Rapture #107: Gas Guzzlers of Ethereum

Alex Svanevik, the CEO of Nansen, did an amazing thread on the top 20 Ethereum gas consumers. In case you want a refresher on what gas is on Ethereum, you can help me break 170k viewers and read my What is Gas article on the MetaMask Discourse here.

Since I thought Alex's thread was so interesting, below you will find some commentary on the top 10 Ethereum gas guzzlers.

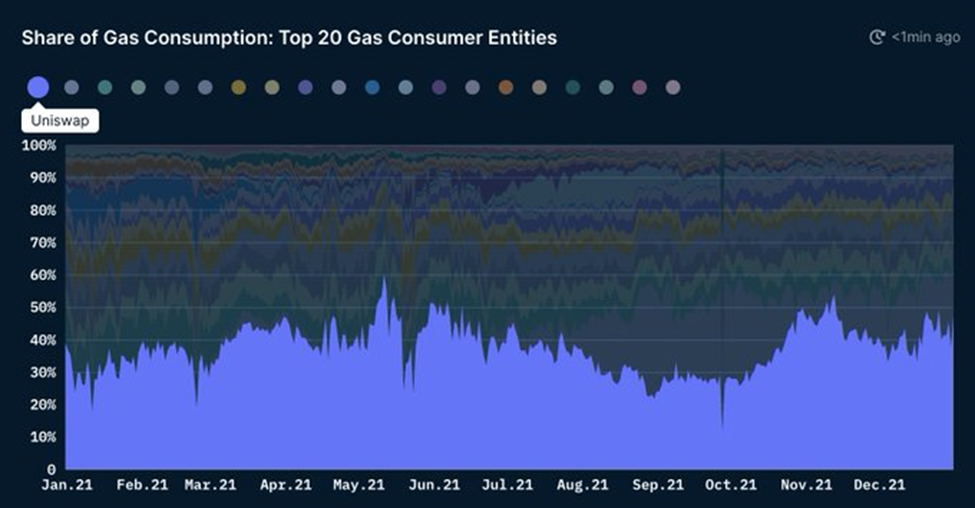

#1 Uniswap

Unsurprisingly, Uniswap comes in at #1. The leading decentralized exchange usually accounts for nearly 40% of all gas expenditures on Ethereum. Considering Uniswap has the second most daily active users on Ethereum and has incredibly complex smart contracts that are expensive to execute, it should come as a surprise to no one that the application consumes the most gas.

#2 OpenSea

In second place comes OpenSea, the most popular NFT marketplace. OpenSea actually has the most daily active users out of any application on Ethereum at almost 50k DAUs. Considering the boom NFTs had in 2021, once again readers should not be too surprised to see that OpenSea is one of the top gas consumers.

#3 1inch

Now it starts getting interesting 1inch, the DEX aggregator, came in third. The fact that 1inch is 7th in DAUs, behind other DEX aggregators like MM Swaps, makes me think that the application has not quite optimized their smart contracts to reduce gas as efficiently as they could.

#4 WETH

People want to lend ETH, and the only way to do that in DeFi is to wrap it. Consequently, the wrapped ether contract came in fourth as the one that consumed the most gas.

#5 Tether

Continuing the trend of assets as gas guzzlers, Tether came in 5th place. Considering nearly $40 billion worth of USDT has been issued and it has almost 40% of the stablecoin market, Tether being a top 5 gas guzzler makes sense.

#6 USDC

USDC coming in #6 also makes sense, as it has the second largest supply of any stablecoin at over $31 billion. USDC continued to eat into the market share of Tether throughout all of 2021, meaning that the smart contracts to mint USDC were running hot.

#7 Aave

Despite only have 5,500 MAUs, Aave, one of the leading lending protocols, came in 7th. While lending markets do require complex smart contract transactions that require a substantial amount of gas, the fact that Aave is #7 is likely indicative that its smart contracts are not as efficient as they could be.

#8 0xProject

While only owning approximately 3% of the DEX market share, 0x comes in at #8. 0x is the third thus far DEX related project in the top 10 gas consumers, which goes to show that users still predominantly utilize crypto as a speculation tool.

#9 MetaMask Swaps

After reading my post on MM Swaps, and knowing that it is a 9 figure revenue generating product, you all likely could have guessed MM Swaps would be in the top 10.

#10 SushiSwap

The final application on this list is SushiSwap. While currently going through a dramatic leadership transition, SushiSwap is still one of the most utilized DEXs in the market.