Rapture #108: Crypto Reacting like a Macro Risk on Asset (for now)

Unless you have been living under a rock these past few weeks, you likely have taken note of a few things: BTC is down 37.5% from its all-time high, innovative tech equities are down approximately 28% (using ARK ETF as a proxy) from their Q4 highs, and the market consensus of how many times the Federal Reserve would raise interest rates this year recently increased.

With the Federal Reserve raising interest rates more agressively, risk-on assets dramatically underperformed. But you thought BTC was an inflation hedge? Well, reality is always more complicated.

BTC is a Long-Term Dollar Hedge, but a Short-Term Risk Asset

It is tough to be a hedge on the dollar while also being cutting edge-tech!

While increasingly BTC is seen as a digital gold, in times of short-term market uncertainty in the short-term, BTC has performed abysmally. I can all too well remember the March 12th, 2020 Coronavirus crash, when BTC dropped 50% in one day and the rest of the crypto market dropped 75% or more depending on the asset. I have scars from that day.

Yet what happened from that March 2020 low, when the Federal Reserve opted to increase the monetary base by an unprecedented amount because of the fear surrounding the coronavirus? BTC proceeded to rally from a low of approximately $4,000 to a high of $69,000 over the following 20 months while the total market cap of crypto increased from $155 billion to just over $3 trillion.

Right now, the market has decided that the Federal Reserve raising rates poses a threat to risk-on markets, or at least is willing to play chicken with the Federal Reserve on that matter. Consequently, risk-on assets have been adversely affected by the short-term climate.

The Game of Fed-Put Chicken

Market participants have colloquially dubbed this game of chicken the Fed Put. If the markets drop a certain amount, surely the Federal Reserve will come in and stop the bleeding. While historically this scenario has held up, the Fed might be less inclined to step in if equities markets drop 5% now that inflation is consistently above 6% year over year. Now, the equities market might have to drop a bit more, say 15%, for the Federal Reserve to revert to the most accommodating of policies.

The issue with that scenario is the middling time of the equities market reaching that drop of 15% before the Federal Reserve stops its slowdown, as that is the time risk-assets are… well… most at risk. The market needs constant reassurance that the Fed will indeed continue supporting the market for risk-on assets to behave appropriately in our current delusional macro environment, which is up only. Until we get to the blow-off top for crypto or the impending implosion of the American economy based on these dollar ponzinomics of course. One of the two.

Cascading Liquidations

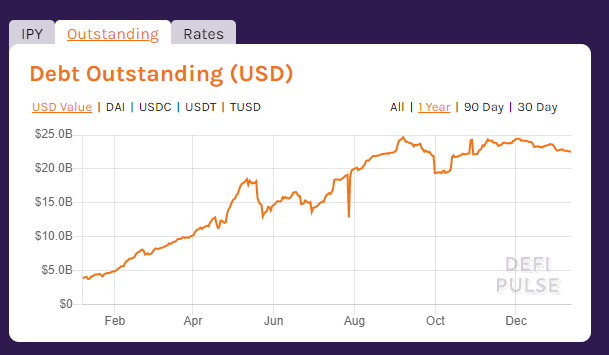

Even with this most recent drawdown, we have yet to have the cascading liquidation event we saw in May for crypto. In fact, debt outstanding in DeFi has barely dropped from its all-time high. If inflation is high, and the market prices in more or more severe rate hikes, during that middling time before the Federal Reserve comes in, risk could be taken out of crypto quickly. This event could cause the liquidation cascade we have yet to see in recent memory. If you think down 37.5% is bad, you have seen nothing yet if that plays out!

The good news is funding rates are near 0% on Binance and are negative (though ever so slightly) for BTC and ETH on FTX, meaning that market participants are getting paid to long their derivative products, which further means that the derivative markets are tilted short.

While there was some puking that occurred between January 7thand 8th as indicated by the surge in daily volume and near zero funding on the derivative exchanges, there is still a substantial amount of leverage in the market as indicated by DeFi.

Complete Loss of Faith in Federal Reserve Scenario (we are not close to here...yet)

Of course, if the market loses faith that the Fed can control inflation/the USD at all, that should actually lead to a dramatic appreciation in crypto because cash will become trash in that scenario and allocators will have to continue to consistently move to alternatives of the dollar.

We are not at/near that point in my opinion though. Just ask your colleagues how likely they think it will be for crypto to replace the dollar and hear the arguments about how "the US has the most guns so that means the dollar will always remain strong dur dur dur." I am sure the patricians in the Roman Empire made the same argument.

Takeaway

While I think there is a higher likelihood we grind up, as I speculate inflation will drop below the whisper expectation and the Fed will not be so hawkish, the short-term downside risk is substantially high right now.

If inflation comes in higher than expected and if the Fed is more aggressive, the crypto markets could drop to new lows in the risk-off environment before the equity market hits fed-put levels, which could cause a cascading liquidation event for crypto.

TL:DR; I have not begun allocating my large cash position back into the market, but I also have not sold any more since late November. I continue to wait for confirmation signals, both from the market and macro.

If you are interested in seeing a related but slightly different take on the same subject, check out Sam Martin's from BlockWorks Group tweet thread here.