Rapture #109: LooksRare Vampires OpenSea

Well, it looks like SOS was just the test before the full on vampire attack on OpenSea was launched. In the past couple days, a new NFT platform called LooksRare came to market. This marketplace vampire attacked OpenSea, adding new liquidity mining incentives in the process to attract users away from OpenSea. While it is still early, I think LooksRare has a chance to be a leading NFT marketplace, just like SushiSwap emerged to be a significant competitor to Uniswap.

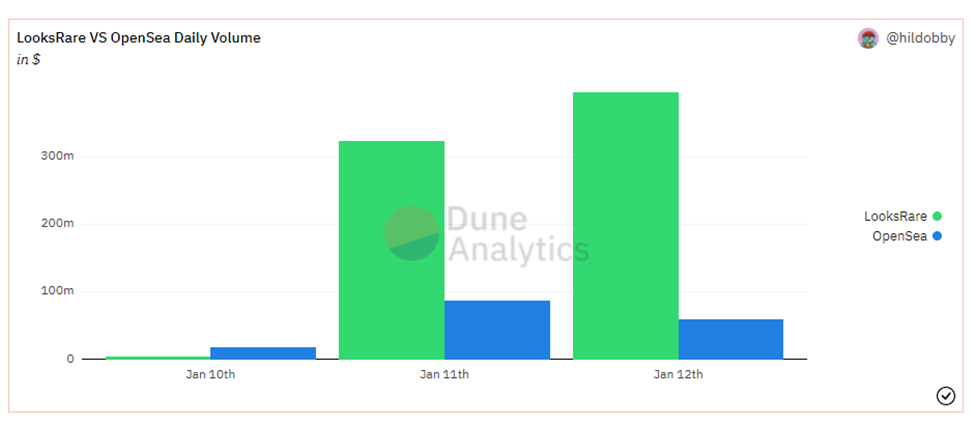

Volume Surpasses OpenSea

In less than 48 hours, LooksRare’s volume has already surpassed that of OpenSea. LooksRare’s volume for January 12th was nearly $400 million compared to OpenSea’s $60 million. Of course, a sizeable amount of that volume is being driven by wash trading because of the liquidity mining, though I doubt the wash trading is profitable unless you hold a substantial amount of LooksRare’s token LOOKS.

Users

While LooksRare has been able to attract a significant amount of volume, its daily user numbers pale in comparison to OpenSea. Currently, LooksRare has just under 3,000 DAUs compared to OpenSea’s roughly 57,500 DAUs. That will be the real number to watch. If OpenSea’s users decrease, while LooksRare’s increases, then LooksRare might have a legitimate shot of overtaking OpenSea in a sustainable way.

LOOKS Token

While many crypto native users did not like OpenSea because the VC darling looked like a traditional Web 2.0 company, the real reason LooksRare is taking off right now is the LOOKS token. While the LOOKS token will be a governance token, currently people are using it to stake, which allows them to earn LOOKS and wETH. Instead of LooksRare keeping the 2.5% transaction fee on NFT auctions, which is denominated in ETH, for itself like OpenSea, the application actually distributes that revenue to stakers of the LOOKs token.

Furthermore, people buying and selling NFTs on LooksRare also earn LOOKS tokens themselves just for using the application, which is where the wash trading comes in.

Finally, users can also earn addition LOOKS rewards by providing liquidity to the LOOKs-ETH pool on Uniswap, which is a typical play by projects looking to bootstrap liquidity for their token.

Takeaway

There are a few takeaways to this event. If the crypto community thinks that a project is too aligned with Web 2.0 or traditional finance values, inevitably a more cyrpto native cultural version will arise.

SushiSwap is the more crypto native version of UniSwap culturally, while Aave is the more crypto native version of Compound. These apps being viewed as loyal to the crypto native vision is more marketing than anything else, but these narratives are powerful.

Furthermore, if a current crypto application does not reward its users with a token, a competitor who would be willing to do so will inevitably arise. Crypto users have now been conditioned to getting paid for using an application. Consequently, they want to be compensated for their early support.