you were interested, the DAOs with the top treasuries are UniSwap ($2.8 billion), BitDAO ($2.7 billion), Lido ($651 million), Compound ($561 million), and Aave ($460 million). All of these DAOs were formed in the past few years.

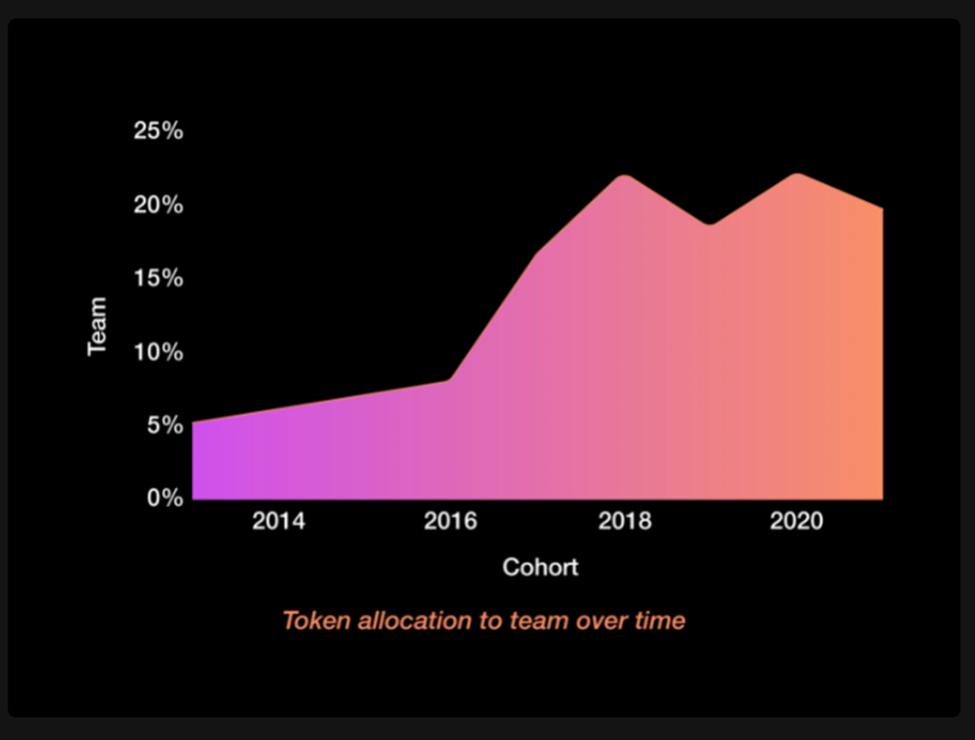

Core Team

Interestingly, core team allocations have been increasing. In 2021, approximately 20% of the token supply was reserved for core team members, an increase from 5% in 2013.

Clearly, entrepreneurs and their supporting teams in the crypto space feel they deserve a larger share of the token allocation, and I don’t necessarily disagree with them. The regulatory risk for entrepreneurs in crypto is extremely high and only increasing as the space becomes more politicized. Compensating for risk typically is how business works.

Furthermore, with an ever increasing supply of capital, entrepreneurs are able to negotiate larger shares of the pie for themselves.

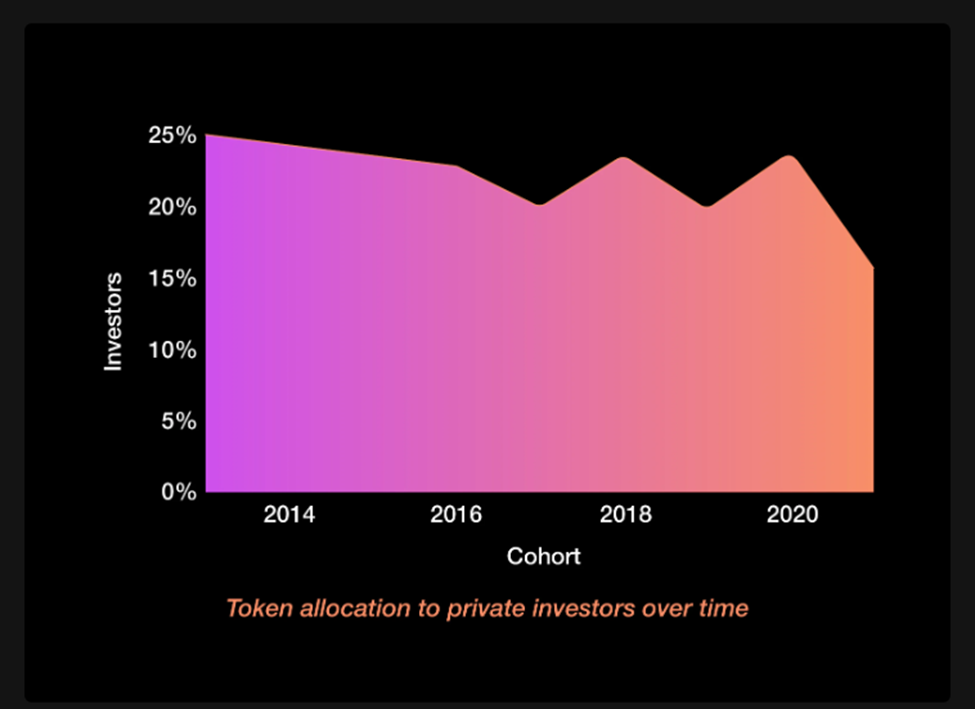

Private Investors

Unsurprisingly, private investors' share of the token supply has been trending down overtime. In 2021, the private investor allocation was around 15%, a decrease from a high of 25% in 2013. The reason why this is unsurprising is that, as we have noted in previous Raptures, the amount of venture capital flowing into crypto is ever increasing. More competition between allocators means that entrepreneurs have more leverage when negotiating. Consequently, allocators get a smaller share of the pie.

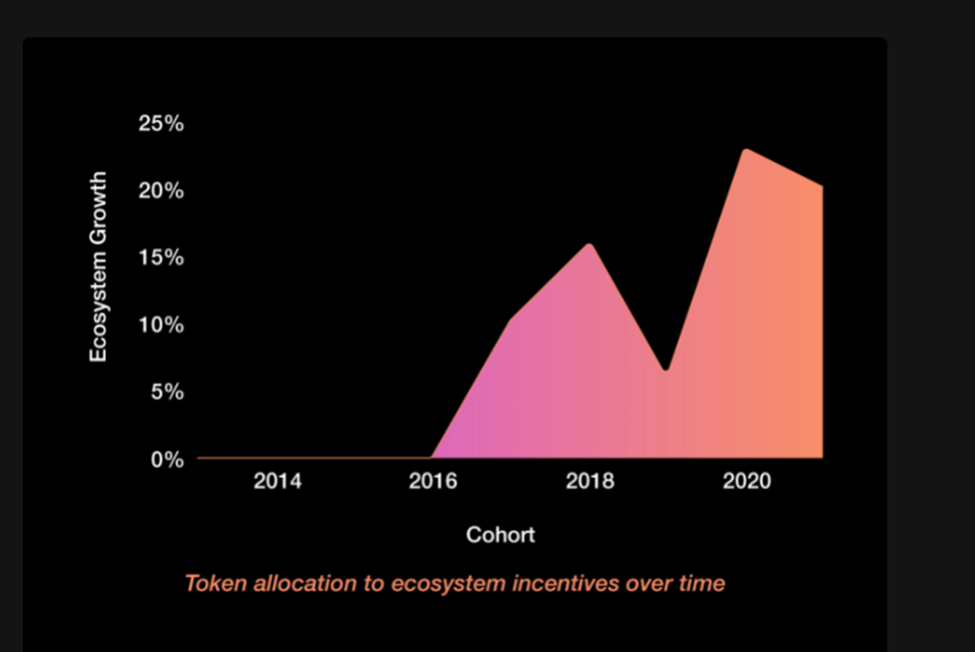

Ecosystem Incentives

Ah, good ol’ yield farming! Compound popularized this technique in 2020. Ever since the success of Compound bootstrapping liquidity on its lending platform, nearly all major crypto projects have opted to use ecosystem incentives in some way. In 2021, more than 20% of the token supply on average was allocated to ecosystem incentives, up from 0% in 2016.

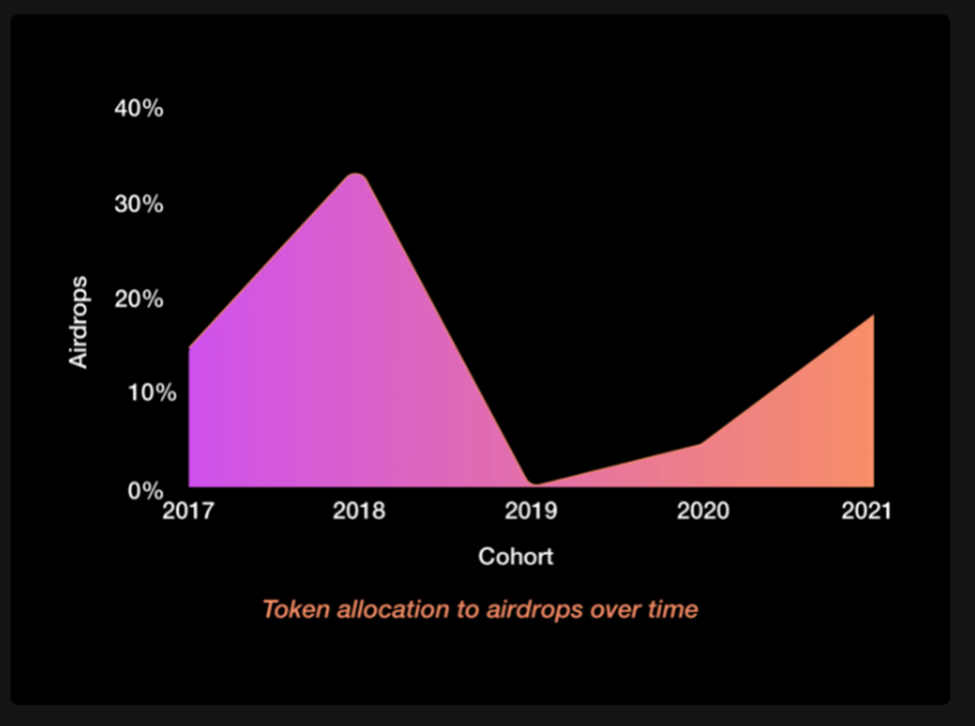

Airdrops

While Airdrops were hot in 2017 – 2018, they dropped to effectively 0% of the token supply in 2019. Yet airdrops have been on the rise again. Users want to be compensated for the early risk they take in using a protocol before it has been robustly tested.

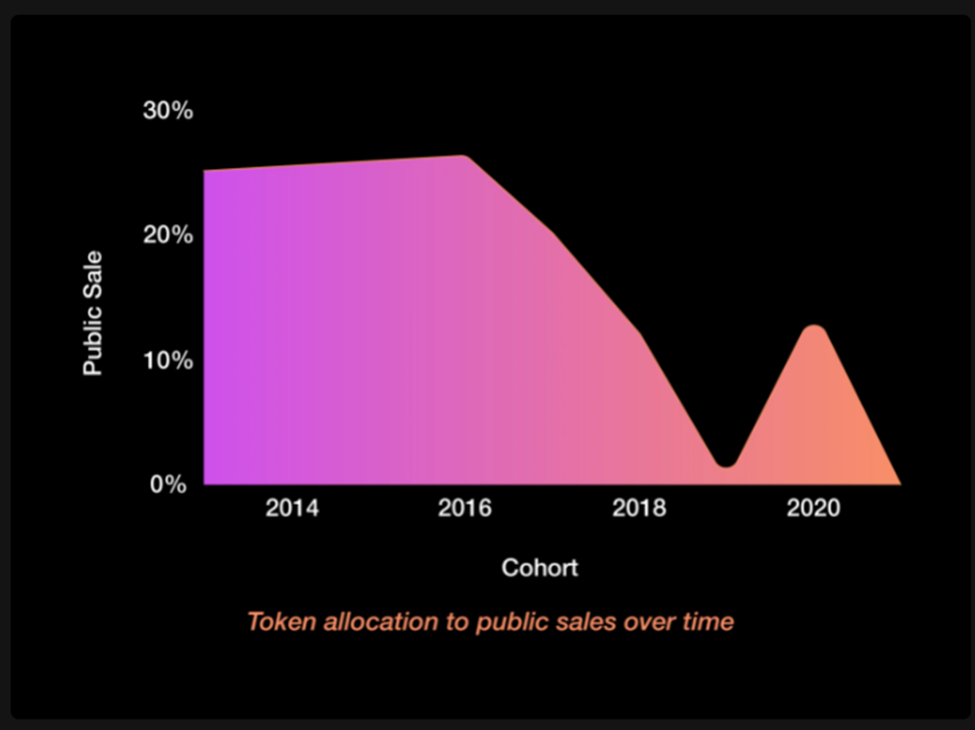

Public Sales

Finally, public sales have dropped off a cliff since the ICO boom, mostly because it is unfeasible from a regulatory perspective. Nearly all of the cases (Eos, Sia, Kik, Ripple Labs, etc.) brought against crypto teams by the SEC center around an ICO event. While ICOs hovered between 20 – 30% of token supplies before the 2018 crash, currently very few projects pursue an ICO.