Rapture #105: How can I help - VCs Jonesing for Crypto

By all accounts, VCs were jonesing for crypto in 2021. An unprecedented amount of capital was deployed into crypto in 2021, showing no signs of abating at least for the first half of 2022.

Why are they investing? Well, crypto assuredly had its mainstream moment in 2021. From Jay Z making his Twitter avatar a crypto punk to Coinbase going public, crypto is definitely where the cool kids are.

Furthermore, VCs salivate at the prospect of a liquidity event occurring in the form of tokens within 1 – 3 years of a project launching instead of the 5 – 10 years they usually have to wait for a traditional company. Being able to point to actualized returns when raising their next fund gives any VC a leg up over their competitors. Finally, VCs often receive discounted tokens for their investment, meaning that the moment the token launches they are in the green.

Because of those reasons, VCs love crypto. Let’s quantify just how big of a year 2021 was with VCs allocating to crypto.

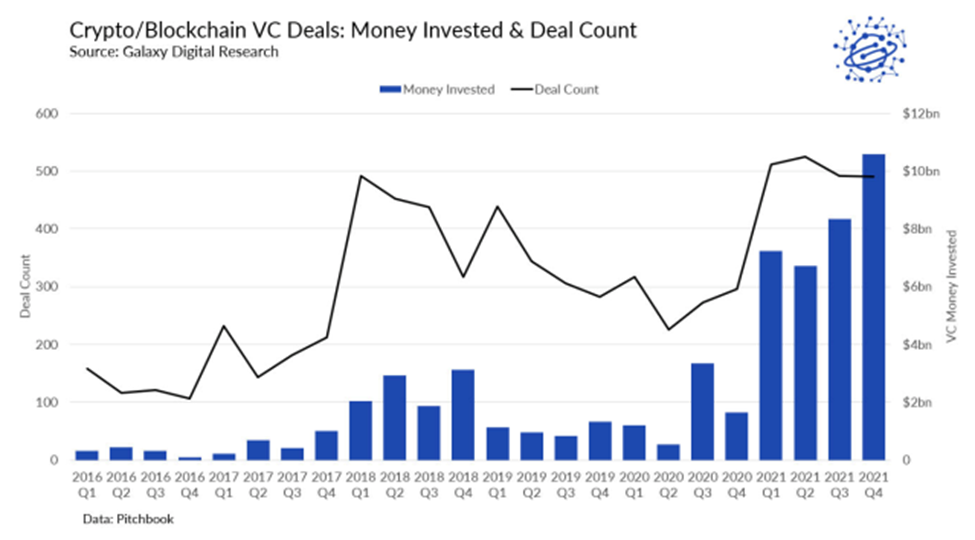

Capital Invested

In 2021, VCs allocated more than $33 billion into blockchain and crypto startups, an increase of approximately 7.1x from the capital they allocated in 2020. Interestingly, according to the number crunching of Jacquelyn Melinek at BlockWorks , 67% of the $22 billion was allocated into rounds that had deals of $100+ million. Not only was the amount allocated to crypto by VCs for 2021 unprecedented, but also the deal sizes were gargantuan by comparison to previous years.

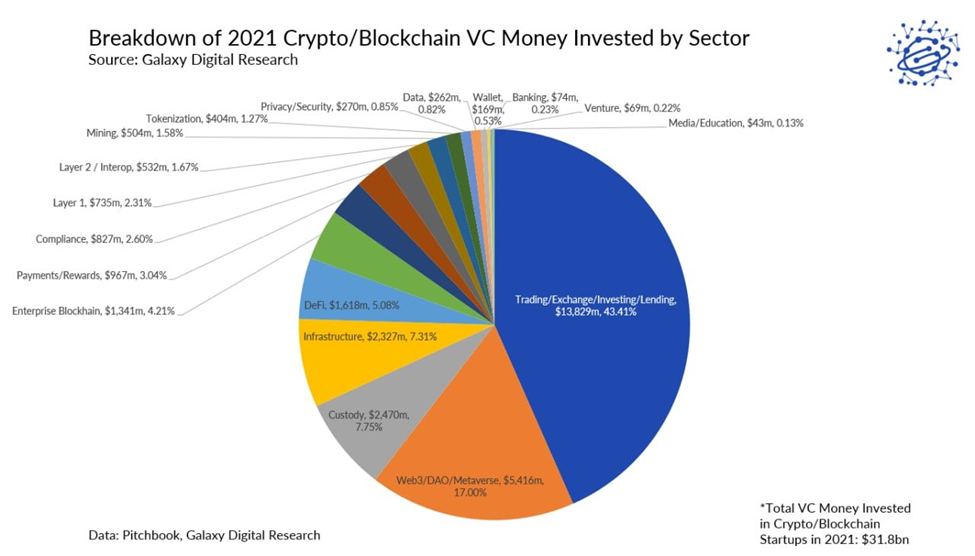

Sector Allocations

Unsurprisingly, 43.41% of the VC money allocated to crypto in 2021 went towards exchanges/trading firms. How else do you think FTX felt justified to buy the naming rights for the Miami Heat stadium. NFT/Web3/Metaverse projects attracted the second most amount of capital, which was 17% of all the VC allocations for 2021.

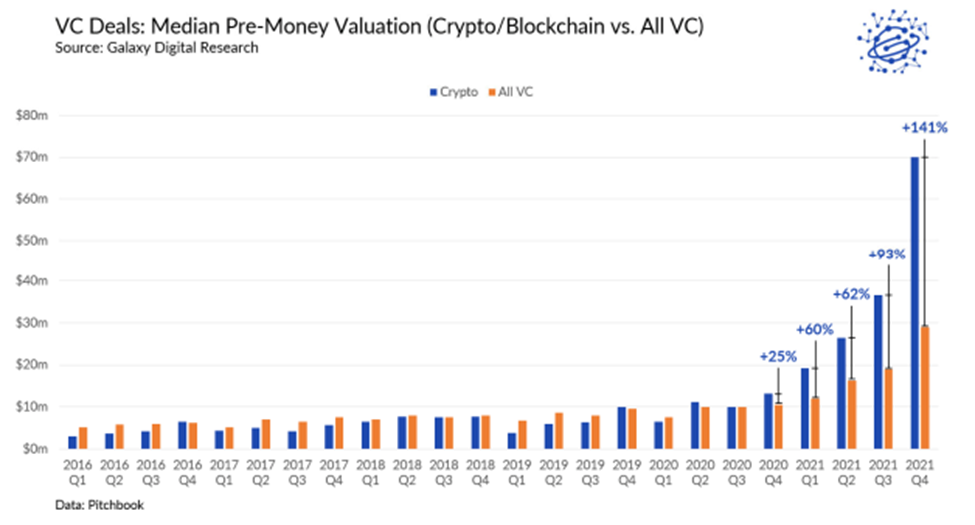

Rich Valuations

Valuations of crypto companies have risen along with the increasing amount of venture capital being allocated to the space. In fact, the median pre-money valuation of a crypto/blockchain company by the end of 2021 was $70 million, a 4.3x increase from the end of 2020. According to Alex Thorn of Galaxy digital, there are around 50 or 60 unicorns in crypto today.

Entrepreneurs Currently Have all the Leverage

As someone who has been looking to invest in some early-stage crypto projects, I can assuredly tell you that entrepreneurs have all the leverage right now in the negotiations. With so much capital entering the space, especially from Venture Capitalists whose LPs told them in 2021 they have to allocate to crypto, capital is an easy commodity to come by. Pre-product $100 million valuations are not unheard of, and every entrepreneur expects work to be delivered upfront by their allocators, such as TVL into unaudited smart contracts from all of the allocators friends.

Of course, private rounds are undoubtedly in a bubble that will deflate quickly now that the public crypto markets have turned. The real impact of all this funding should be seen in a couple of years, when the capital that has been deployed has actually yielded some innovative projects.