Rapture #106: What Bear Market? NFTs Bucking the Trend

While the fungible crypto market is absolutely getting clobbered right now, with BTC down more than 40% from its all time highs, NFTs have been one of the few green areas of the market. Lets dive into some numbers that back up the NFT bull run.

Floor Prices on the Rise

Despite the negative moves in the crypto market at large, the floor prices of the largest NFT collections have actually been rising dramatically. The Bored Ape Yacht Club floor price is up almost 50% in the last 30 days, the Mutant Ape Yacht Club floor price is up nearly 120% in the past 30 days, and the Crypto Punks’ floor price is only down just over 10%, which is still outperforming BTC. Most of the other major collections’ floor prices I eyeballed, from Cool Cats to Doodles Meebits and more, were up between 2 – 60%, all substantially outperforming the traditional crypto markets.

OpenSea on a Tear

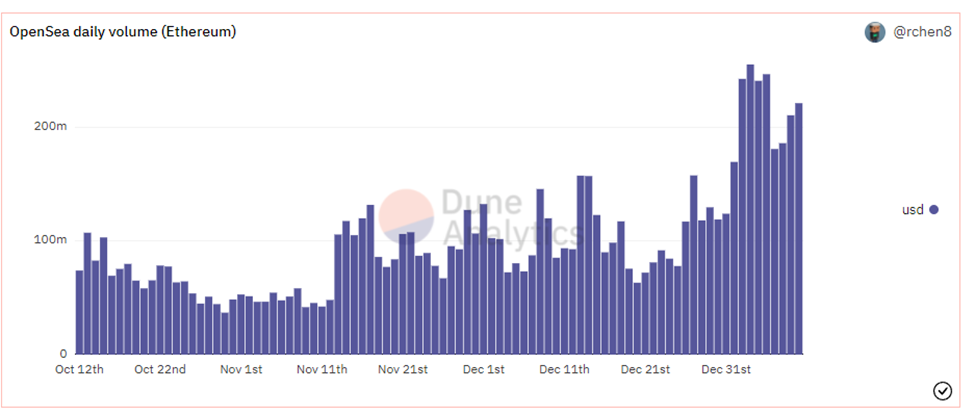

OpenSea, the leader in NFT marketplaces with more than 57,000 DAUs, is also showing impressive growth for the month of January. Already for the month of January, OpenSea has generated nearly $2 billion worth of volume. Their all time high volume was August 2021, when the marketplace hit approximately $3.5 billion of volume. If the current volumes keep up for the rest of the month, OpenSea is on pace to nearly double the volume it had in August 2021. Furthermore, as you can see from the graph above, daily volumes are actually increasing right now.

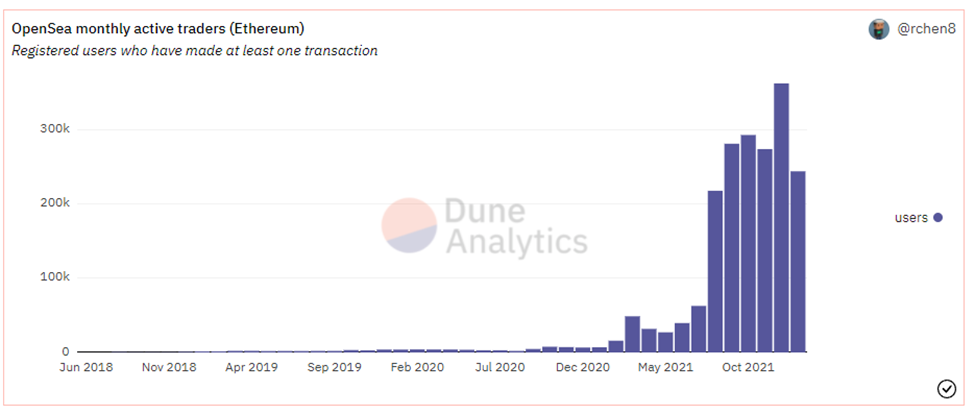

Not only are volumes increasing on OpenSea, but so are monthly active traders.

OpenSea is on track to demolish its December of highest monthly active traders, which was just over 360,000, for January. All this activity has led to the site going down multiple times in some fashion during the past week

Defying Expectations

This recent rise in price NFTs, and interest in them, has defied the expectations of many market participants, including myself. I thought that when liquidity dried in the crypto market as a whole and we entered a downward trending market, that NFTs would be obliterated as the most illiquid asset.

While our downtrend is still relatively young, the increase in active users in NFT paired with the increasing floor pries has proven my hypothesis false thus far.

An alternative hypothesis I now see floating around is that those who speculate on NFTs are fundamentally different than those who speculate on cryptos like BTC, ETH, SOL, etc. Consequently, a fall in the mainstream assets theoretically should not affect the NFT market.

While I still do not subscribe to this theory and believe NFTs will dramatically decrease in a sustained bear market, the increasing user growth in the NFT ecosystem truly stands out against slowed growth or complete stalled user activity in other areas of the market. This trend will be important to monitor, as any crypto native should be looking at where the pockets of action are in this bearish environment.