Rapture #102: Why the Underbanked and Unbanked Love Crypto

A fascinating study came out by Morning Consult that has some insightful statistics surrounding crypto. While crypto gets a bad rep for being a rich boy speculator’s plaything, many who don’t have access to the current financial system are actually adopting crypto at incredibly high rates.

Underbanked and Unbanked are Widely Adopting Crypto

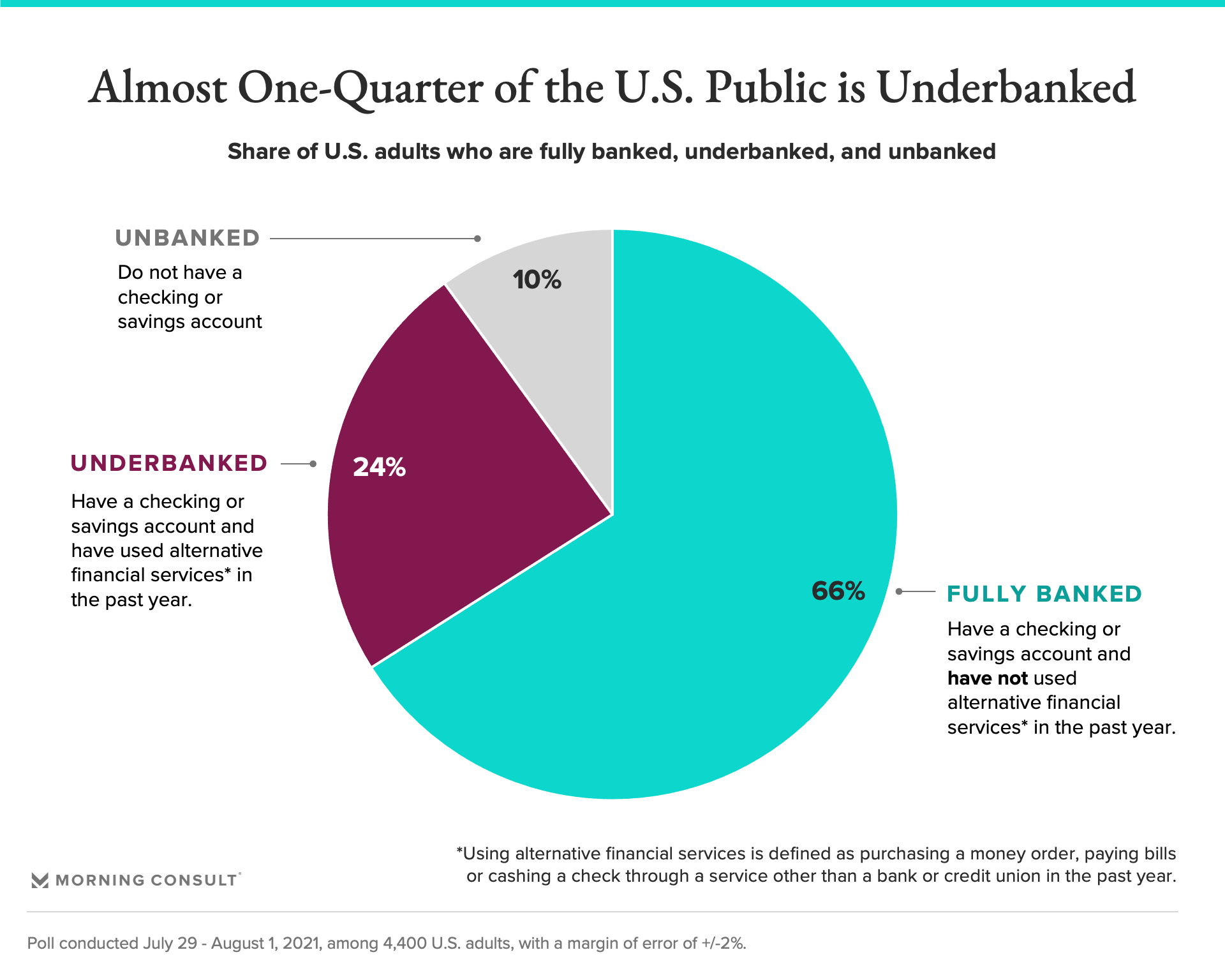

Just for some quick definitions, underbanked means individuals who have a bank account but often rely on alternative financial services such as money orders, check-cashing services, and payday loans rather than on traditional loans and credit cards to manage their finances and fund purchases. Unbanked means an individual who is not served by a bank or similar financial institution.

Now that we have those definitions out of the way, let’s delve into some of the insights from Morning Consult’s study.

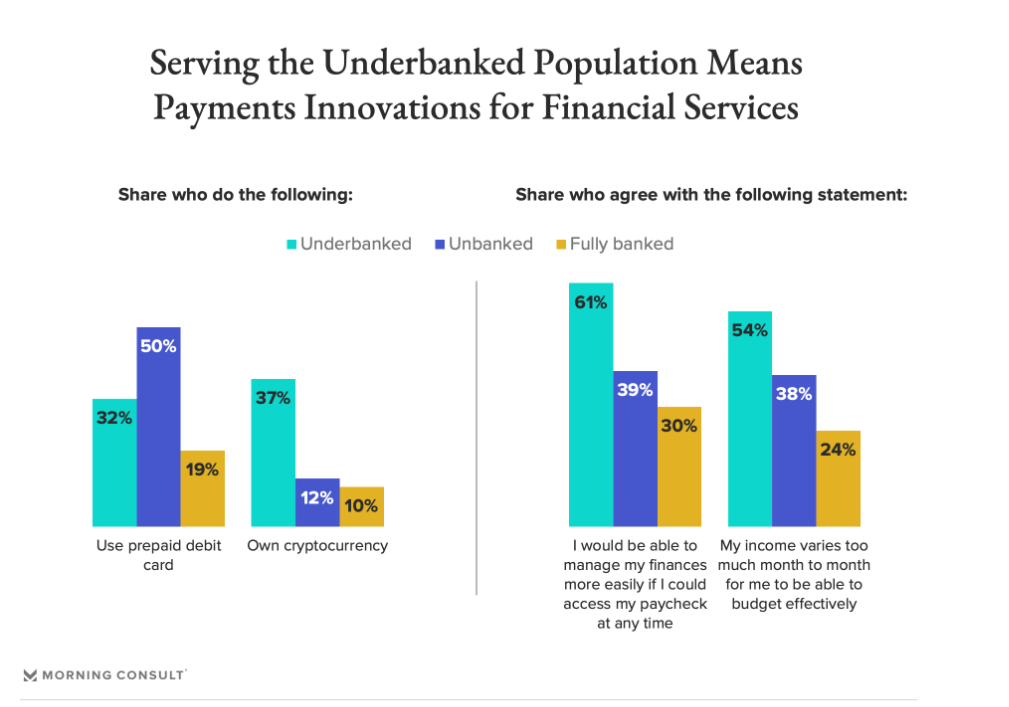

According to a 4,400 US adult population poll, 37% of those who were underbanked and 12% of those who were unbanked utilize cryptocurrency. The percentage of fully banked people who own crypto was only 10%, meaning both the underbanked and unbanked used crypto at far higher rates. Those are some fascinating numbers!

The Everyman Asset Class

Without a doubt, crypto is still very much a retail dominated asset class. Large institutions have opted not to enter the asset class in the past few years, many citing reasons such as regulatory risk, career risk, and volatility. Thus, since the asset growth has largely driven by average Joe retail, there is a much higher chance the person participating in the survey who utilizes crypto is either underbanked or unbanked.

Furthermore, crypto in the United States is typically held by young men, as 43% of men ages 18 to 29 hold crypto vs. only 16% of the total population. Young men, especially the ones who are not yet in college/not yet entered the work force, are far more likely to not have bank accounts or be underbanked.

Finally, with all the marketing around crypto being anti-bank, the under/unbanked likely were attracted to the messaging of the asset class.

Alternative Bank Account

Yet another driving force for those entering crypto must be the fact that the current banking infrastructure does not benefit the everyman in any form or fashion. The average interest rate for a savings account in the US is .06%, while the average interest rate for a checking account is .03%. These are paltry rates, especially when you consider inflation in the US reached 6.8%year over year in the month of November, meaning the real rate of return one receives for their money in a bank is closer to -6.74%!

In crypto, you can earn 3.28% APY on your USD stablecoin via the most vanilla lending platform, Compound, which is more than 54.7x greater than what you earn in a savings account. While there is no FDIC insurance in crypto, a 54.7x difference can convince even the stodgiest pro bankers, and more easily the ones who have difficulty getting access to banks, to consider moving their funds over.

Future

While the numbers are fascinating right now, I think within 3 years, they will be even more staggering. Accessing a MetaMask wallet and lending out your stablecoins via DeFi is far easier than getting approved and signing up for a bank account.

I expect that the unbanked and underbanked across the world will continue to flock to crypto as the alternative financial system they always needed but could not receive within the current banking infrastructure.